On The Verge: Strategy’s Recent Purchase Positions Total Bitcoin Holdings Near 600,000

Strategy, the Bitcoin (BTC) proxy firm formerly known as MicroStrategy and founded by Bitcoin bull Michael Saylor, has announced a significant new acquisition of the market’s leading cryptocurrency on Monday.

Strategy Capitalizes On Significant New BTC Acquisition

In a recent filing with the U.S. Securities and Exchange Commission (SEC), the company revealed it purchased an additional 4,020 BTC for $427.1 million, translating to an average price of $106,237 per token.

This acquisition comes on the heels of Bitcoin reaching a new record high close to $112,000 last week, driven by renewed inflows into Bitcoin exchange-traded funds (ETFs) and favorable regulatory developments under President Trump’s administration.

Saylor shared the news on social media platform X (formerly Twitter), noting that the latest purchase brings Strategy’s total Bitcoin holdings to approximately 580,250 BTC, acquired for a total investment of $40.6 billion, at an average price of $69,979 per token.

As Strategy continues its aggressive Bitcoin accumulation strategy, the company is also planning to raise additional capital to further enhance its holdings.

$7.7 Billion Gain From Bitcoin Investments

As reported by NewsBTC last Friday, Strategy announced the launch of a $2.1 billion At-The-Market (ATM) equity program for its preferred stock, Strife (STRF), deemed as a crucial step toward the firm’s long-term goal of establishing a strong Bitcoin-backed financial infrastructure.

During an investor update, CEO Phong Lee, alongside Executive Chairman Saylor, highlighted the impressive year-to-date performance of the firm’s Bitcoin-linked securities, Strike (STRK) and Strife, as key factors driving this expansion.

Lee emphasized, “We’re currently at a 16.3% BTC yield for the year, against a 25% target,” indicating the firm’s ambitious goals. So far, Strategy has achieved a dollar gain of $7.7 billion from its Bitcoin investments and aims to reach a target of $15 billion.

The company had previously issued $212 million through Strike’s ATM program without encountering adverse pricing pressure . Given the high trading volume and strong investor demand, Lee expressed optimism that the $2.1 billion Strife ATM could be executed with similar success.

In contrast to its other offerings, Strike is designed for “Bitcoin-curious” investors, featuring an 8% coupon and potential upside through Bitcoin conversion. Saylor described it as a “Bitcoin fellowship with a stipend,” appealing to a different risk profile.

Currently, Strategy operates three ATM programs: $21 billion each for MicroStrategy (MSTR) equity and Strike, and $2.1 billion for Strife. These programs are rebalanced daily, allowing the company to adjust its issuance based on market conditions , volatility, and investor appetite.

At the time of writing, BTC is attempting to consolidate above the key $109,370 mark, which has the potential to become a new support level and allow for new records to be reached in the coming weeks. Year-to-date, the cryptocurrency has gained 56%.

Featured image from DALL-E, chart from TradingView.com

Shiba Inu Trapped Inside Triangle: 17% Move Incoming?

An analyst has pointed out that Shiba Inu is currently trading within a triangle pattern, which coul...

Cardano (ADA) Capped Below Resistance — Will Buyers Regain Control?

Cardano price started a fresh decline below the $0.80 zone. ADA is now consolidating and might aim f...

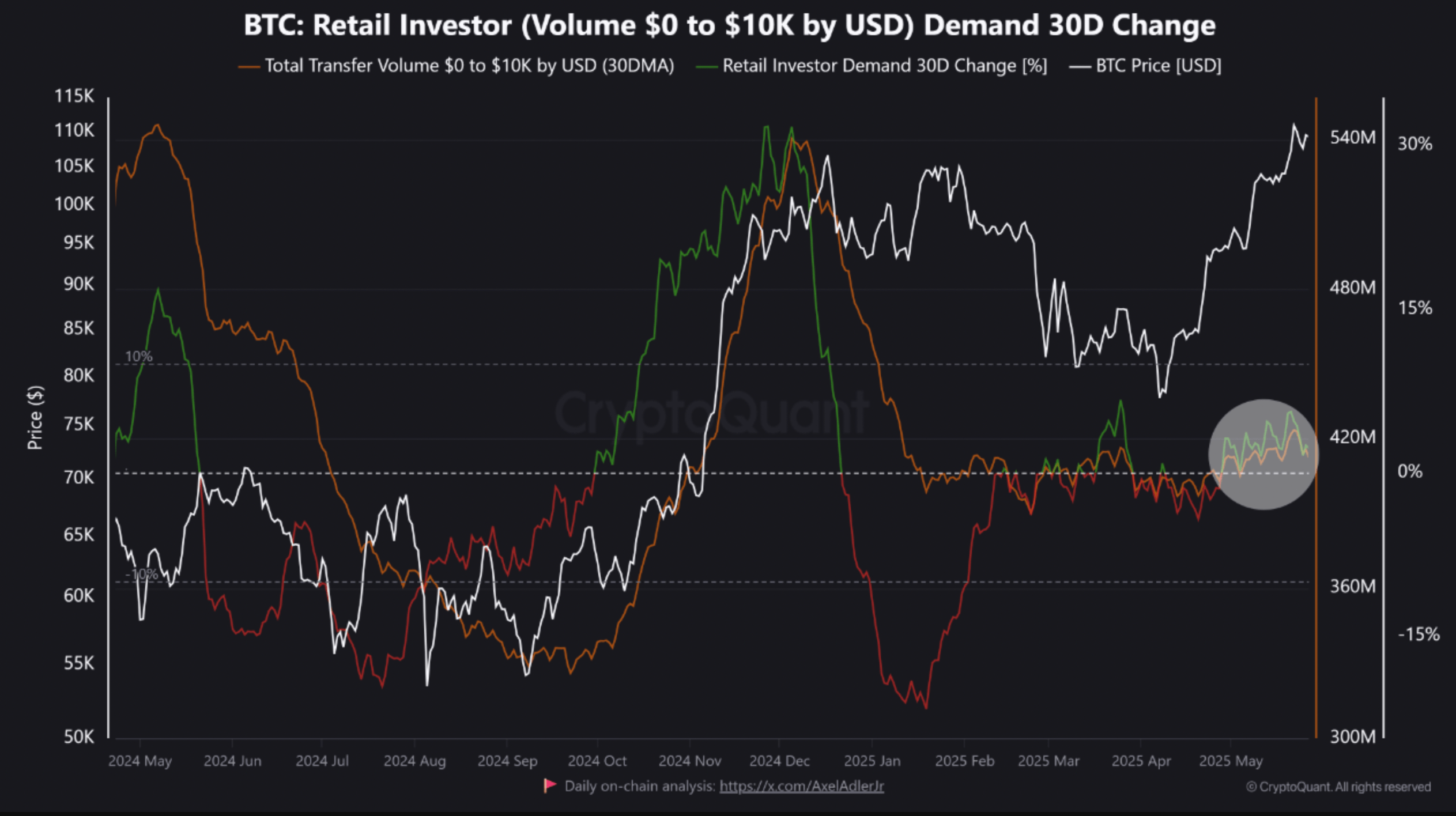

Bitcoin Surges With Low Retail Interest – Is A Second Wave Coming?

Recently, Bitcoin (BTC) achieved a new all-time high (ATH) of $111,980 on Binance crypto exchange, s...