Veteran Analyst Says Bitcoin Is Programmed for Surge to $400,000: Here’s Why

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Kyle Chassé’s analysis shows that Bitcoin price follows global M2 money supply growth with a 90-day lag, indicating potential future gains.

While Bitcoin has shown slight short-term weakness over the past 24 hours, it remains within a strong trading range. In recent days, the price has stabilized, generally fluctuating between $108,000 and $110,000.

This period of consolidation may represent a pause before a larger move, according to analysts monitoring Bitcoin’s relationship with global monetary trends.

Tracking Bitcoin Price Against Global Money Supply

In a tweet, market analyst Kyle Chassé highlighted Bitcoin’s daily price on the BITSTAMP exchange alongside the global M2 money supply, which measures cash, checking deposits, and near-money assets worldwide.

His analysis uses a 90-day offset on the M2 data to compare earlier money supply trends with Bitcoin price movements. This offset reveals that Bitcoin’s price tends to follow the trajectory of global liquidity with approximately a three-month delay.

Bitcoin’s price history highlights significant volatility, including a peak above $109,000 in January and a drop below $75,000 in early April.

Following that dip, Bitcoin resumed an upward trend that broadly aligned with rising global M2 levels, albeit with variations in timing and magnitude. The global monetary expansion has coincided with Bitcoin’s renewed gains, despite ongoing price fluctuations.

Chassé projects that Bitcoin could eventually reach $400,000, based on this correlation. Reaching that target would require an increase of roughly 270% from the current level near $108,000, a scenario he believes is plausible if global M2 growth continues.

https://twitter.com/kyle_chasse/status/1927206528416682435

Previous Confirmation on the Correlation

Earlier in May, Julien Bittel, Head of Macro Research at Global Macro Investor,

supported

a similar thesis. He noted that global M2 acts as a 12-week leading indicator for Bitcoin price movements.

According to Bittel’s data, increases in global liquidity have consistently preceded Bitcoin rallies by about three months over the past two years.

Between early 2023 and early 2024, global M2 rose from $98 trillion to just over $108 trillion. Bitcoin’s price mirrored this trend, climbing above $100,000 by late 2024. A mid-2024 pause in M2 growth coincided with Bitcoin’s range-bound behavior and its drop below $80,000, aligning with a broader stagnation in global liquidity.

Since late 2024, global M2 has surged again, surpassing $111 trillion. Based on Bittel’s 12-week lead model, this points to potential strength in Bitcoin prices extending into mid-2025.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/508682.html

Related Reading

Cardano to $10 Is Cooking: Top Analyst Shares 5 Ingredients for a 1,233% Rally in 2025

Cardano could be up for a rally to double digits, with an analyst highlighting major catalysts for t...

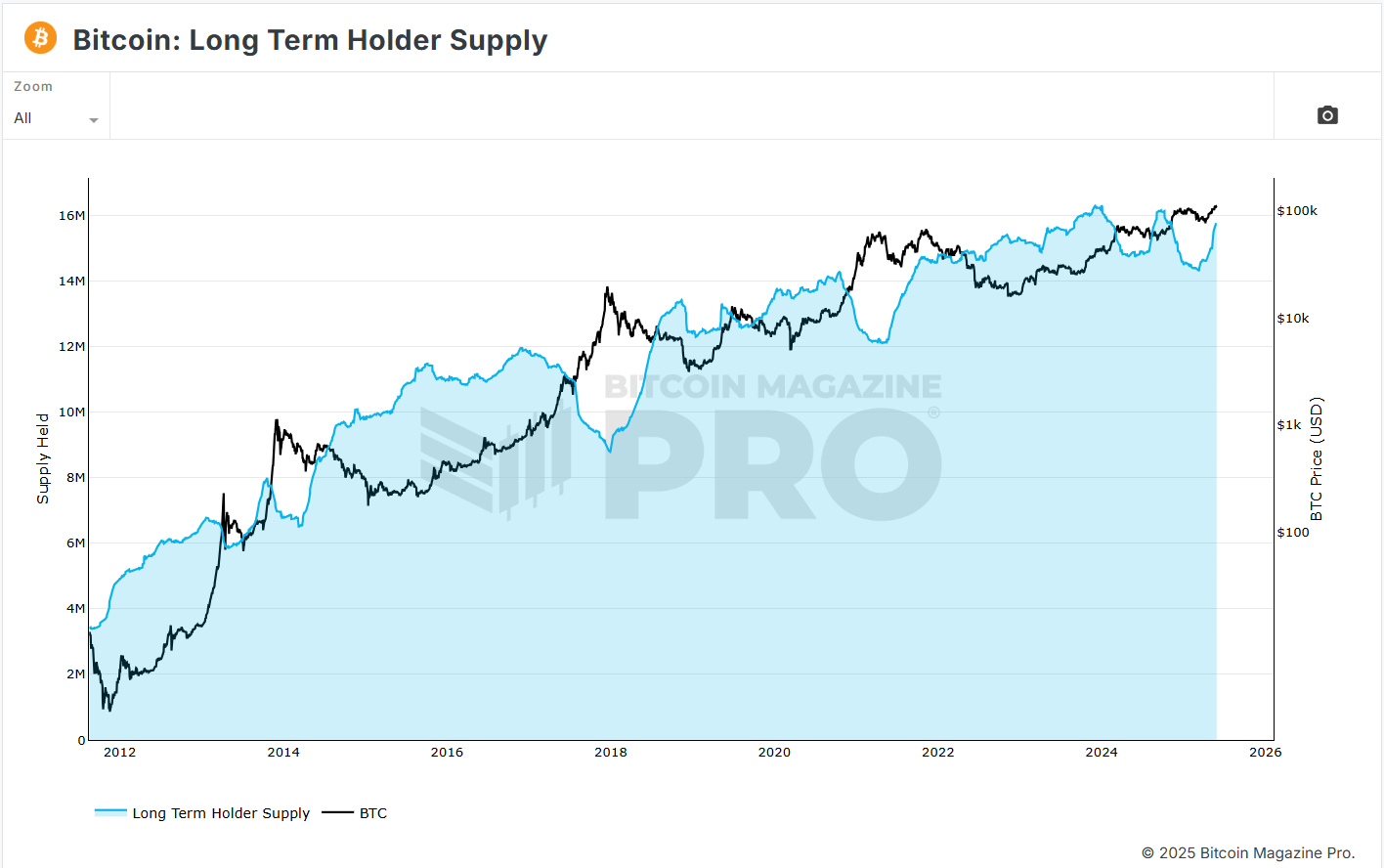

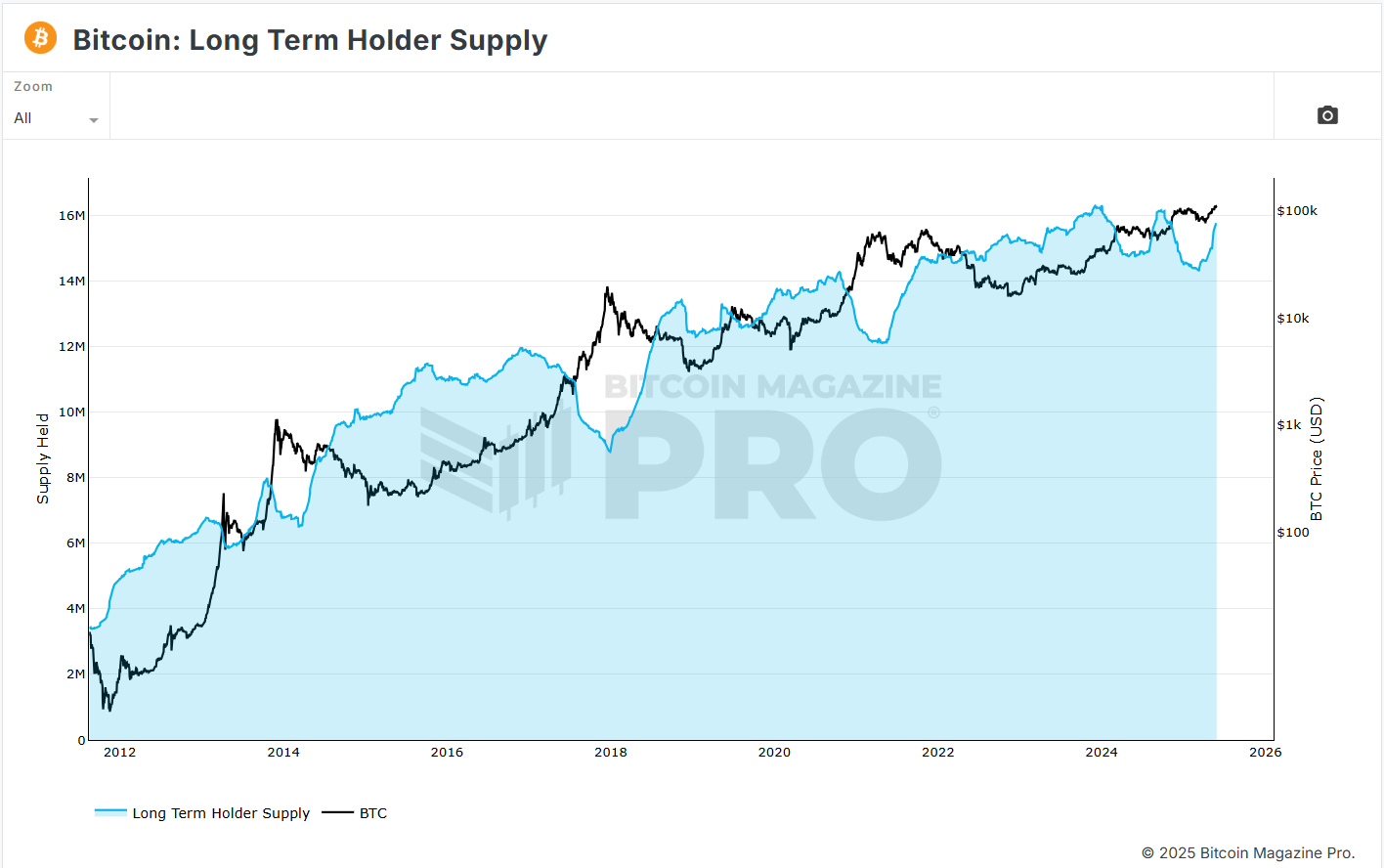

Data Shows Long-Term Bitcoin Holders Refuse to Sell; Soon No BTC Will Be Left for Latecomers

A recent report shows that long-term Bitcoin holders are not selling at current prices, and soon, th...

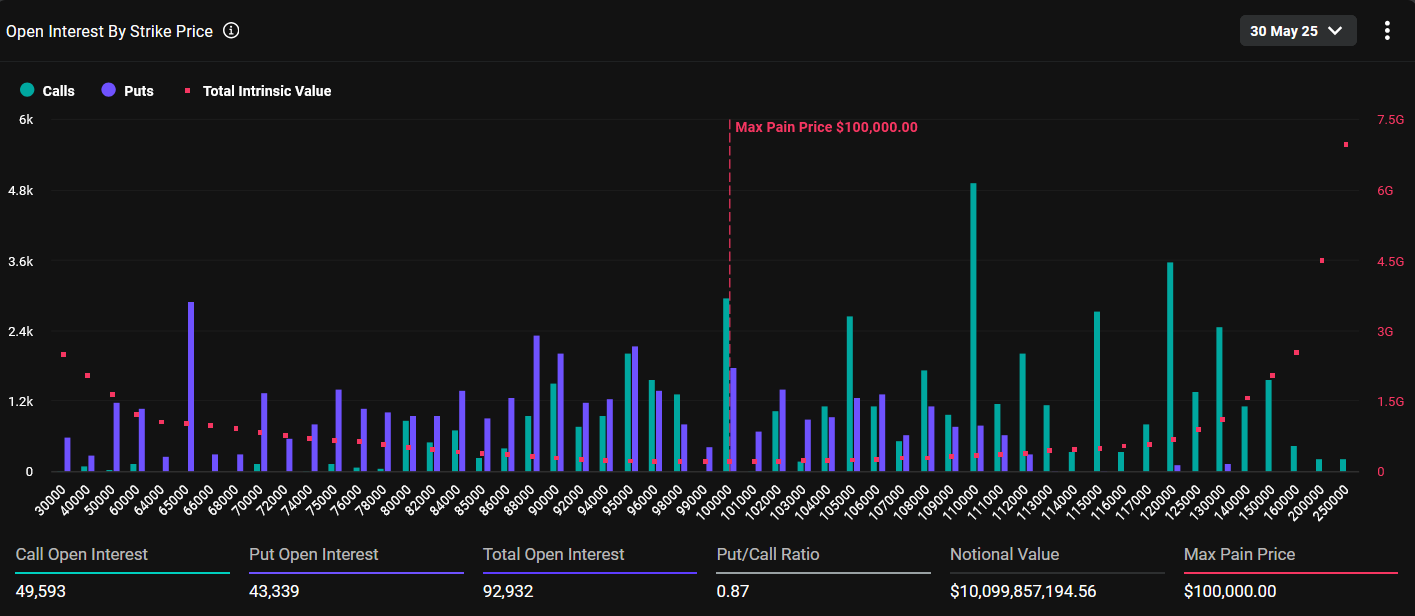

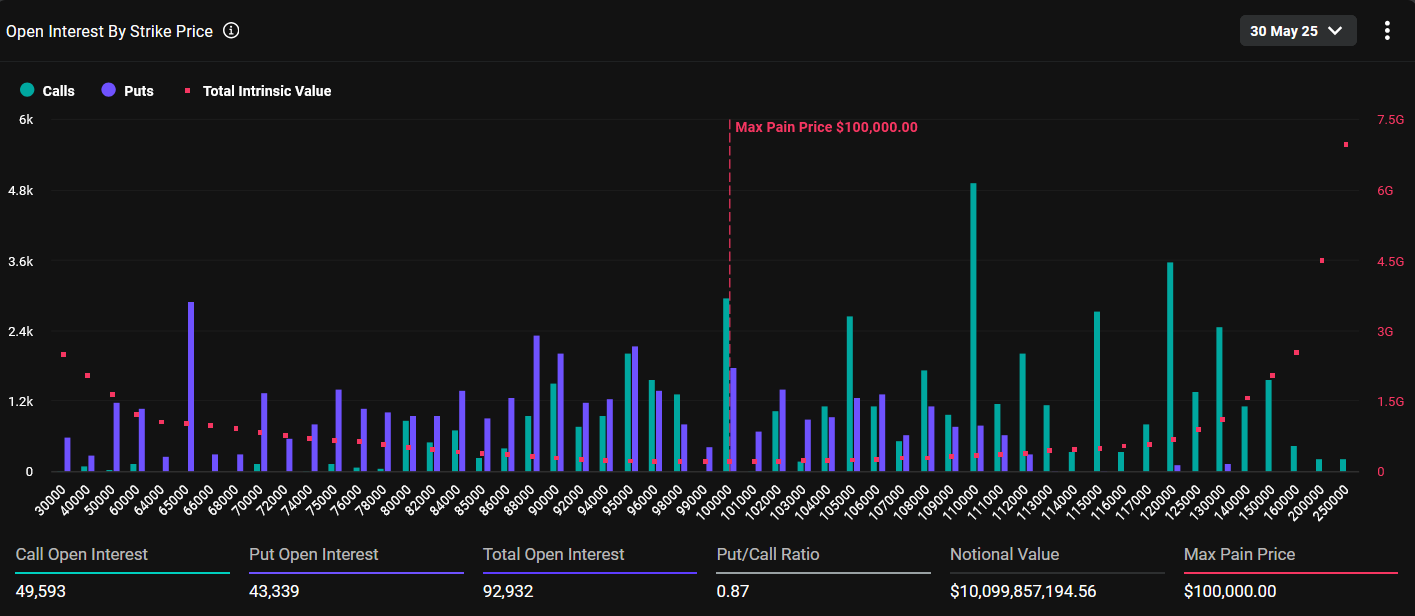

Nic Puckrin Says Bitcoin Volatility Looming Ahead of $10B Options Expiry

Nic Puckrin highlighted that Bitcoin is currently struggling, potentially due to the massive options...