Chainlink Powers Cross-Border CBDC-Stablecoin Pilot Between Hong Kong and Australia

Favorite

Share

Scan with WeChat

Share with Friends or Moments

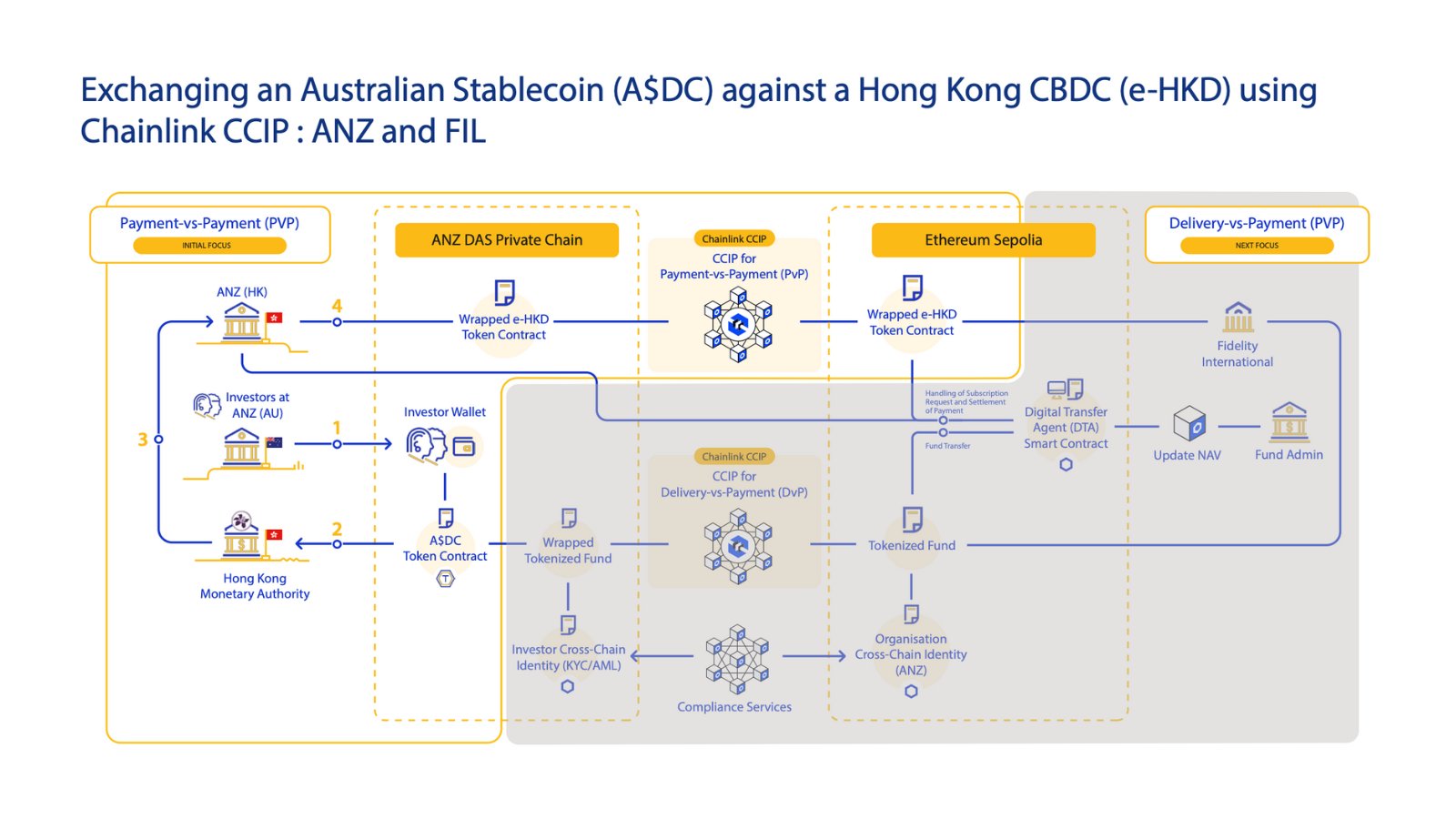

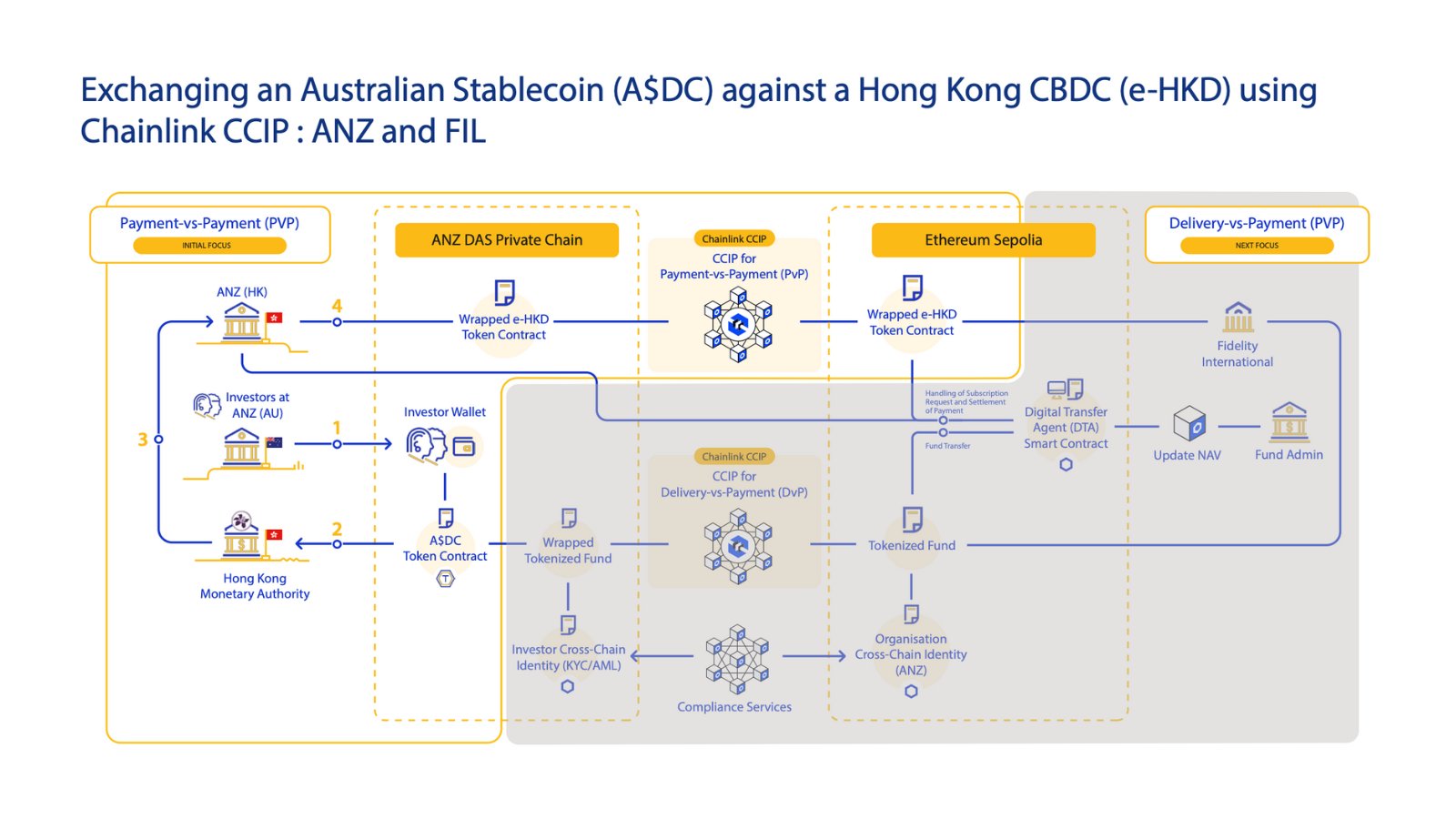

Chainlink (LINK) played a pivotal role in a successful pilot program that facilitated the exchange of two central bank digital currencies (CBDCs).

The pilot involved the Hong Kong digital dollar (e-HKD) and an Australian stablecoin. It was part of Phase 2 of the e-HKD+ Pilot Program, initiated by the Hong Kong Monetary Authority.

Chainlink’s Cross-Chain Interoperability Protocol

enabled

seamless transactions. It showcases how smart contract technology can bridge traditional finance and the decentralized finance ecosystem.

Chainlink’s Role in Cross-Border Payments

At the heart of this milestone was Chainlink’s Cross-Chain Interoperability Protocol, which allowed the exchange between the two digital assets. The transaction used the Australian Stablecoin issued by the Australia and New Zealand Banking Group alongside the e-HKD.

This integration was key in demonstrating how blockchain-based infrastructure can enhance the efficiency and security of international payments.

Chainlink’s

protocol effectively bridged the gap between different blockchain networks, providing a seamless experience for all parties involved.

Involvement of Financial Giants

The pilot's success was further strengthened by the involvement of major financial institutions. Visa, Fidelity International, ANZ, and China Asset Management Company participated in the transaction framework.

Each of these players contributed to the pilot's execution and success, reinforcing the growing collaboration between traditional finance and decentralized technologies. This partnership highlights how established financial players are beginning to adopt and integrate blockchain and digital currency solutions into their existing systems.

Expansion of Blockchain Use in Traditional Finance

This pilot also comes when traditional financial institutions show increasing interest in blockchain and Web3 technologies. Recently, JP Morgan

concluded

its first transaction on a public chain, signaling a deeper commitment to the Web3 space.

Using Chainlink’s technology to connect private and public networks, JP Morgan’s transaction with tokenized U.S. Treasuries on Ondo Finance demonstrates how blockchain is reshaping traditional finance.

Chainlink’s Role in Cross-Border Payments

At the heart of this milestone was Chainlink’s Cross-Chain Interoperability Protocol, which allowed the exchange between the two digital assets. The transaction used the Australian Stablecoin issued by the Australia and New Zealand Banking Group alongside the e-HKD.

This integration was key in demonstrating how blockchain-based infrastructure can enhance the efficiency and security of international payments.

Chainlink’s

protocol effectively bridged the gap between different blockchain networks, providing a seamless experience for all parties involved.

Involvement of Financial Giants

The pilot's success was further strengthened by the involvement of major financial institutions. Visa, Fidelity International, ANZ, and China Asset Management Company participated in the transaction framework.

Each of these players contributed to the pilot's execution and success, reinforcing the growing collaboration between traditional finance and decentralized technologies. This partnership highlights how established financial players are beginning to adopt and integrate blockchain and digital currency solutions into their existing systems.

Expansion of Blockchain Use in Traditional Finance

This pilot also comes when traditional financial institutions show increasing interest in blockchain and Web3 technologies. Recently, JP Morgan

concluded

its first transaction on a public chain, signaling a deeper commitment to the Web3 space.

Using Chainlink’s technology to connect private and public networks, JP Morgan’s transaction with tokenized U.S. Treasuries on Ondo Finance demonstrates how blockchain is reshaping traditional finance.

Chainlink’s Role in Cross-Border Payments

At the heart of this milestone was Chainlink’s Cross-Chain Interoperability Protocol, which allowed the exchange between the two digital assets. The transaction used the Australian Stablecoin issued by the Australia and New Zealand Banking Group alongside the e-HKD.

This integration was key in demonstrating how blockchain-based infrastructure can enhance the efficiency and security of international payments.

Chainlink’s

protocol effectively bridged the gap between different blockchain networks, providing a seamless experience for all parties involved.

Involvement of Financial Giants

The pilot's success was further strengthened by the involvement of major financial institutions. Visa, Fidelity International, ANZ, and China Asset Management Company participated in the transaction framework.

Each of these players contributed to the pilot's execution and success, reinforcing the growing collaboration between traditional finance and decentralized technologies. This partnership highlights how established financial players are beginning to adopt and integrate blockchain and digital currency solutions into their existing systems.

Expansion of Blockchain Use in Traditional Finance

This pilot also comes when traditional financial institutions show increasing interest in blockchain and Web3 technologies. Recently, JP Morgan

concluded

its first transaction on a public chain, signaling a deeper commitment to the Web3 space.

Using Chainlink’s technology to connect private and public networks, JP Morgan’s transaction with tokenized U.S. Treasuries on Ondo Finance demonstrates how blockchain is reshaping traditional finance.

Chainlink’s Role in Cross-Border Payments

At the heart of this milestone was Chainlink’s Cross-Chain Interoperability Protocol, which allowed the exchange between the two digital assets. The transaction used the Australian Stablecoin issued by the Australia and New Zealand Banking Group alongside the e-HKD.

This integration was key in demonstrating how blockchain-based infrastructure can enhance the efficiency and security of international payments.

Chainlink’s

protocol effectively bridged the gap between different blockchain networks, providing a seamless experience for all parties involved.

Involvement of Financial Giants

The pilot's success was further strengthened by the involvement of major financial institutions. Visa, Fidelity International, ANZ, and China Asset Management Company participated in the transaction framework.

Each of these players contributed to the pilot's execution and success, reinforcing the growing collaboration between traditional finance and decentralized technologies. This partnership highlights how established financial players are beginning to adopt and integrate blockchain and digital currency solutions into their existing systems.

Expansion of Blockchain Use in Traditional Finance

This pilot also comes when traditional financial institutions show increasing interest in blockchain and Web3 technologies. Recently, JP Morgan

concluded

its first transaction on a public chain, signaling a deeper commitment to the Web3 space.

Using Chainlink’s technology to connect private and public networks, JP Morgan’s transaction with tokenized U.S. Treasuries on Ondo Finance demonstrates how blockchain is reshaping traditional finance.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/510578.html

Related Reading

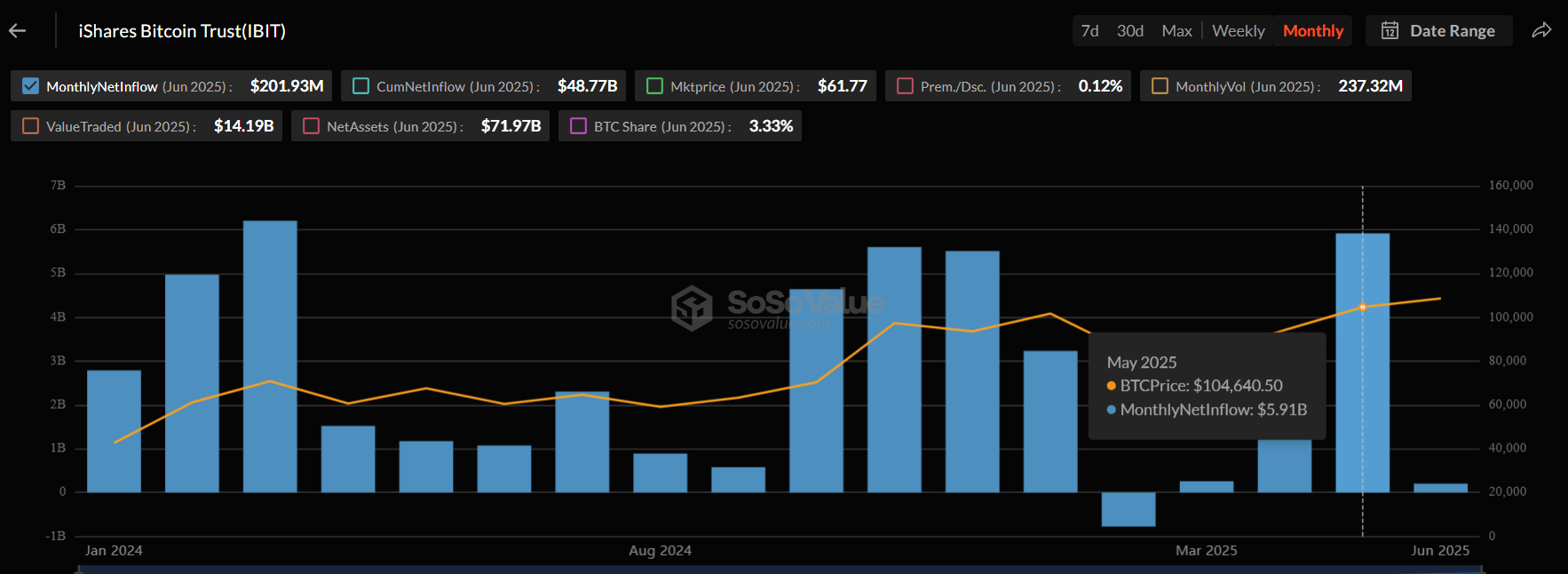

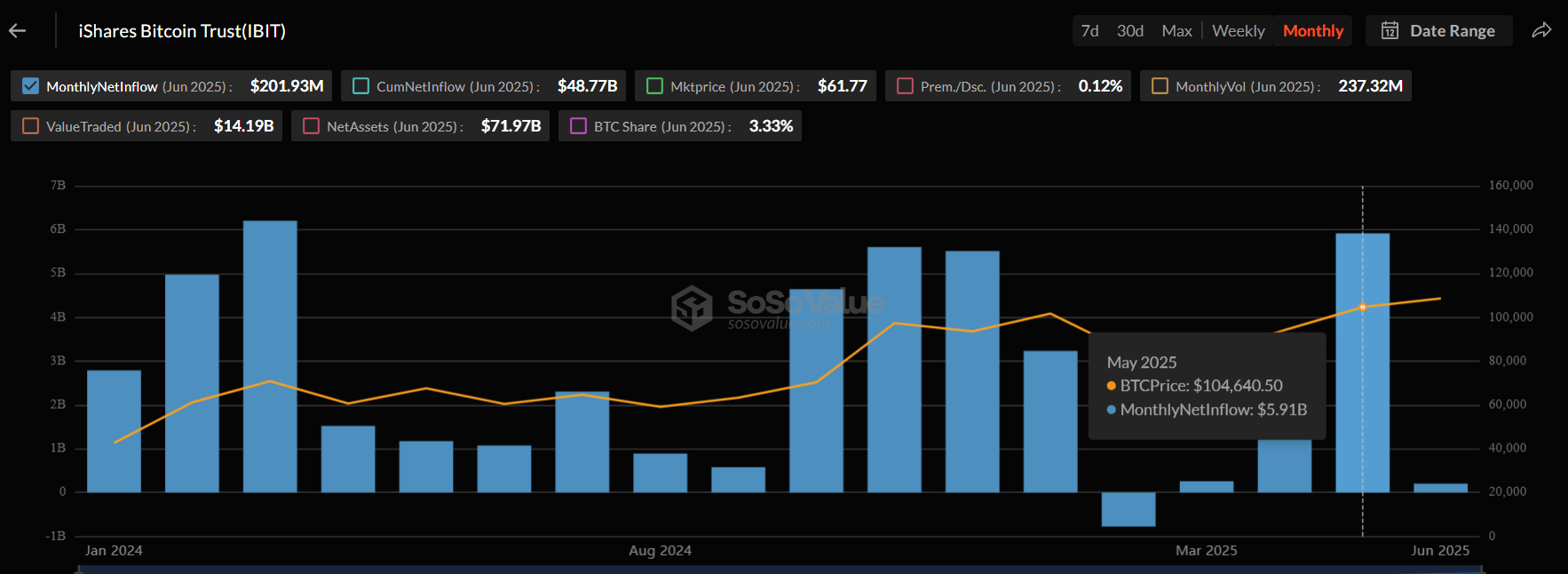

BlackRock Says Institutions Bitcoin Adoption is Still Very Early

Asset manager BlackRock has highlighted a growing interest among institutions and wealth advisors in...

XRP is The Covid of Finance: Gary Cardone

Financial expert Gary Cardone has slammed XRP for its alleged alignment with global authoritarianism...

Most People Will Never Own a Meaningful Amount of XRP: Analyst

XRP community commentator Pumpius has highlighted three psychological reasons that prevent most indi...