Ignore The Trump–Musk Noise: Bitcoin’s Backbone Stays Solid

A sudden slide in Bitcoin’s dollar value rattled traders this week after US President Donald Trump and Elon Musk tangled in public comments. The drop was sharp, and it raised questions about whether BTC can keep its upward momentum. According to market data, prices dipped quickly before finding a floor, leaving some investors on edge while others looked to on-chain figures for clues.

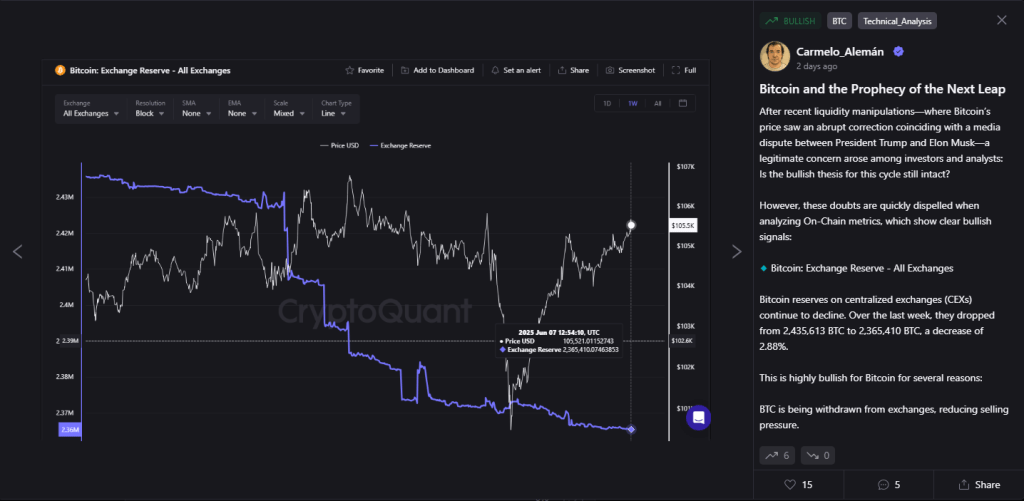

Exchange Reserves Slip

Based on reports from CryptoQuant , the amount of Bitcoin held on centralized exchanges fell from 2,435,600 BTC to 2,365,400 BTC over seven days. That’s a nearly 3% decline. When coins leave exchanges it often means people want to hold them in private wallets. Fewer coins available to sell can tighten supply. In turn, that may help prices recover.

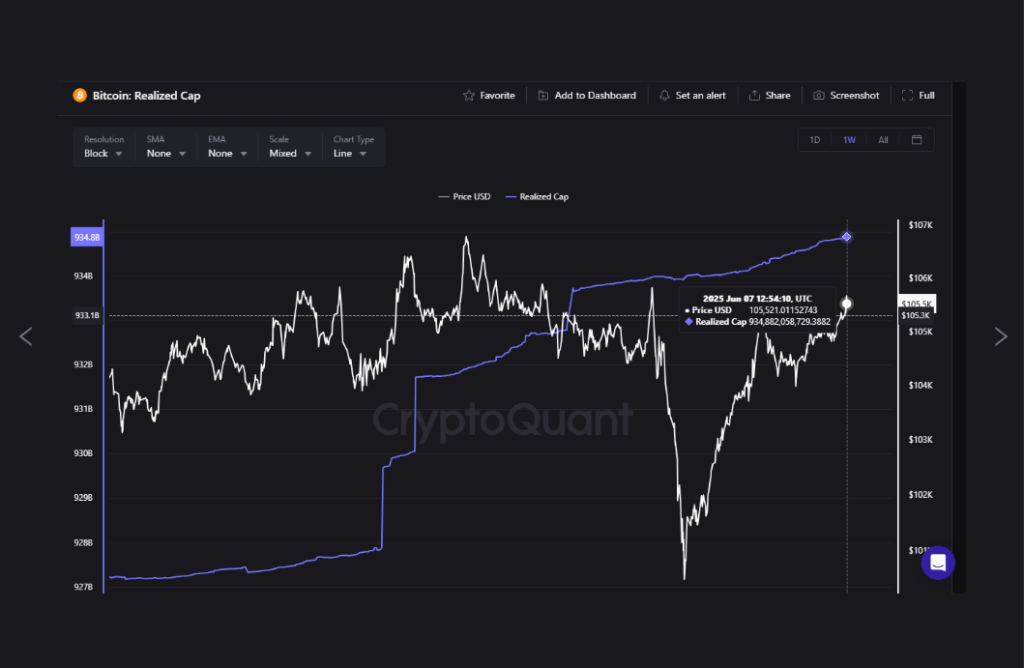

Realized Cap Hits New High

According to the same data, Bitcoin’s Realized Capitalization recently hit $935 billion. It’s the highest level on record. Realized Cap tracks the value of all coins at the price when they last moved on-chain. A rising number shows fresh capital flowing into Bitcoin. It suggests both small traders and large institutions are still betting on BTC’s long-term value.

Netflow Shows Accumulation

Netflow Shows Accumulation

Based on the flow of deposits and withdrawals, Bitcoin’s netflow has been negative. That means more coins have left exchanges than have been deposited. Withdrawals beat deposits in trading volume. In simple terms, holders aren’t looking to sell right now. It’s a classic sign that buyers outnumber sellers—at least in the on-chain arena.

UTXO Bands Point To Holder Confidence

UTXO Bands Point To Holder Confidence

CryptoQuant’s UTXO Value Bands also reveal growing activity across multiple coin-age groups. UTXO stands for Unspent Transaction Outputs. It measures the age and value of coins that haven’t moved. When you see more coins in older bands and steady movement in newer ones, it tells you a variety of investors—from long-term holders to recent buyers—are staying active. That pattern tends to shore up market support.

Looking AheadEven if Bitcoin’s price can swing wildly day to day, these on-chain signals hint at solid backing underneath. Less supply on exchanges, a record realized cap of $934.88 billion, ongoing negative netflow and rising UTXO activity all point toward patient investors holding their ground. Short-term dips may still occur, especially when big names trade barbs on social media. But for many in the market, the long-term story remains intact.

Featured image from Unsplash, chart from TradingView

Bitcoin Weekly Chart Flexes Strength—Is The Moonshot Just Getting Started?

Bitcoin is making waves once again, flashing strength on the weekly chart as it closes well above ke...

XRP Price Remains Bullish Above $2, This Falling Channel Says $3.8 Is Coming

The XRP price is holding strongly above $2, maintaining its momentum as technical indicators show si...

Don’t Risk Frozen Funds: Coinbase Has a Major Issue, So Choose Non-Custodial Best Wallet Instead

Coinbase CEO Brian Armstrong has acknowledged that the unexpected freezing of user accounts has been...