Bitcoin Recovers From $100K Dip While On-Chain Data Shows Rising Miner Activity

Bitcoin is showing signs of recovery after a brief but sharp dip triggered by recent market turbulence linked to public tensions between Donald Trump and Elon Musk. The price of BTC had dropped to nearly $100,000 during the height of the reaction, but has since rebounded .

At the time of writing, Bitcoin is trading at $104,891, marking a steady recovery from the 24-hour low. While the broader crypto market continues to digest the fallout, new data suggests that another force, miner activity, is beginning to shape the near-term outlook.

Bitcoin Surge in Miner Inflows Could Pressure Price Action

According to on-chain analytics published by CryptoQuant contributor CryptoOnchain, Bitcoin miners have dramatically increased the volume of BTC transferred to exchanges.

Between May 19 and May 28, miner-to-exchange inflows exceeded $1 billion per day, levels not seen in previous market cycles. These inflows are often viewed as a proxy for miners’ intent to sell, which could influence short-term supply dynamics and introduce added volatility to BTC’s spot market performance.

The rise in realized inflows from miners to exchanges is interpreted as a sign of growing sell-side pressure. Since miners are key liquidity providers in the Bitcoin ecosystem, large-scale transfers to exchanges are typically seen as preparations to offload BTC.

Historically, spikes in miner outflows have preceded periods of downward price pressure, particularly when they occur alongside fragile market conditions.

CryptoOnchain emphasizes that while miner selling isn’t inherently negative, it can impact short-term price stability. As a result, traders and investors often monitor these flows to better assess potential risks.

When miner inflows surge, it reflects the sector’s sentiment regarding profitability , operational stress, or anticipated price changes. CryptoOnchain noted:

Paying close attention to these inflows—especially during historical peaks like the current phase—can help with risk management and more informed trading decisions.

Hash Ribbon Signal Suggests Longer-Term Opportunity

Amid rising sell pressure, another indicator is flashing a potential opportunity. CryptoQuant analyst Darkfost noted that Bitcoin’s Hash Ribbons indicator, a metric derived from comparing 30-day and 60-day moving averages of network hashrate, has recently produced a new buy signal.

This metric is used to evaluate miner stress and recovery phases , and is generally interpreted as a signal that miners have gone through a period of capitulation and are now stabilizing or recovering. This signal has historically aligned with favorable long-term entry points, except in unique events like China’s 2021 mining ban.

While the short-term effects of mining stress may contribute to price weakness , analysts suggest that these periods often set the stage for longer-term rallies. When miner capitulation resolves, it can clear excess supply from the market and establish stronger support levels.

Featured image created with DALL-E, Chart from TradingView

Featured image created with DALL-E, Chart from TradingView

Elon Musk ‘Will Do Anything’ To Make XRP King, Tech Mogul Says

According to social media buzz, the growing clash between Elon Musk and US President Donald Trump ha...

Ethereum Holds Key Range Support After Pullback – Bulls Eye $3,000 Level

Ethereum has faced a sharp pullback, dropping over 10% in the last 24 hours as global tensions and m...

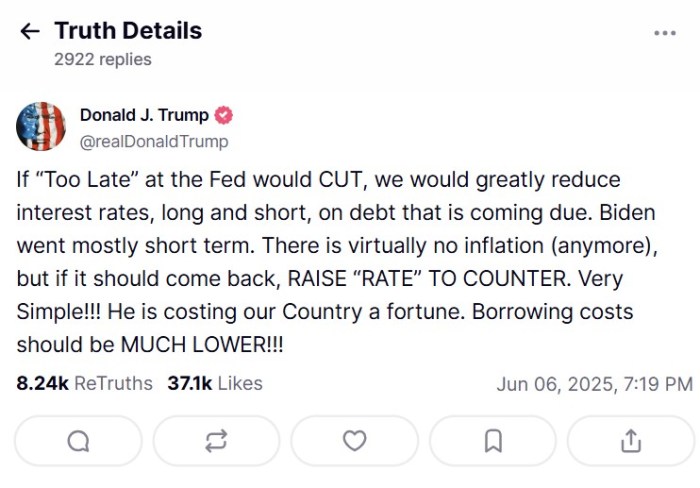

Best Altcoins to Buy as Trump Urges Fed to Cut Interest Rates in Favor of Crypto

Bitcoin made a new all-time high on May 22 when it crossed $112K. Although it dipped below $100K soo...