Researcher Says This Bitcoin Cycle Feels Like 2017, When BTC Surged Over 5,000%

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Joe Burnett, Director of Market Research at Unchained, says today’s Bitcoin market dynamics are strikingly similar to those during the explosive 2017 bull run.

In a recent market

analysis

, Burnett highlighted strong parallels between the current Bitcoin cycle and the dramatic 2017 bull market. According to him, while the 2020–2021 season brought significant growth, the momentum of those years didn’t quite match the parabolic energy seen in 2017.

For context, from January 2016 to December 2017, the price of Bitcoin soared by 5,640%, rising from $350 to $20,089. Meanwhile, the 2020/2021 cycle delivered an 8X surge with BTC rising from $6,900 to $68,000.

Burnett suggested that key headwinds such as China’s mining ban and FTX’s "paper Bitcoin" activity may have dampened the 2021 season. Meanwhile, the 2024–2025 season is shaping up differently.

Altcoin Mania Then, Bitcoin Treasury Mania Now

Burnett recalls how, in 2017, altcoin speculation indirectly drove demand for Bitcoin. At the time, most users had to buy Bitcoin first in order to access altcoins on other exchanges, especially since Coinbase only listed a handful of assets. This created what Burnett calls a “black hole” effect, where speculative capital was drawn into Bitcoin as a gateway asset.

Today, a similar dynamic is playing out, but this time through Bitcoin treasury companies. Firms like Strategy and MetaPlanet are raising capital by issuing equity and using those proceeds to acquire Bitcoin. This effectively converts speculative equity demand into Bitcoin buying pressure.

Notably, as previously reported,

12 companies joined

the Bitcoin treasury trend in May.

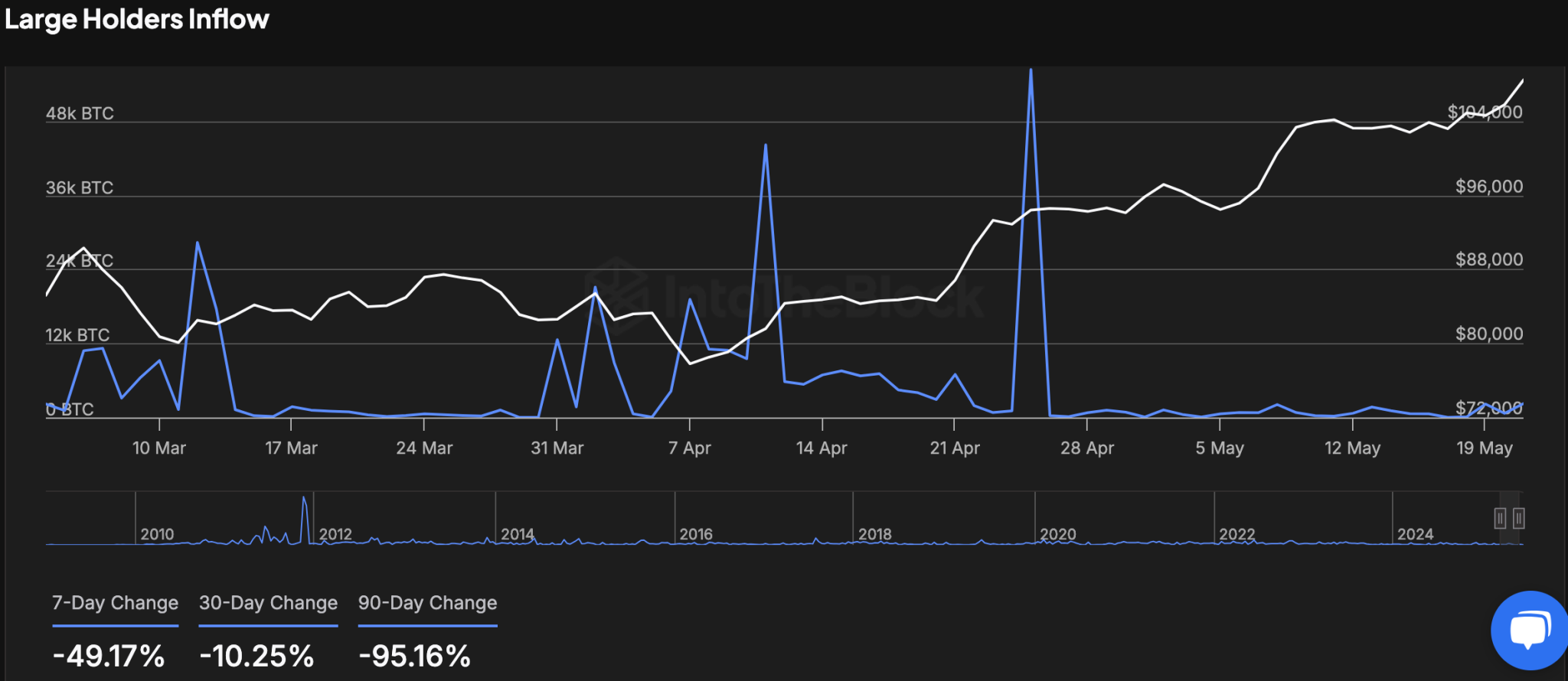

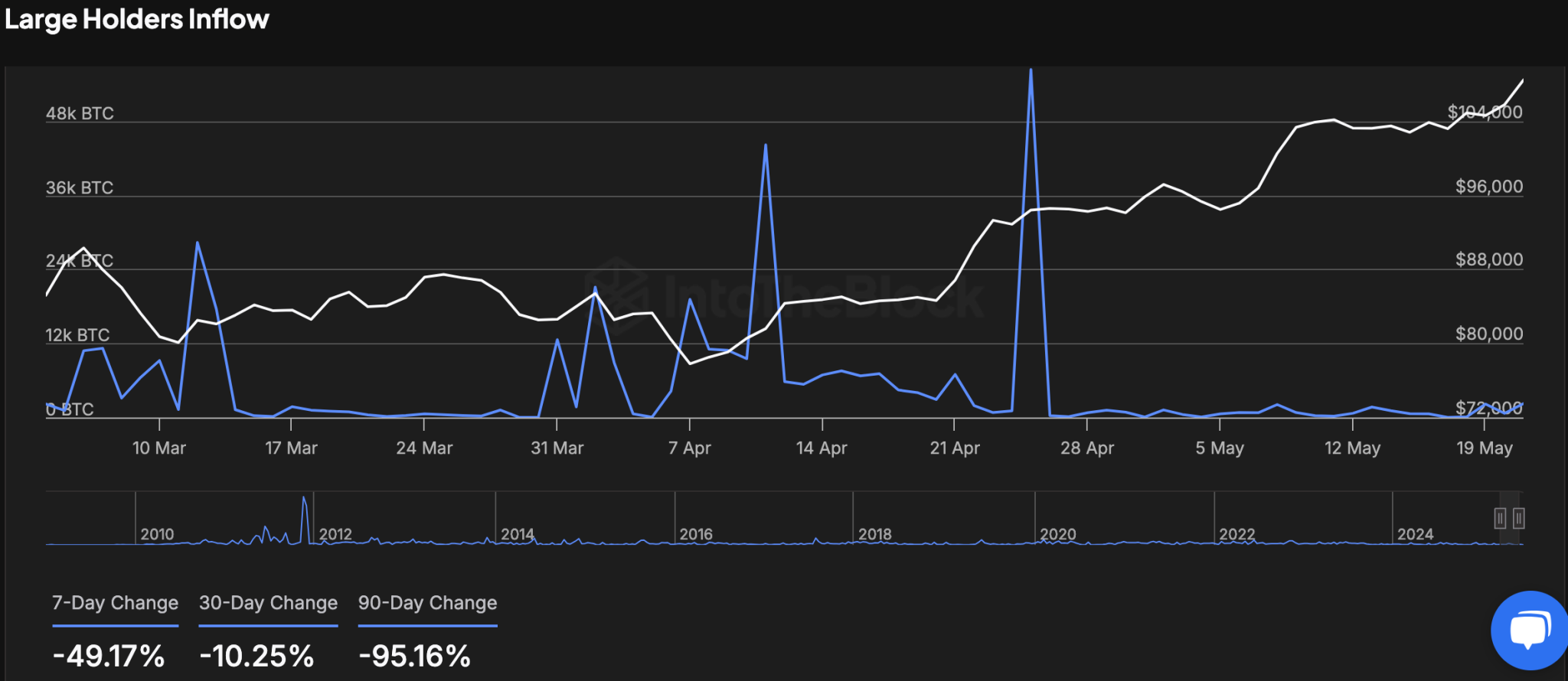

ETF Inflows and Institutional Demand Add Fuel

Another critical factor supporting the bullish outlook is the continued influx of institutional capital via

spot Bitcoin ETFs

. These inflows represent a robust and sustained source of demand that, when combined with speculative flows into Bitcoin-focused companies, could set the stage for another vertical move in Bitcoin’s price.

Notably, firms like BlackRock have acquired over 600,000 BTC over the past year amid their ETF listings.

Setting the Stage for a Parabolic Move

Burnett concludes that if these trends hold and macroeconomic conditions remain relatively favorable, the Bitcoin market could be nearing the beginning of another parabolic phase.

The confluence of strong fundamentals, institutional adoption, and speculative interest could recreate the kind of rapid price acceleration not seen since Bitcoin’s historic run to $20,000 in late 2017.

Bitcoin is trading at $105,000 at press time, and some industry commentators believe prices as high as $500,000 could be a target this season.

When Altcoin Season?

Meanwhile, concerns have emerged that the rotation of capital into ETFs and Bitcoin-related investments is delaying the prospects of an altcoin season. Some analysts

suggest that

altcoins now need a new narrative to thrive alongside Bitcoin, as the typical rotation trend may be over.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/509785.html

Related Reading

Expert Says This Development Could Be Huge for XRP

Some influential voices in the XRP community speculate that XRP could benefit from the wild rumor th...

Moscow Exchange Launches Bitcoin Futures Tied to BlackRock ETF

The Moscow Exchange has launched trading of Bitcoin futures, marking a significant step in the growi...

John Bollinger Suggests Bitcoin Rally May Be Exhausting

John Bollinger highlights a "Three Pushes to a High" pattern on Bitcoin, signaling the end of its ra...