Institutional Bitcoin Holdings Soared 924% in a Decade: Gemini and Glassnode Report

The post Institutional Bitcoin Holdings Soared 924% in a Decade: Gemini and Glassnode Report appeared first on Coinpedia Fintech News

A new joint report by Gemini and Glassnode reveals a dramatic shift in Bitcoin ownership, highlighting the cryptocurrency’s growing maturity and institutional adoption. According to the report, centralized treasuries—including governments, ETFs, public companies, and centralized exchanges —now hold nearly 31% of all circulating Bitcoin , totaling over 6.1 million BTC worth approximately $668 billion .

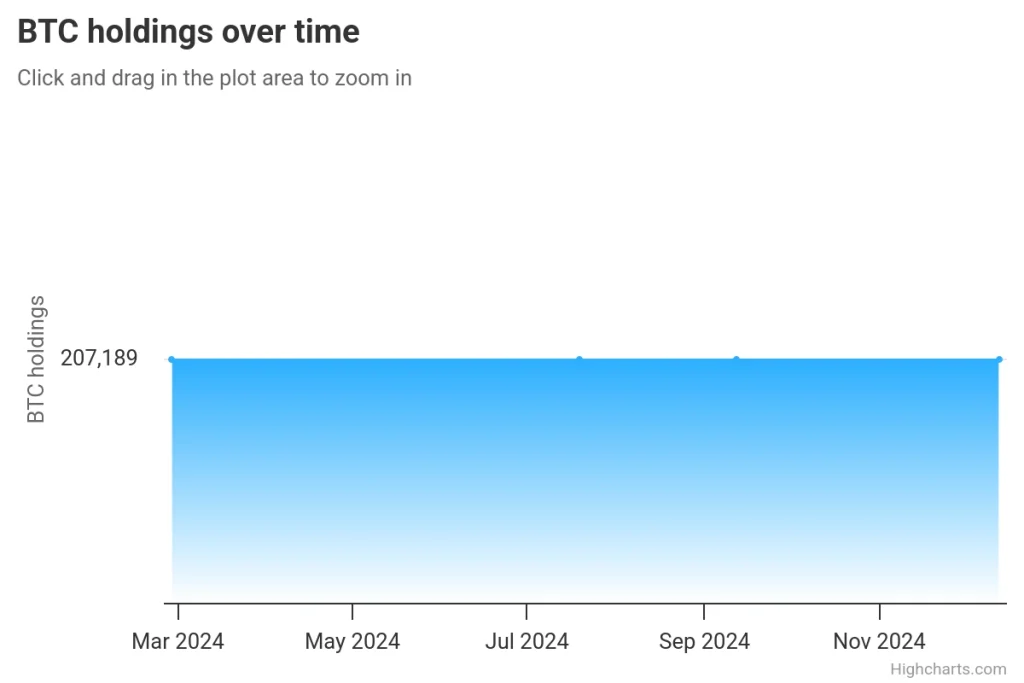

Government Bitcoin Holdings Surge Through Seizures

Governments around the world collectively hold 529,705 BTC , valued at over $57 billion . The United States leads with 207,189 BTC , followed by China with 194,000 BTC and the United Kingdom with 61,000 BTC .

The report highlights that these holdings are not from open market purchases but have mostly come from seizures and enforcement actions .

ETFs Take the Lead in Bitcoin Accumulation

Bitcoin ETFs are rapidly growing as dominant holders. They now control 1,390,267 BTC , worth about $150 billion . The largest holder is BlackRock’s iShares Bitcoin Trust , which owns 665,638.1 BTC . Fidelity’s Wise Origin Bitcoin Fund and Grayscale Bitcoin Trust follow with 198,685.8 BTC and 185,203.6 BTC , respectively.

These numbers reflect rising institutional confidence in Bitcoin as a long-term financial asset.

Public Companies Double Down on BTC

Public companies have become aggressive buyers, collectively holding 763,479 BTC , valued at $82.38 billion . MicroStrategy continues to lead this category with a staggering 582,000 BTC in reserves. Other key players include Marathon Digital Holdings with 49,179 BTC and Riot Platforms with 19,225 BTC .

This further signals Bitcoin’s growing role as a strategic asset for corporations seeking to protect against inflation and economic uncertainty.

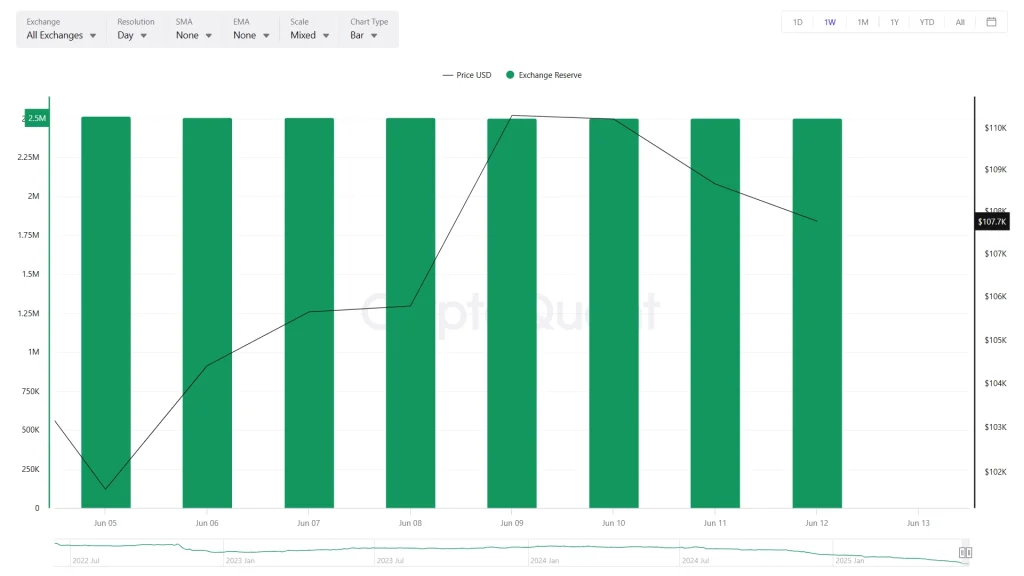

Centralized Exchanges Still Hold a Large Share

The report also confirms that centralized exchanges make up a significant portion of the 6.1 million BTC controlled by centralized entities. Current BTC exchange reserves stand at 2.5 million BTC .

However, analysts believe much of this Bitcoin belongs to retail users , not the exchanges themselves. Still, the inclusion of exchanges highlights the role of custodial platforms in Bitcoin’s ecosystem.

Private Companies Show Distributed Ownership

In contrast to public firms, private companies collectively hold 457,870 BTC , valued at around $49.4 billion . The distribution is more spread out in this segment.

Block.one holds 140,000 BTC , while Tether Holdings owns 100,521 BTC . Other notable holders include Xapo Bank with 38,931 BTC and Twenty One Capital with 37,229.7 BTC .

- Also Read :

- Bitcoin Sell-off to Stop After $130K Breakout, Says Bitwise CEO

- ,

Bitcoin’s Price Mirrors Institutional Growth

The report highlights that institutional Bitcoin holdings have surged 924% over the past decade . During the same period, Bitcoin’s price jumped from under $1,000 to over $100,000 . In just the past year, the price has climbed 60.2% , showing increased stability and mainstream acceptance.

This price performance is closely tied to growing institutional interest, which has created a stronger foundation for Bitcoin as an asset class.

Conclusion: Bitcoin Matures, but Risks Remain

The data reflects a structural transformation in Bitcoin’s ownership landscape. With governments, ETFs, public companies, and exchanges holding a large share of circulating BTC, Bitcoin is now entering a phase of institutional maturity .However, despite this evolution, Bitcoin still remains a risk-on asset , subject to macroeconomic forces and market sentiment. Its volatility may have reduced, but it has not disappeared.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Czech Opposition Pushes No-Confidence Vote Over $45M Bitcoin Deal Scandal

The post Czech Opposition Pushes No-Confidence Vote Over $45M Bitcoin Deal Scandal appeared first on...

Crypto Liquidations: $1.14 Billion Wiped Out as Market Faces Double Attack?

The post Crypto Liquidations: $1.14 Billion Wiped Out as Market Faces Double Attack? appeared first...

BlackRock XRP ETF Coming Soon, Hints ETF Expert Nate Geraci

The post BlackRock XRP ETF Coming Soon, Hints ETF Expert Nate Geraci appeared first on Coinpedia Fin...