Is Bitcoin Headed For A Meltdown? Veteran Trader Sees 75% Crash Ahead

Bitcoin’s recent price surge hasn’t stopped warnings of a steep drop. After rising 1.87% in 24 hours and 3.61% over the past week, Bitcoin trades near $109,192. According to Peter Brandt, a veteran trader, these gains could be setting up the biggest crash in years.

Crash Scenario Outlined

According to Brandt’s analysis, Bitcoin could plunge by as much as 75%. If that happens, today’s $109,800 price would fall to roughly $27,290. That level takes us back to the lows of early 2023. It would wipe out a huge chunk of value, reversing more than two years of gains. Few investors have models ready for such a steep slide.

Historical Parallels With 2022

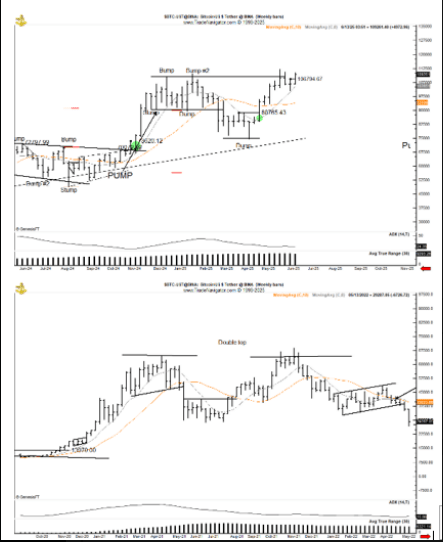

Based on reports, Brandt sees a replay of the 2022 chart. Back then, Bitcoin hit tops of $65K in April 2021 and $69K in November 2021. It then fell sharply into the bear market, losing more than half its value.

Is Bitcoin $BTC following its 2022 script and setting up for a 75% correction? Doesn’t hurt to ask this, does it? pic.twitter.com/BAywkhSwgy

— Peter Brandt (@PeterLBrandt) June 10, 2025

This time around, the world’s top crypto formed highs above $108,000 in December 2024 and January 2025, then dropped under $100,000. After recovering near $112,000 last month, BTC may be gearing up for a similar breakdown.

Key technical markers are flashing red. The 9-period EMA has just crossed below the 21-period EMA on the daily chart. In past sell-offs, that crossover marked the start of big downtrends.

Traders will want to see if Bitcoin closes below both EMAs for a week or more. A failure to reclaim the $108,000 level could be the final trigger before panic sets in.

Market Reactions And Risks

Market Reactions And Risks

Derivatives data is mixed but leans bearish. Trading volume jumped almost 30% to $100 billion, while open interest rose 1%. On Binance and OKX, the long/short ratios sit at about 0.5501 and 0.53, showing more shorts than longs.

When too many people bet on a drop, a squeeze can follow—if the crash doesn’t start soon. Still, the current crowding could backfire if Bitcoin holds above support.

Funds tied to Bitcoin have seen nearly $57 million in outflows over the past week. That may sound big, but it’s under 0.2% of the roughly $50 billion assets under management.

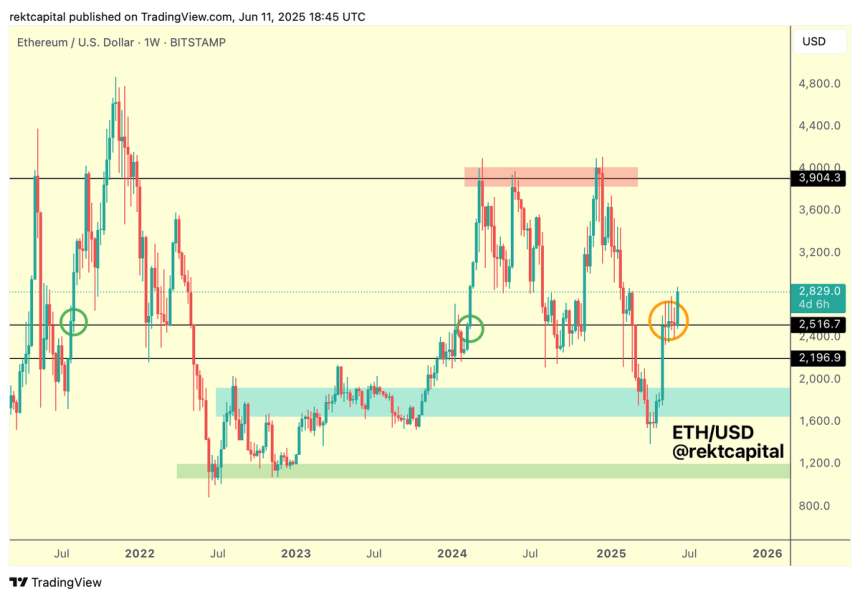

By contrast, Ethereum products attracted $295 million. So while some money is leaving Bitcoin, it’s shifting around inside crypto rather than fleeing entirely.

For now, Bitcoin sits at a crossroads. Will it break support and roll over toward the mid-$20,000s? Or will it shake off warnings and press higher? Either way, traders need to watch the $108,000 zone closely.

According to Brandt, a 75% drop could catch unprepared investors off guard. Managing risk and keeping orders tight seems more critical now than ever.

Featured image from Pixabay, chart from TradingView

Altcoin Season Just Flashed A Golden Cross Amid Crypto Market Recovery

Crypto analyst InvestingScope has drawn market participants’ attention to a major occurrence that hi...

Nasdaq Says Yes To Cardano: ADA Earns A Spot Among Crypto Giants

Cardano’s ADA has joined the Nasdaq Crypto Index, moving from the sidelines into the institutional s...

Ethereum Repeats History – Key Support Holds Again Ahead Of Potential Rally

Ethereum is at a critical juncture after breaking above key resistance but failing to sustain moment...