Ethereum (ETH) Price Analysis: Is $2,850 the Next Pitstop?

The post Ethereum (ETH) Price Analysis: Is $2,850 the Next Pitstop? appeared first on Coinpedia Fintech News

While the crypto market today has been ranging sideways, Ethereum has made decent moves both on its price chart and with news around its fundamentals. The altcoin’s on-chain health is displaying remarkable strength. Reportedly, the exchange balances have been dropping constantly and have now hit their 7-year low.

That’s not all, ETH-based ETFs have outrun the global crypto market’s ETFs with $321 million worth of inflows. In this analysis, we give you an overview of Ethereum holding $219 billion worth of capital and where the ETH price could head next in the short term.

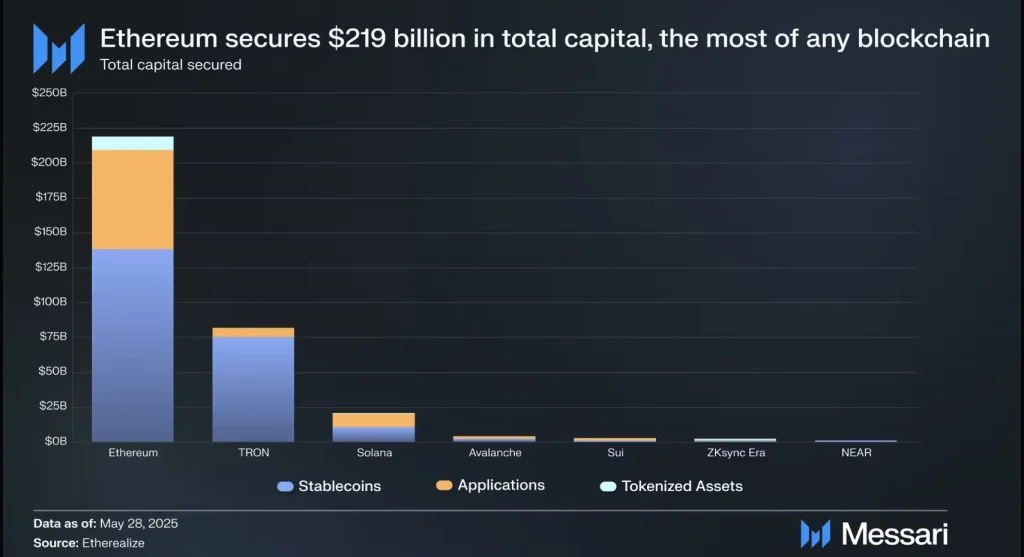

Ethereum Secures $219 Billion?

According to Messari , Ethereum continues to dominate the blockchain landscape, securing $219 billion in total capital, the highest of any network. This capital spans stablecoins, applications, and tokenized assets, reinforcing the altcoin’s position as the foundational layer of Web3. The chart highlights how it dwarfs all other chains in economic weight, with more than double the secured capital of TRON and vastly more than Solana, Avalanche, and others.

Ethereum (ETH) Price Analysis:

Ethereum is currently trading at $2,601.69, up 4.44% in the last 24 hours. Its market cap has surged to $314.25 billion with a sharp increase in trading volume to $20.02 billion, a +51.83% rise highlighting renewed market activity. The 24-hour price range saw a low of $2,477.29 and a high of $2,649.85, reflecting growing bullish momentum.

The next key resistance lies between $2,750–$2,850. A decisive move above this range could open doors for a test of $3,000 in the near term. On the downside, ETH finds solid support between $2,260–$2,100, a zone where previous consolidations occurred. Given the current strength in both fundamentals and technicals, Ethereum appears poised for further upside, barring major macro headwinds.

Read our Ethereum (ETH) Price Prediction 2025, 2026-2030 for long term price targets!

FAQs

The price of 1 ETH at the time of publication is $2,601.69 with a change of +4.44% since yesterday.

The $321M in ETF inflows signifies growing institutional demand and mainstream adoption of Ethereum as a long-term asset.

Investors are increasingly staking ETH in cold storage or staking, indicating long-term confidence and reduced sell pressure.

Dogecoin (DOGE) Price Analysis and Short-term Targets

The post Dogecoin (DOGE) Price Analysis and Short-term Targets appeared first on Coinpedia Fintech N...

Coinbase to List PancakeSwap ($CAKE): Will This Trigger a Bullish Price Surge?

The post Coinbase to List PancakeSwap ($CAKE): Will This Trigger a Bullish Price Surge? appeared fir...

Treasure Global Announces $100M Digital Asset Treasury Strategy to Invest in Bitcoin and Ethereum

The post Treasure Global Announces $100M Digital Asset Treasury Strategy to Invest in Bitcoin and Et...