Bitcoin Futures Market Shows Moderate Bearish Pressure Amid Price Stability

- Bitcoin futures show moderate bearish pressure near all-time price highs.

- Sharp futures dips cause only short-term Bitcoin price corrections.

- Heavy futures volatility hasn’t stopped Bitcoin’s long-term uptrend.

Bitcoin’s futures market continues to reflect a moderate bearish tilt, while the cryptocurrency’s price holds firm near all-time highs. As of June 18, the futures market power, a metric that measures net buying or selling pressure, registered at –93K. This figure points to a shift toward bearish positions but does not suggest aggressive selling.

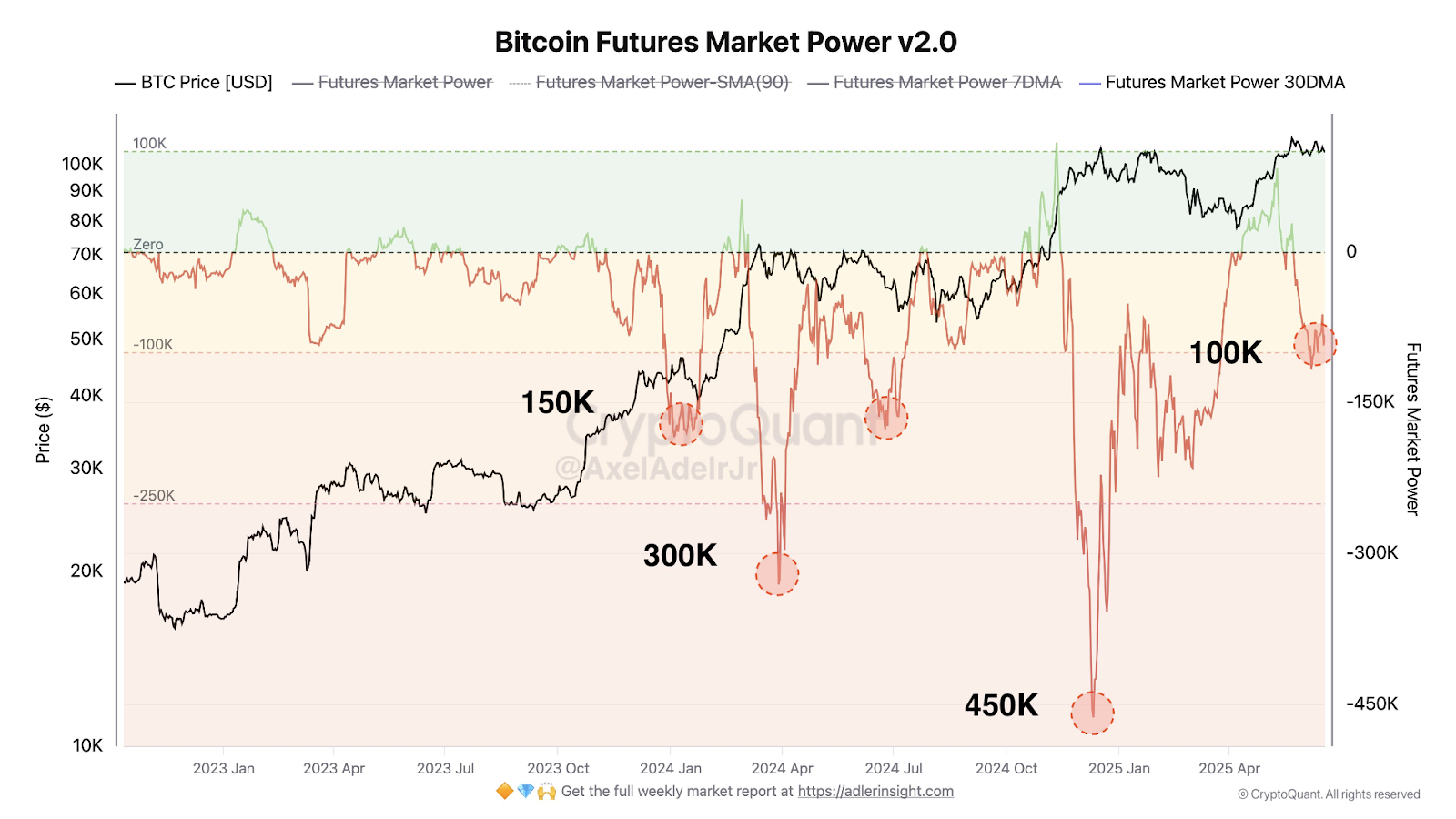

The “Bitcoin Futures Market Power v2.0” chart, sourced from CryptoQuant, shows the interplay between Bitcoin’s price in U.S. dollars and futures market pressure from early 2023 through mid-2025. Bitcoin’s price, represented by a black line, surged from below $20,000 in early 2023 to slightly above $100,000 by mid-2025.

The futures market power, shown by a red line, measures the dominance of buying or selling in the futures market. Its scale is plotted on the right vertical axis and contains several sharp negative dips. These downward spikes, marked at approximately 150K, –300K, –450K, and –100K, occurred during late 2023, early 2024, late 2024, and mid-2025, respectively.

Despite these major declines in futures market power, Bitcoin’s price maintained an upward pattern. For example, the largest dip near 450K in late 2024 aligned with Bitcoin’s price nearing the $100,000 mark. This indicates intense market activity that, while volatile, did not prevent the price from advancing overall.

Historical Context of Bearish Spikes

The history of bearish spikes in the futures markets indicates that they usually brought about short-term price corrections. Historic data indicates that a dip of –50K to -150K, like during the months of January 2024, July 2024, and April 2024, had a local price decrease of 5-10 percent.

The chart also contains moving averages of futures market power that is used in futures market power, which even out erratic fluctuations, yet provide no focus on the current market condition. Also, the current volatility in the futures market is evidence of the involvement of futures traders in the price dynamics of Bitcoin.

Liquidation and short-selling cycles have not had much short-term effect on Bitcoin ‘s long-term growth patterns over the last two and a half years. Instead, these occurrences are volatility incidents on a continuous bullish structure.

4 Top Crypto Gems to Buy Today for Big Returns: Unstaked, Toncoin, Arbitrum & Ondo Finance

Explore the top crypto gems to buy today, including Unstaked, Toncoin, Arbitrum & Ondo Finance. Lear...

Zoro Partners with NodeGo AI to Unlock AI Decentralized Machine Learning Capabilities

Zoro combined its data layer with NodeGo AI’s distributed computing for the two to develop a decentr...

ADA Eyes Breakout, XRP Stalls Below $0.50, but Web3 ai Shines with Sub-$0.001 Entry and 17x Upside Potential!

Explore ADA’s bullish trend, XRP’s uncertain path, and why Web3 ai’s smart AI tools make it a stando...

Adler Jr (@AxelAdlerJr)

Adler Jr (@AxelAdlerJr)