Why Holding Bitcoin Feels 90% Like Hell And 10% Like Heaven—Analyst

Bitcoin’s price saw a wild swing last week, briefly rising above $111,800 on May 23 before dropping to $109,600 today. Despite the sudden dip, the world’s largest cryptocurrency ended the week near $110,000, trading at $109,770 at last check. While short-term volatility continues to rattle some nerves, a growing number of investors and analysts are focusing on Bitcoin’s bigger picture.

Frustration And Patience Seem To Go Hand In Hand

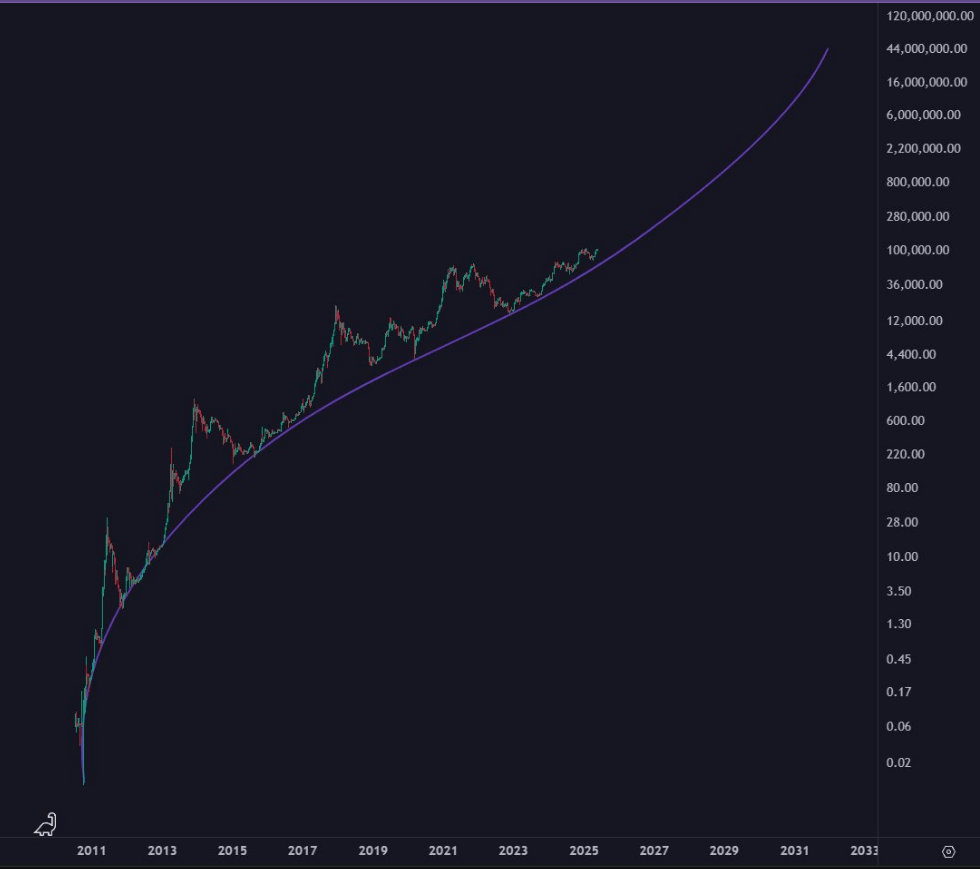

Thomas Fahrer, co-founder of Apollo, has been vocal about the emotional side of owning Bitcoin . According to him, holding Bitcoin is often frustrating—about 90% of the time, he said. But he believes it pays off for those who stick around. Fahrer shared a price chart stretching from 2011 to a projection for 2031, using a curved trendline on a logarithmic scale to show Bitcoin’s consistent upward pattern over time.

Several moments stood out on the chart. In 2015, Bitcoin crashed to around $212. In 2020, it found support near $5,000. And in 2022, after reaching a peak above $67,000 the year before, it fell to around $16,000. But through all the noise, Fahrer says Bitcoin has followed its long-term curve.

Holding Bitcoin means getting rich while feeling frustrated 90% of the time.

Deflationary money – designed to increase in value – forever.

It’s difficult for the human mind to comprehend. Most still don’t get it. pic.twitter.com/d604FyoQn3

— Thomas Fahrer (@thomas_fahrer) May 25, 2025

A Deflationary Design That’s Hard To Grasp

Fahrer also pointed to Bitcoin’s design as a deflationary currency. Unlike the US dollar, which loses value as more of it enters the system, Bitcoin has a hard cap—only 21 million coins will ever exist. Every four years, the number of new coins created is cut in half through a process called halving. That makes it harder for new supply to outpace demand over time.

Fahrer believes that many people still don’t fully understand this. The idea that money can grow in value instead of losing it goes against how most people were raised to think about spending and saving.

Numbers Tell Their Own Story

Numbers Tell Their Own Story

One Bitcoin investor, using the name Carl Menger, shared a comparison that got attention. According to his data, if someone held $100 in cash from 2020 to 2025, its buying power would shrink to just $76. But that same $100 put into Bitcoin would grow to $1,201 over the same stretch of time.

It’s a sharp contrast. While inflation chips away at fiat savings, Bitcoin, with its fixed supply, shows the opposite effect when prices go up. That’s the kind of visual that sticks.

Once you see it, you can’t unsee it. #Bitcoin pic.twitter.com/4OBqOLgm3n

— Carl ₿ MENGER

(@CarlBMenger) May 24, 2025

Robert Kiyosaki , the author known for “Rich Dad Poor Dad,” also joined the conversation. He said people often think they need to buy a whole Bitcoin to benefit, but that’s not true. Even owning 0.01 BTC, he said, could have a major impact down the line if Bitcoin continues to perform as it has in the past.

Kiyosaki also mentioned that Bitcoin has made it easier to build wealth without relying on things like gold. It’s a view that matches the mindset of many younger investors who are looking for alternatives.

While the market remains unpredictable day to day, the long-term message coming from these voices is clear: Bitcoin may test your patience, but it hasn’t broken its trend yet.

Featured image from Gemini Imagen, chart from TradingView

Greed Rising, Chainlink Stalling: Will LINK Smash Past $20 And Race To $36.5?

Chainlink’s token, LINK, has barely budged this month. It sits in 13th place by market cap after pic...

Crypto Analyst Predicts XRP Price Could Shoot To $12 Soon

Crypto analyst Cryptoinsight has provided a bullish outlook for the XRP price, predicting that it co...

Indecisive Close For Litecoin, But The Real Story Lies In BTC.D’s Next Move

Litecoin (LTC) wrapped up the day with an indecisive close, leaving traders on the edge of their sea...