Virtual Protocol (VIRTUAL) Breaks Key Resistance In Second Parabolic Rally, Targets $3.

The post Virtual Protocol (VIRTUAL) Breaks Key Resistance In Second Parabolic Rally, Targets $3. appeared first on Coinpedia Fintech News

Key Highlights:

- VIRTUAL has gained 89.89% in May, currently trading at $2.39 with MCap of $1.56B

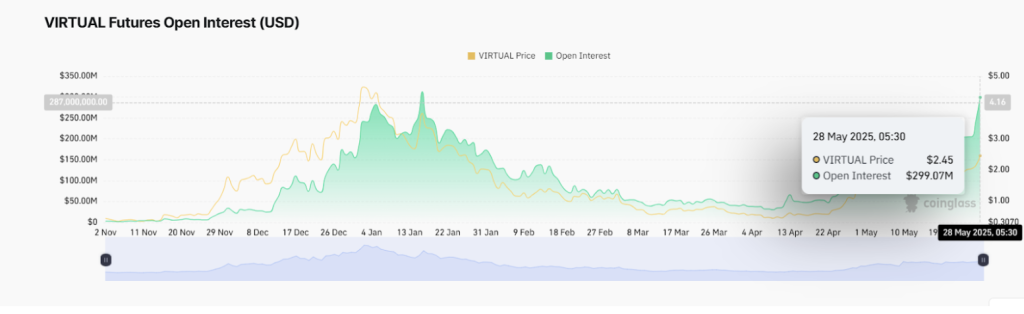

- Futures Open Interest surged from $35M in April to $239M by May 9; now at $299M.

- Daily trading volume hit $2.14B on May 9, currently at $1.38B.

- Momentum remains strong. Trend is bullish, but traders should watch for signs of exhaustion near resistance.

- Price has surpassed the $2.20 breakout zone, signalling a strong continuation setup.

Virtuals Protocol (VIRTUAL) is regaining momentum, breaking above $2.20 in a renewed parabolic rally, with traders eyeing $3 as technicals lead, while ecosystem usage growth remains moderate.

VIRTUAL/USD Price Analysis: Second Parabolic Rally in Progress

The April rally lifted VIRTUAL by 275%, from $0.60 to $2.25, forming three base structures before the vertical breakout. Since the May low of $1.68, VIRTUAL has formed another parabolic arc:

- Base 1: $1.95–$2.00 — initial consolidation.

- Base 2: $2.20 — breakout and continuation level.

The current price structure mirrors the first parabola, now approaching higher resistances. A U-shaped recovery from April to May has confirmed structural strength and dip buying.

Key Levels:

-

Support Levels:

- $2.20 — Base 2 breakout zone.

- $1.95–$2.00 — Base 1 zone.

- $1.68 — retracement low from early May.

-

Resistance Levels:

- $2.80 — local structure top.

- $3.00 — psychological breakout barrier.

- $3.50 — macro continuation level.

- $3.87–$4.00 — long-term ATH zone from January.

Growth Catalyst

Key Levels:

Support:

$1.95–$2.00 (Base 1), $2.20 (Base 2), $1.68 (retracement low)

Resistance:

$2.80 (local structure top), $3.00 (psychological breakout), $3.50 (macro continuation)

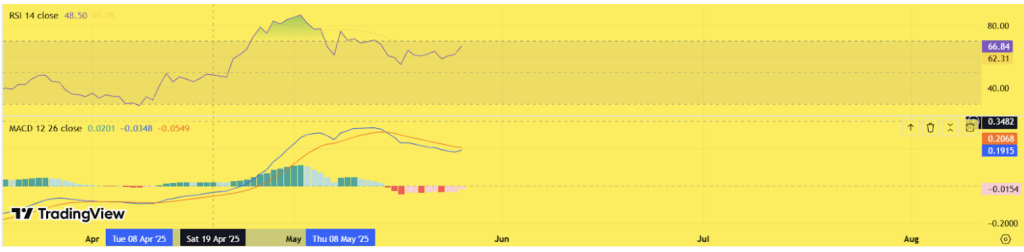

- RSI: 66.84 — showing strong bullish momentum nearing overbought levels.

- MACD: Flattening with a potential bullish crossover by early June, suggesting renewed upside strength.

Track the latest Virtuals Protocol price, market cap, and technical trends at Coinpedia Markets . Get real-time data, charts, and insights on the VIRTUAL coin

On-Chain Metrics: Speculative Strength Holds

Futures Open Interest:

Futures open interest soared from $35.2M on April 11 (at $0.45) to $239.56M by May 9 ($2.09). As of May 28, open interest sits at $299.07M with price at $2.39 — just below its January high of $312.53M when VIRTUAL traded at $3.81. This shows rising leveraged positioning and speculative conviction.

Trading Volume:

Volume peaked at $2.14B on May 9, then dipped to $1.11B on May 24. As of May 28, it has rebounded to $1.38B, showing renewed interest and sufficient liquidity for continuation.

Growth Catalysts Fueling the Rally

- Genesis Launchpad (April 17) : Introduced a new token distribution mechanism, triggering fresh user interest and participation.

- Binance.US Listing (April 29): Significantly expanded trading access and improved liquidity through a top-tier exchange.

- Narrative Momentum: Branding as an AI-agent prediction protocol has attracted speculative attention from trend-focused traders.

- Influencer Engagement: Prominent crypto analysts highlighting VIRTUAL’s outperformance against ETH and SOL have boosted its visibility.VIRTUAL Price Prediction: Can Bulls Reach $3.00?

VIRTUAL Price Prediction: Can Bulls Reach $3 ?

VIRTUAL remains in a confirmed parabolic rally, supported by high open interest and strong volume. If price holds above $2.20 and breaks $2.80 with strength, the path toward $3.00 becomes likely. The current U-shaped recovery reflects a continuation of the macro trend.

Short-Term Forecast (May 29 – June 5):

- Possible short-term pullbacks to $2.35–$2.40 .

- A revisit to $2.20 remains healthy within the arc structure.

- Breakout above $2.80 could send VIRTUAL to $3.00 .

Mid-Term Outlook (June 5 – June 14):

- If $3.00 breaks with volume, next resistance is $3.50 .

- Beyond that, $3.87–$4.00 becomes the macro breakout target.

The parabolic structure remains valid as long as $2.20 holds. Failure below this level could break the curve.

SOL Strategies Ditches Bitcoin Holdings for Solana: Company Now Owns 420,355 SOL

The post SOL Strategies Ditches Bitcoin Holdings for Solana: Company Now Owns 420,355 SOL appeared f...

Central African Republic to Tokenize Over 1.7k Ha of Land Using Its Meme: CAR Price Surges Over 17%

The post Central African Republic to Tokenize Over 1.7k Ha of Land Using Its Meme: CAR Price Surges ...

Cardano Price Prediction: Indicators Suggest Steady Rise Throughout 2025, While These 3 Small-Caps Could Rise 20x by June’s End

The post Cardano Price Prediction: Indicators Suggest Steady Rise Throughout 2025, While These 3 Sma...