Cantor Fitzgerald Kicks off $2B Bitcoin Lending Program

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Cantor Fitzgerald has officially kicked off its $2 billion Bitcoin-backed lending program with its first deals involving FalconX and Maple Finance.

This is according to a Bloomberg

report

today. Specifically, FalconX, a prime brokerage for crypto, confirmed that it secured a loan facility backed by Bitcoin as part of a wider agreement with Cantor.

The firm expects to tap more than $100 million from this new line of credit. Maple Finance also announced that it received the first portion of a similar loan from Cantor, as highlighted in Bloomberg's report.

These early deals show that crypto lending is making a comeback. The space took a hit in 2022 when companies like

Celsius

and

BlockFi

collapsed. However, signs of life have recently returned.

Importantly, Bitcoin-focused companies such as Blockstream have landed major investments, and Xapo Bank started offering Bitcoin-backed loans earlier this year. Now, Cantor's lending program adds momentum to this recovery.

Cantor Fitzgerald's Involvement in Bitcoin

Nonetheless, this isn't Cantor Fitzgerald's first move into Bitcoin. The firm has spent the past year steadily building its presence in the crypto scene. In July 2024, Cantor introduced its plan to offer $2 billion in Bitcoin loans, promising to expand the program in stages and work closely with trusted Bitcoin custodians.

By April 2025, Cantor partnered with Tether, SoftBank, and Bitfinex to launch Twenty One Capital, a $3.6 billion venture aiming to hold more than 42,000 Bitcoin. This initiative was structured using a $200 million SPAC through Cantor Equity Partners. The firm plans to raise even more funds for additional Bitcoin purchases.

Also, in May 2025, Cantor Equity Partners

acquired

close to $459 million worth of Bitcoin through a merger with Twenty One Capital.

The firm's leadership said they would keep investing in Bitcoin, even if prices fell sharply. Cantor also holds a major position in MicroStrategy, with around $1.9 billion in shares, showing strong faith in the future of Bitcoin. Last October, its CEO

suggested

that Bitcoin ranks alongside oil and gold as commodities.

Vivek's Strive Deepens Bitcoin Ties Amid Growing Institutional Adoption

Meanwhile, Cantor is not the only firm doubling down on crypto. Most recently, Investment firm Strive announced raising $750 million through a private investment round. The firm plans to build its Bitcoin treasury and pursue strategies designed to outperform Bitcoin itself.

https://twitter.com/StriveFunds/status/1927355424862339413

Strive's approach involves buying undervalued biotech firms, picking up distressed crypto claims like those tied to Mt. Gox, and investing in discounted Bitcoin-backed credit.

Other major financial institutions are also stepping into the space. The Bank of Montreal invested $150 million in Bitcoin ETFs, mostly through BlackRock's fund.

Barclays disclosed

$131 million in similar investments.

BNY Mellon recently picked up $68 million in MicroStrategy shares. Also, several big U.S. banks, including Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS, are expected to start offering spot Bitcoin ETF services by the end of the year.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/508454.html

Related Reading

XRP Drop Zone: Expert Sees a 1,500% “Crash” That Could Push XRP to $27

Market analyst EGRAG is expecting a massive XRP price "crash," citing its historical performance, bu...

Pundit Says $8 XRP This Year Is Big, But Don’t Get Too Excited

XRP investors eyeing an $8 price target this year may be celebrating too soon, according to Xena, a ...

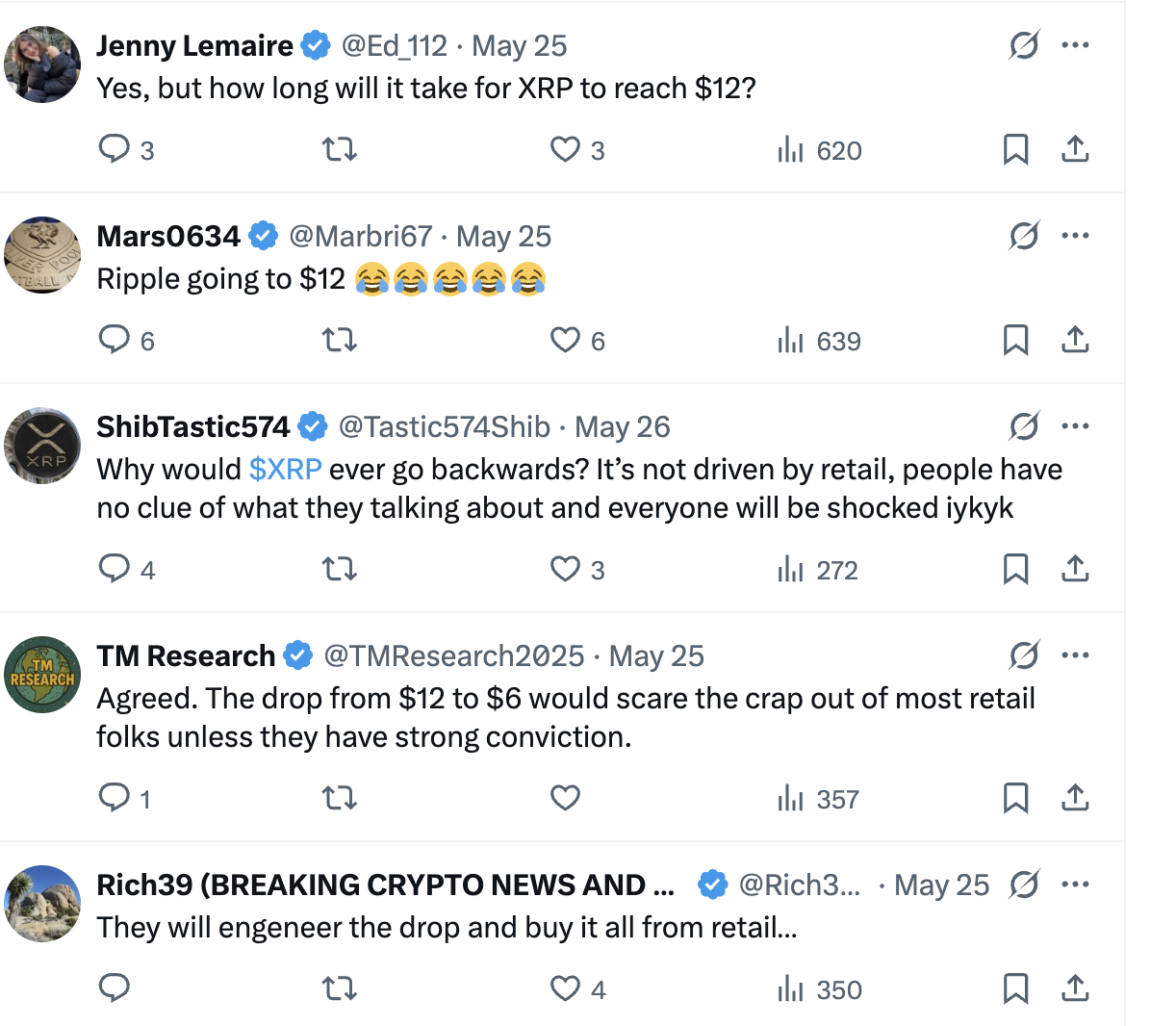

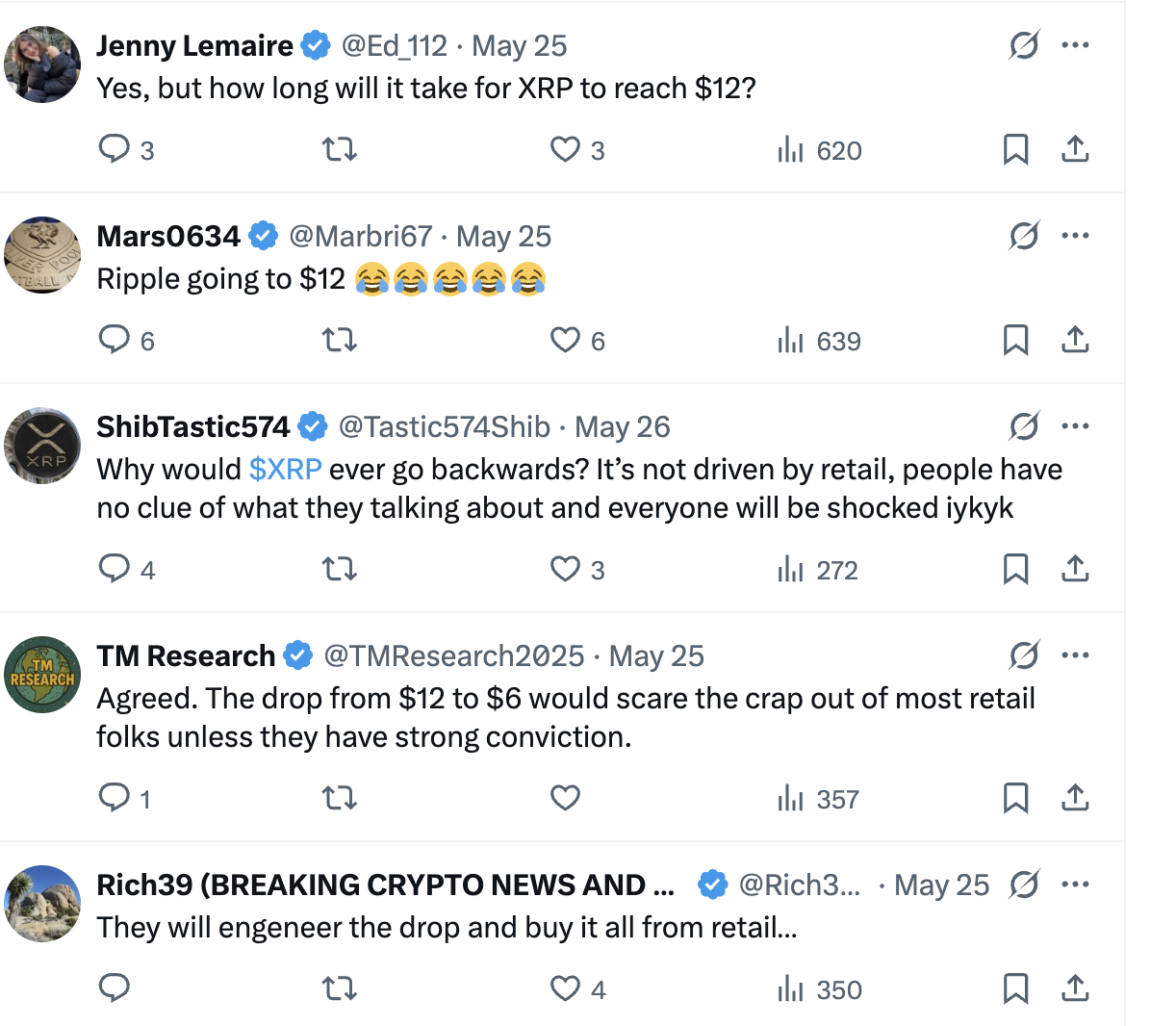

Pundit Says Smart Money Won’t Flinch When XRP Dips from $12 to $6

Although XRP lingers around $2, speculators in the community are constantly pondering the potential ...