Bitcoin Finally in 401(k)s as US Labor Department Lifts Crypto Restrictions for Retirement Plans

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The U.S. Department of Labor (DOL) has rescinded its 2022 guidance that discouraged the inclusion of crypto options such as Bitcoin in 401(k) retirement plans.

This

move

could make crypto assets a standard component of American retirement portfolios, potentially unlocking access to over $7 trillion in retirement savings.

2022 Guidance Reversed

The original 2022 compliance release advised fiduciaries to exercise extreme caution when considering crypto investments, citing concerns about volatility, custody, and the speculative nature of crypto assets. This departed from the DOL’s historically neutral stance and was criticized as bureaucratic overreach.

The department’s latest action, announced on May 28, 2025, officially rescinds that guidance. It now reaffirms a neutral position, neither endorsing nor discouraging the inclusion of crypto in retirement plans by fiduciaries.

Labor Secretary Slams Biden-Era Policy as ‘Overreach’

Lori Chavez-DeRemer, confirmed as U.S. Labor Secretary in March, expressed disapproval of the prior administration’s approach to labor and investment policy. She criticized what she described as excessive government interference under the Biden Administration and emphasized that fiduciaries, not federal officials, should make investment decisions.

Her remarks reflect the Trump administration’s broader pivot toward crypto-friendly policies and reinforce growing confidence in the legitimacy of digital assets.

In April, the U.S. Federal Reserve

withdrew key supervisory

guidance on crypto, granting banks more freedom to engage with Bitcoin and other crypto assets. This policy shift ends the requirement for advance notice or special approval for crypto-related activities.

Additionally, the Fed, FDIC, and OCC jointly retracted earlier warnings about crypto risks, pivoting toward standardized oversight. Now, the Department of Labor has joined this trend of regulatory easing for crypto.

Bitcoin at $111K: Timing Favors Crypto Inclusion

The timing couldn’t be more favorable.

Bitcoin

recently reached a new all-time high of $111,970 in 2025. Analysts note that its impressive performance has shifted perceptions even among conservative investors, making it a more viable option for retirement strategies.

Interestingly, Coinbase CEO Brian Armstrong recently predicted that every American will eventually have crypto in their 401(k). This latest policy change brings that vision one step closer to reality.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/508670.html

Related Reading

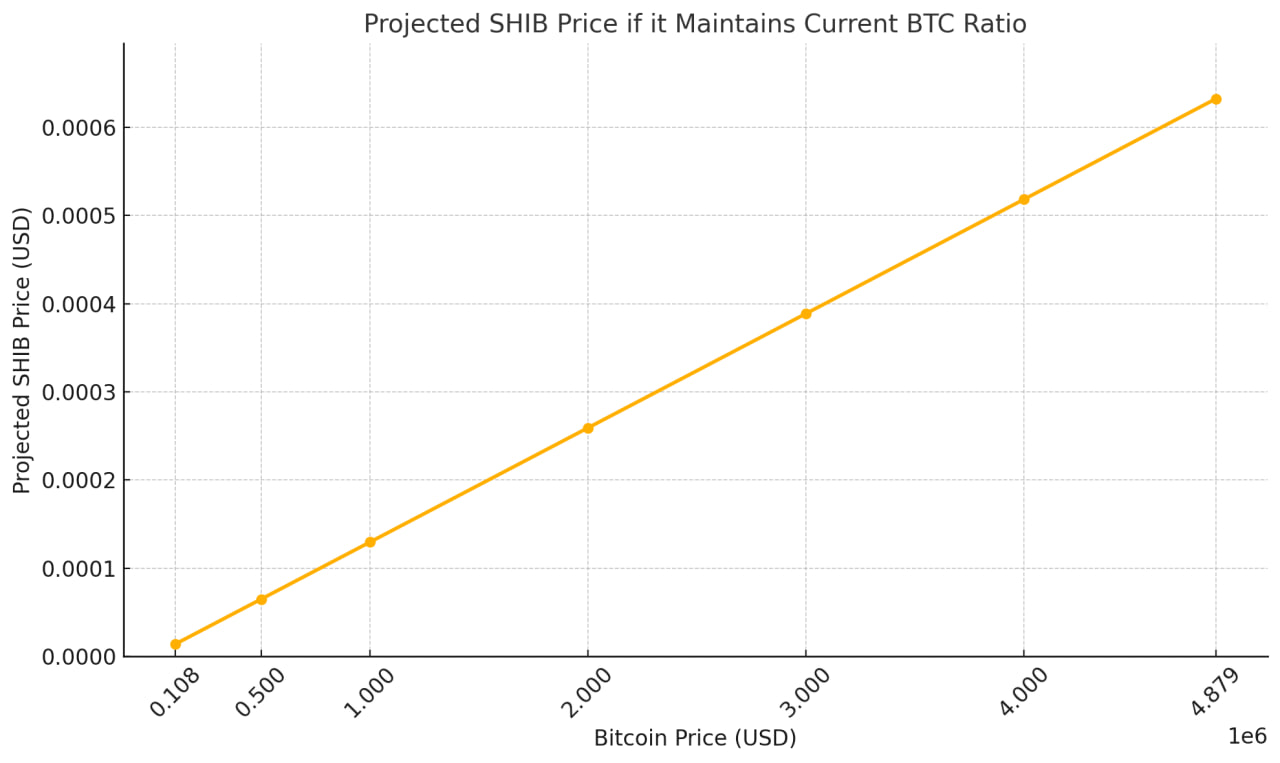

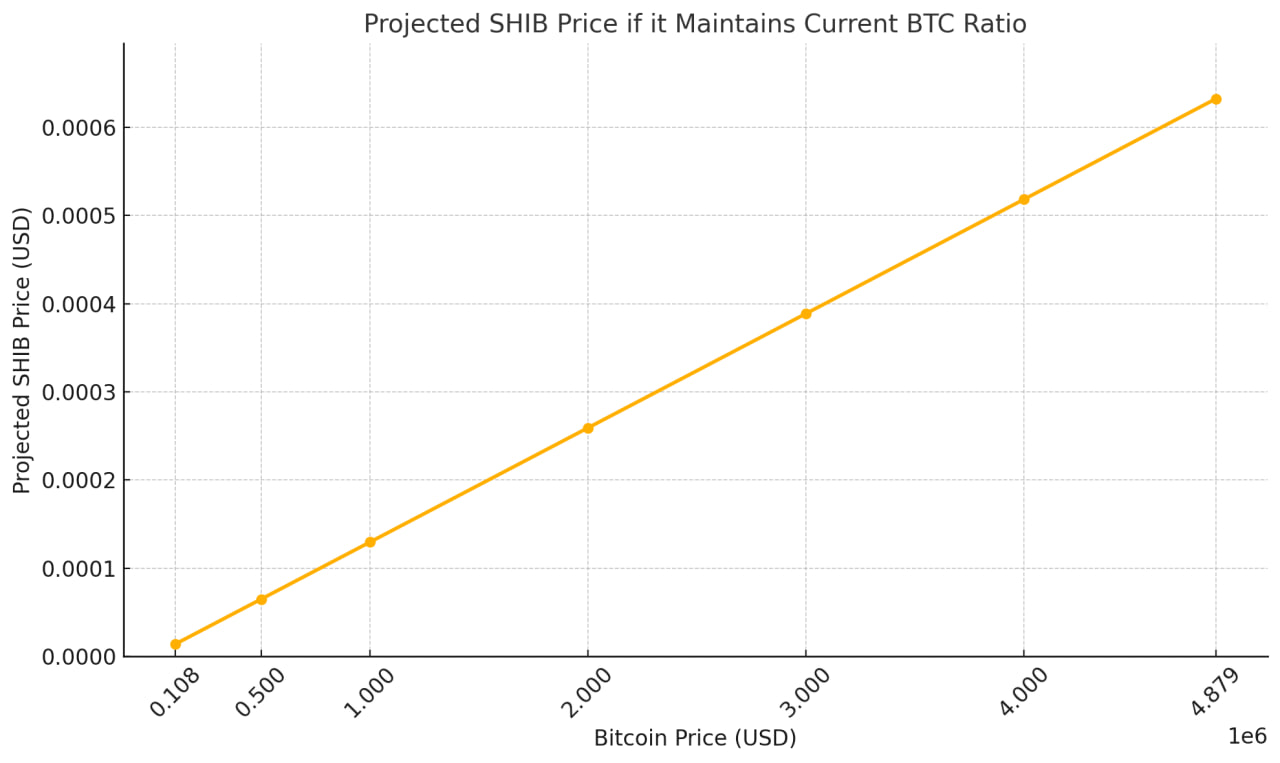

Here’s How High Shiba Inu Can Rise if Bitcoin hits $4,878,819 By 2040

Bitcoin’s projected rise to $4.87 million by 2040 could have a ripple effect on altcoin performance,...

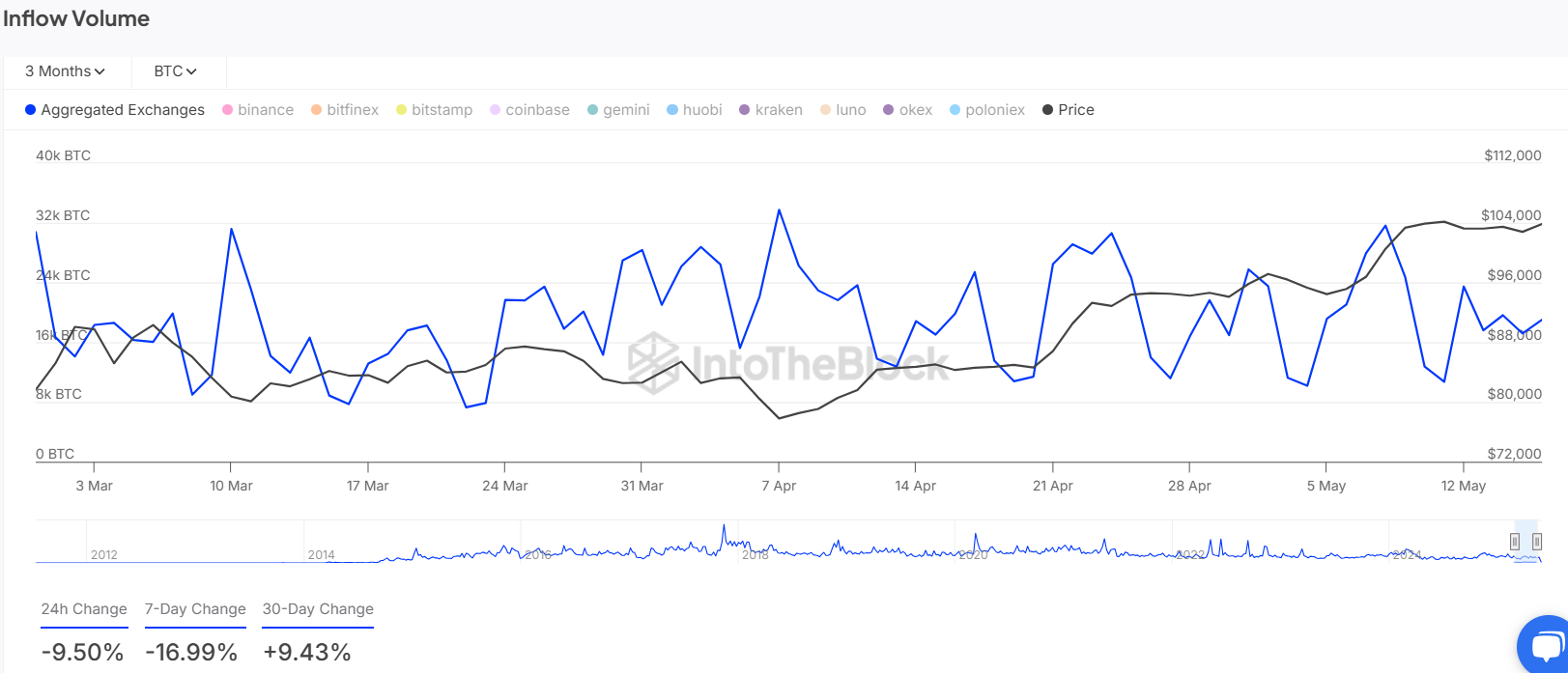

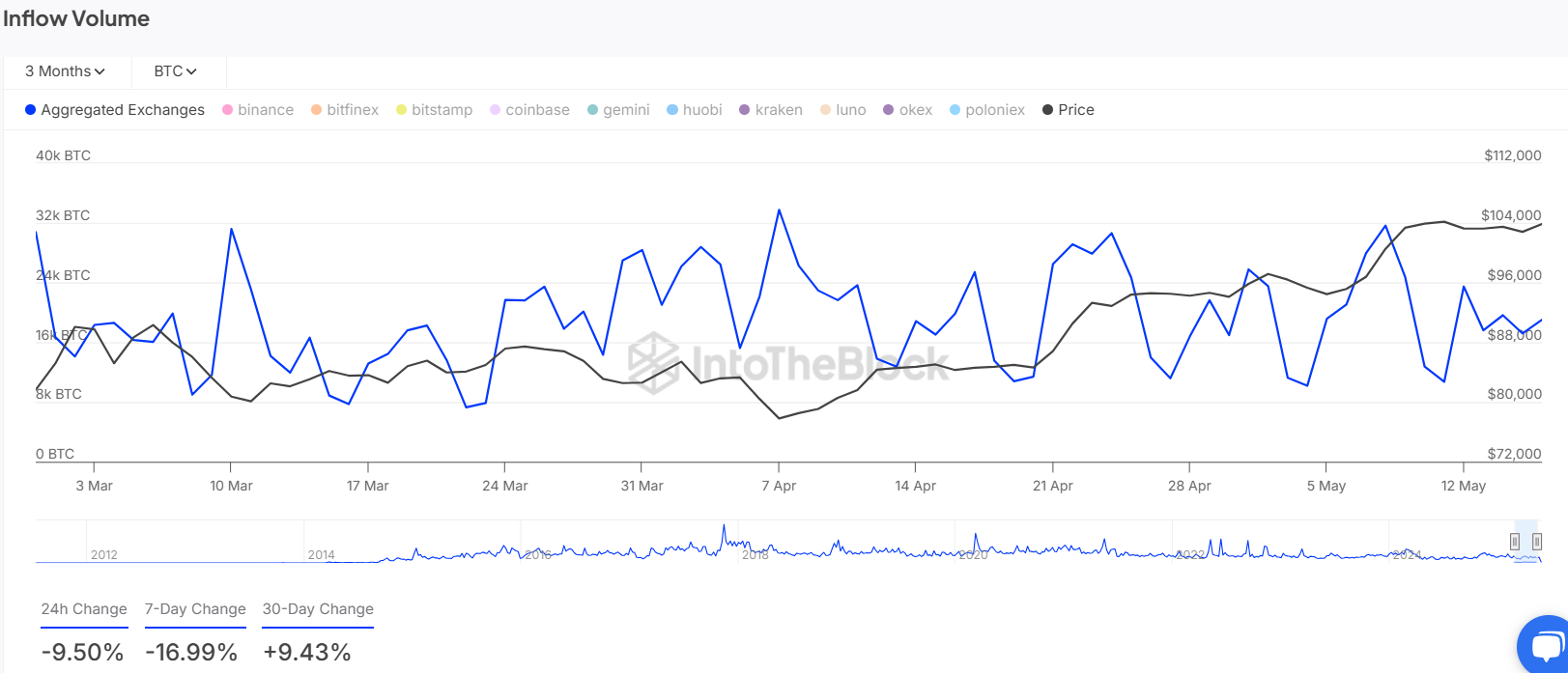

Two New Bitcoin Wallets Withdraw $84.2M in BTC From Binance, What’s Happening

Two new Bitcoin wallets recently withdrew large amounts from Binance’s hot wallet.This news comes ...

Stripe in Talks with Banks to Integrate Stablecoin Payments

Stripe Inc. is accelerating its exploration of stablecoins, engaging in talks with banks to integrat...