SharpLink Bets Big on Ethereum, Secures Spot as Top Public ETH Holder

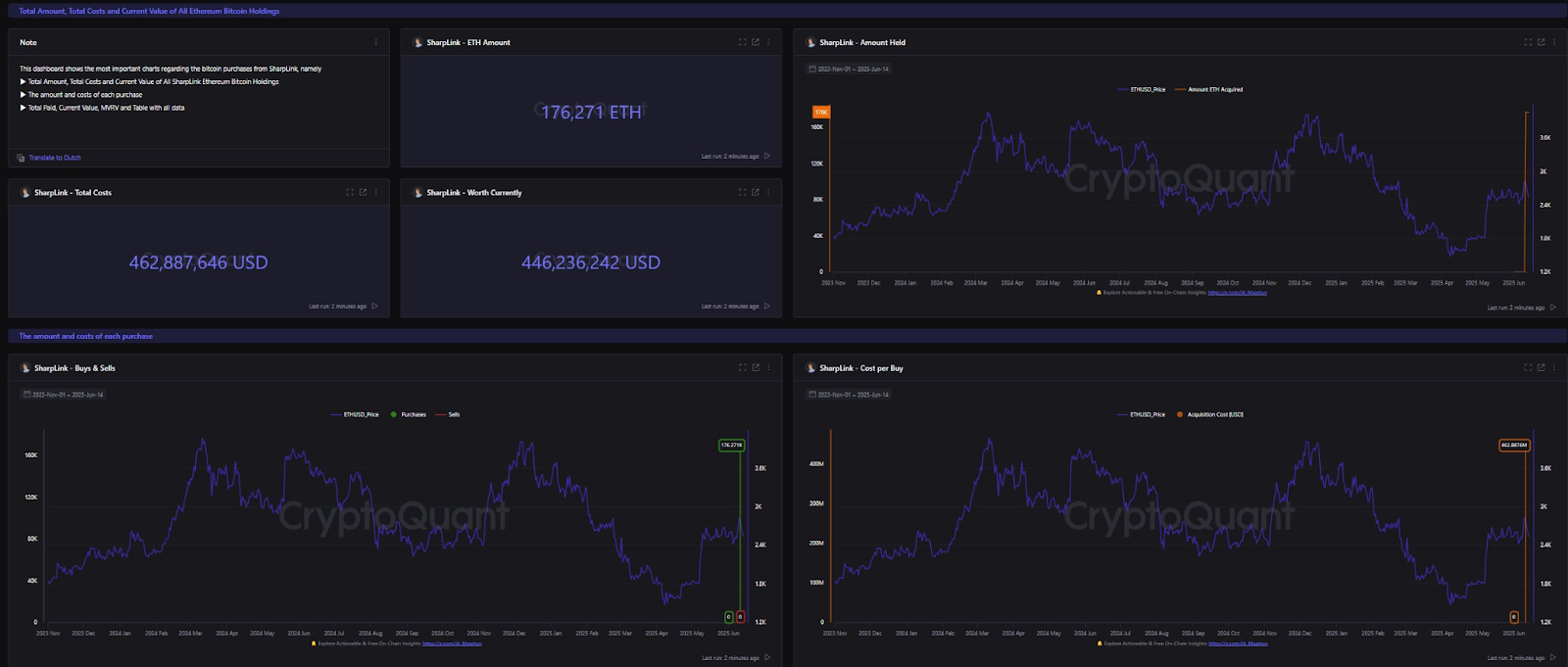

- SharpLink has purchased 176,271 ETH or $463 million and is now the largest Ethereum holder on a public basis.

- More than 95% of SharpLink Ethereum is staked to generate returns and safeguard the network.

- Institutions such as BlackRock are also purchasing ETH in large quantities this month, as well as whales.

SharpLink has now become the biggest publicly traded owner of Ethereum with a purchase of 176,271 ETH, amounting to about $463 million. CryptoQuant was the first to confirm the portfolio shift on the chain, and the total acquisition cost was $462.88 million. The treasury of SharpLink is currently worth $446.2 million with changes to its value according to market price since the acquisition.

The purchase results from a new ETH -centered reserve scheme introduced on May 27. After the announcement, SharpLink stock, which had jumped 400% on the day, joined the bulk of stocks, which had soared 2,100% in the week. According to the company, its ETH portfolio is currently staked in over 95% on staking and liquid staking platforms to earn yield.

CEO Rob Phythian described the move as a historical moment and the reason why Ethereum will provide programmable infrastructure for future digital trade and decentralized applications.

ETH-Based Treasury Model Gains Institutional Traction

The pivot of SharpLink is similar to the trend of increased corporate embrace of digital assets, but SharpLink differentiates itself through its Ethereum focus, not Bitcoin. Led by former Strategy executives and Ethereum co-founder Joseph Lubin, the shift by SharpLink seems to be strategic and symbolic.

Lubin, the CEO of Consensys, added that this move by its treasury is a critical institutional milestone. He attributes this to the coincidence of the accelerating U.S. legislative clarity on stablecoins and digital asset markets, making Ethereum more acceptable to institutional investors.

The ETH-per-share of SharpLink has emerged 11.8% above its early June levels, driven both by cap gains and staking. The company already received $79 million to facilitate its crypto reserve transition.

Whales, Institutions Boost Ethereum Holdings

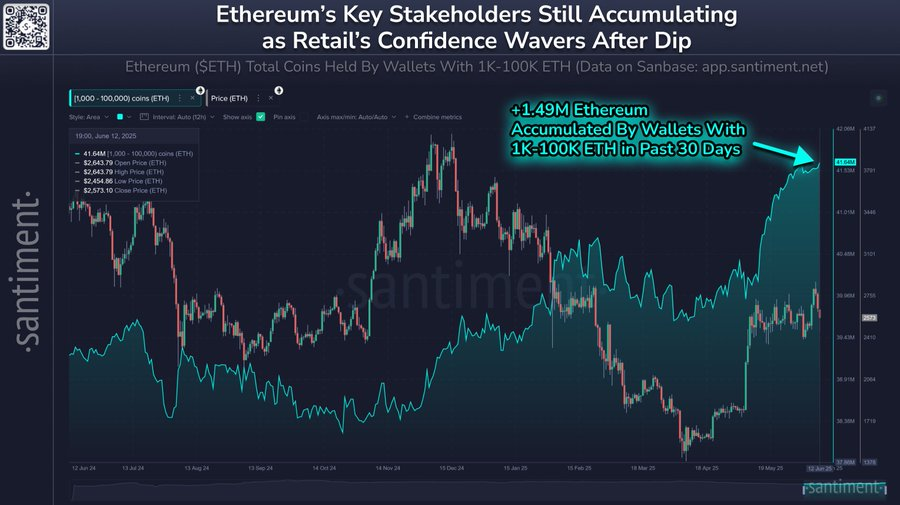

SharpLink is supported by on-chain data. Santiment notes that an address between 1,000 and 100,000 ETH increased holdings by 1.49 million in the last month. Such wallets currently contain 26.98% of the total Ethereum available. Meanwhile, minor holders have started selling, indicating redistribution between retail and major investors.

iShares Ethereum Trust by BlackRock also sustains its ravenous buying. The fund purchased $240 million worth of ETH between June 3 and 6, with over half a billion dollars purchased monthly. It currently possesses over 1.5m ETH worth approximately $4 billion.

Cumberland and Galaxy Digital have also joined the party, heralding robust institutional demand in Ethereum despite the wider market hesitation. SharpLink has become one of the companies with crypto in treasury, alongside Strategy and GameStop, but it differs significantly because it concentrates on Ethereum rather than Bitcoin. Its ETH-per-share value has increased by 11.8% since the beginning of June, confirming the strategy on a shareholder level.

Crypto Holds Firm as Geopolitical Turmoil Shakes Global Markets

Crypto investor Kyle Chassé notes Bitcoin and altcoins are surging while stocks fall as Bitcoin stay...

BNB Price Prediction 2025 Signals a $700 Breakout While Qubetics Builds Momentum

BNB eyes a $700 breakout amid ETF buzz and token burns, while Qubetics gains traction in RWA tokenis...

Major Crypto Token Unlocks This Week: ARB, VANA, ZK, APE, SAROS, and More Set to Drive Market Liquidity

The data highlighted major upcoming token unlocks in which multiple crypto assets including Arbitrum...