Bitcoin Up 15% in a Month, Analyst Cautions on MVRV Resistance Level

Bitcoin is currently trading at $109,000, marking a marginal decline of 0.6% over the past 24 hours. Despite this short-term dip, the broader market trend remains intact, with Bitcoin recording an approximate 15% gain over the past month.

This performance comes after BTC set a new all-time high just above the $111,000 mark a few days ago, continuing its strong upward momentum through Q2 2025.

Burak Kesmeci, a contributor on CryptoQuant’s QuickTake platform, recently discussed the Market Value to Realized Value (MVRV) ratio in his latest analysis, “Bitcoin MVRV: Will the Long-Term Downtrend Break This Time?”

The MVRV ratio compares Bitcoin’s market value to its realized value, effectively measuring holders’ profitability and offering insights into market sentiment and potential turning points.

MVRV Ratio Approaches Crucial Resistance

In his analysis , Kesmeci highlighted the importance of the 365-day Simple Moving Average (SMA365) as a benchmark for the MVRV metric. Historically, when Bitcoin’s MVRV crosses above and maintains weekly closes over the SMA365, it typically signals sustained upward momentum.

Kesmeci provided the example from April 2025, when the MVRV ratio exceeded the SMA365, corresponding with Bitcoin’s substantial price increase from around $94,000 to $111,000, subsequently setting a new record high.

Currently, the MVRV stands at 2.36, comfortably above the SMA365 level of 2.14. However, the analyst points out a significant resistance looming at 2.93, a critical historical level where previous rallies encountered headwinds.

The upcoming test at this resistance could indicate whether Bitcoin will sustain its upward trajectory or experience a period of stabilization or correction . Kesmeci emphasized caution, suggesting that traders carefully monitor the MVRV behavior, as approaching these levels often prompts market participants to reassess risk .

Bitcoin Retail Investors Remain Cautiously Absent

Another factor shaping Bitcoin’s market conditions is the noticeable lack of retail investor engagement. Kesmeci observed that despite Bitcoin achieving new record highs in the second quarter of 2025, retail investor participation, measured by transfer volumes in smaller denominations (under $10,000), remains relatively subdued.

While Bitcoin’s price trajectory has remained robust, retail volumes have seen minimal increases, indicating the current rally is primarily driven by institutional or large-scale investors .

Historically, retail investor participation has served as an essential driver for sustained bull markets, amplifying price movements initially propelled by institutional investments.

Kesmeci notes that past major rallies, such as the one observed in 2020-2021, gained significant momentum when retail investors actively joined in. Thus, a critical aspect moving forward will be monitoring retail activity.

Any uptick in retail investment could potentially catalyze further Bitcoin appreciation, reinforcing recent gains and setting the stage for a broader market rally.

Featured image created with DALL-E, Chart from TradingView

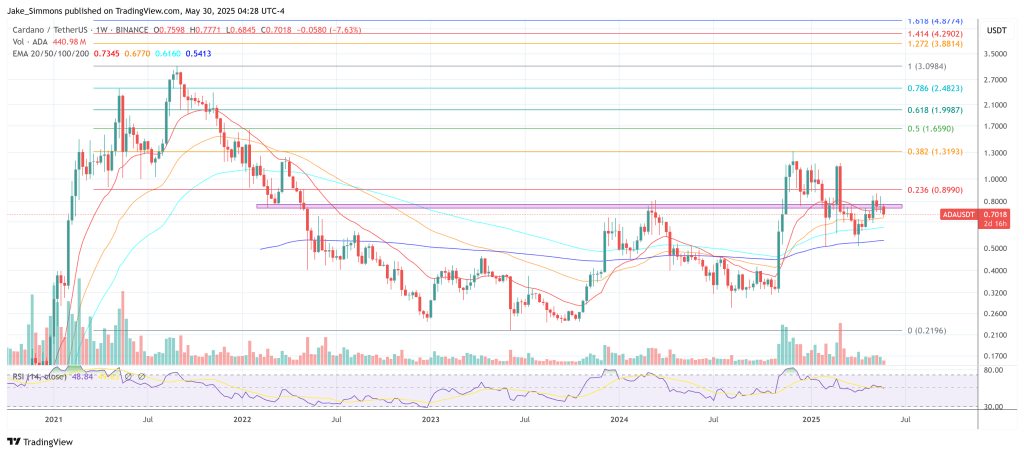

Analyst: Cardano To $10 In 2025? These 5 Catalysts Could Ignite ADA

Cardano staking pool operator (SPO) Sssebi (@Av_Sebastian) has ignited a debate by asserting that Ca...

Bitcoin ETFs See $9 Billion Inflows Amid Escalating Shift Away From Gold

Recent trends in the Bitcoin ETFs market reveal a significant shift in investor sentiment, with fund...

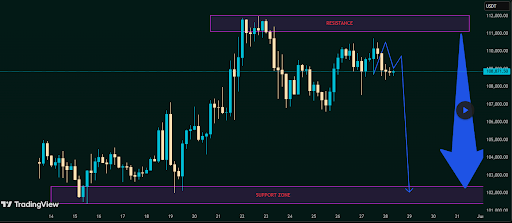

Analyst Predicts Big Drop For Bitcoin Price As Bearish Pressures Mount After $111,000 ATH

Bitcoin is showing signs of fatigue after reaching a new all-time high of $111,814 on May 22. Since ...