2,700% XRP Rise? Analyst Predicts Monster Move Based On The Charts

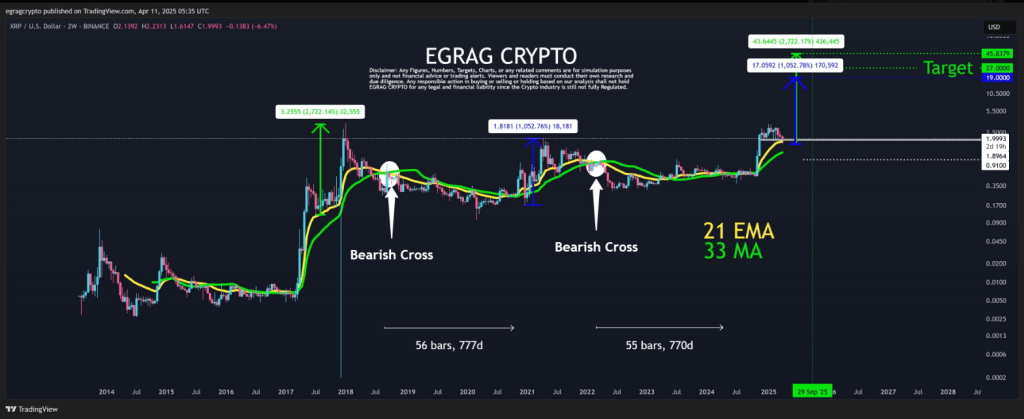

A well-known crypto analyst, going by the name Egrag Crypto, has laid out some eye-popping targets for XRP . According to his charts, the token could climb as high as $45, a 2,700% jump from its current price.

A more modest scenario would still send it to $19, up a little over 1,000%. He points to past cycles where similar moves took shape over roughly 770 days. Yet not everyone is on board with his bullish outlook.

Historical Moves And Cycle Timing

Based on reports, Egrag Crypto stresses that XRP’s rallies in 2017 and 2021 followed almost identical paths. The token hit $3.25 in 2017 after surging 2,770%. Then in 2021 it jumped 1,052% to about $1.80.

Each rally was marked by a bearish crossover on the 21 EMA and the 33 MA, followed by sideway trading for around 777 days after the 2018 peak and 770 days after the 2021 high. He believes the same setup started late in 2024, when XRP climbed nearly sixfold from its previous low.

#XRP – Targeting $19 or $45?

Charts Men lie, women lie, but charts don’t!

I’m not improvising here; I’m relying on historical data to present future predictions. Will it rhyme exactly? No, because if it were that easy, everyone would be a multimillionaire!

Human… pic.twitter.com/YasA4k98fd

— EGRAG CRYPTO (@egragcrypto) April 11, 2025

Bullish Targets And Risks

According to the analysis, a repeat of past moves could push XRP as high as $45. A less aggressive run would still see it reach $19. Egrag Crypto even points to an intermediate target of about $27 as a likely milestone.

Those numbers assume a straight path up, but markets rarely move in straight lines. Big jumps often end with sharp pullbacks. Traders chasing 2,700% gains could face long wait times and steep drops.

Bearish Views Gain Ground

Bearish Views Gain Ground

Other voices warn against getting swept up in the hype. Market watcher Koroush says now is a time for shorts. He pegs a possible decline to $1.30. Others favor a short bias, pointing to weakening demand and faltering momentum.

Advice For TradersEgrag Crypto recommends a simple Dollar-Cost Averaging plan. Buy small amounts at regular intervals. That way, no one big buy leaves you exposed. He says to sell in slices, too. Lock in gains at key levels instead of betting everything on the top. This kind of step-by-step play can cut losses and smooth out wild swings.

Looking AheadThe debate around XRP’s next phase is far from over. Historical charts show one side of the story. On-chain trends, legal battles, and macro factors tell another. If charts really don’t lie, as Egrag Crypto quips, XRP might be gearing up for a fireworks show.

Featured image from Unsplash, chart from TradingView

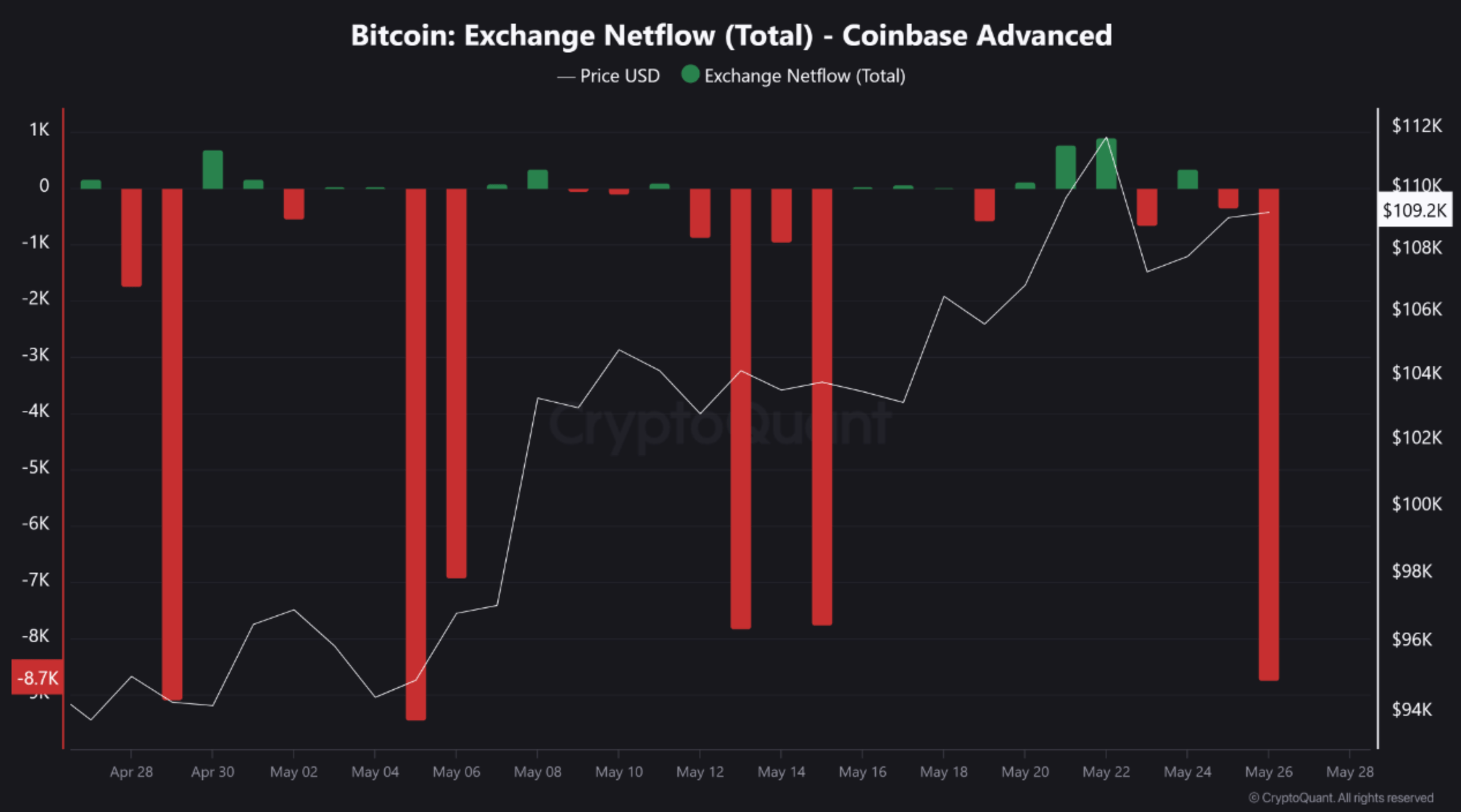

Bitcoin Sees Massive 7,883 BTC Outflow From Coinbase – Are Institutions Loading Up?

As Bitcoin (BTC) continues to trade near its recent all-time high (ATH) of $111,980, activity on maj...

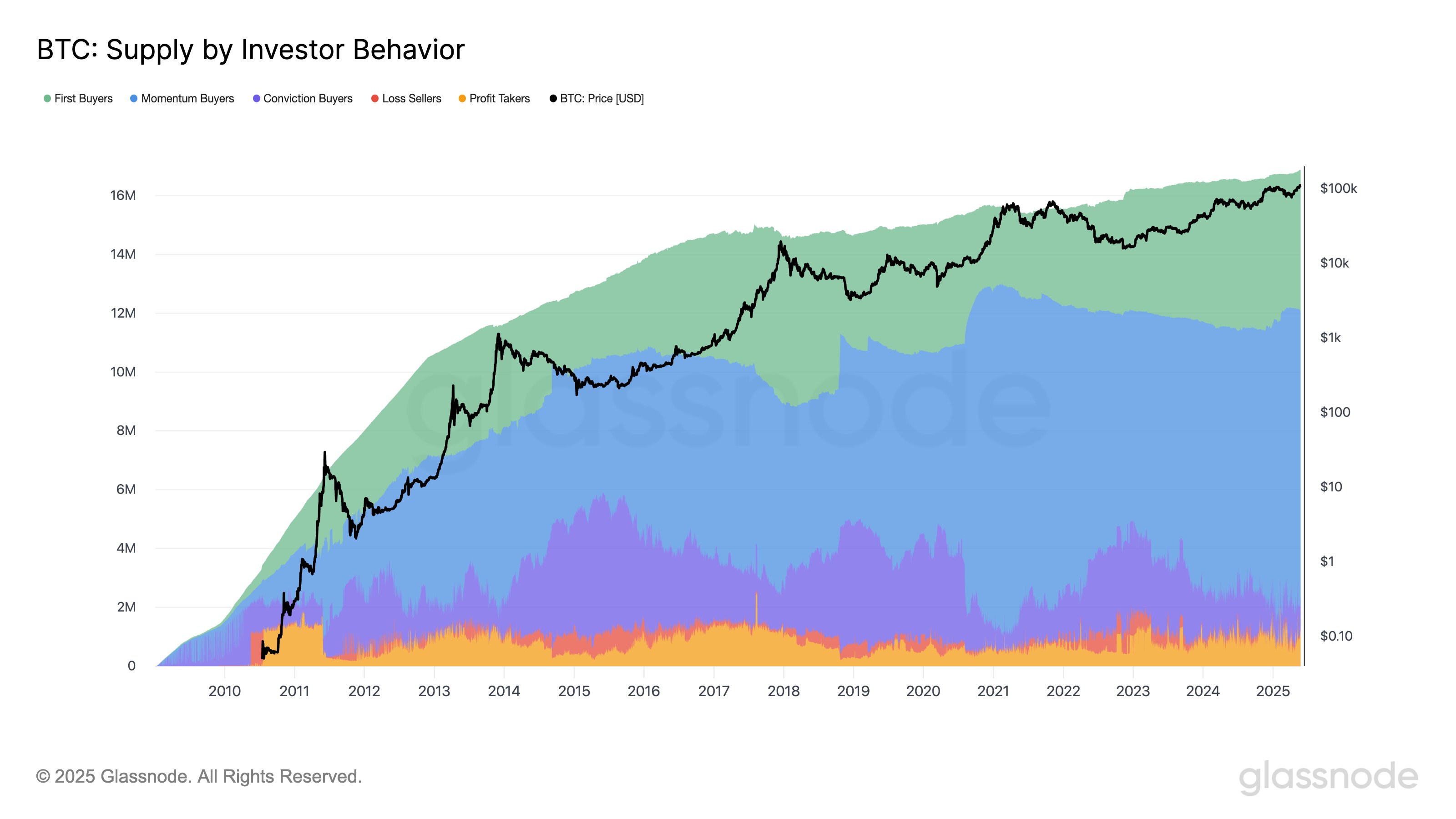

How Does Bitcoin Investor Behavior Shape Trends? Glassnode Reveals

The on-chain analytics firm Glassnode has explained how Bitcoin investor behavior tends to reflect i...

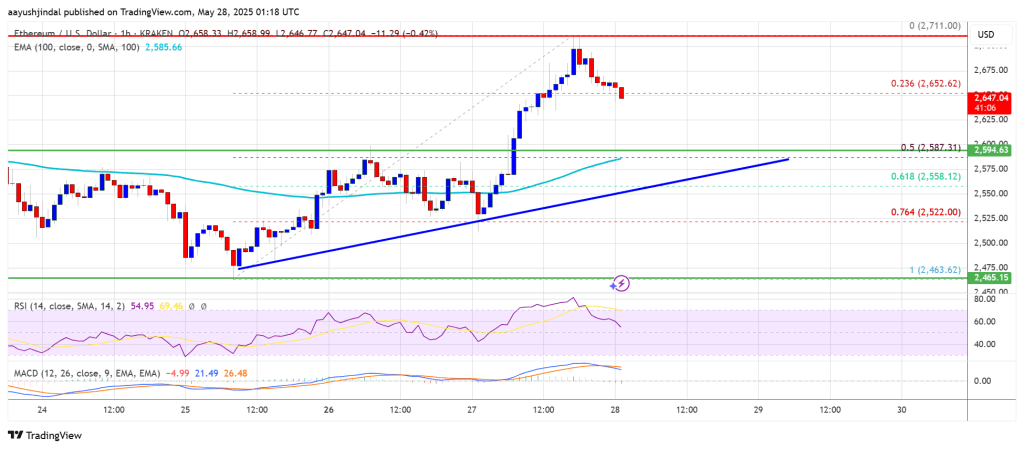

Ethereum Price Rallies as Bitcoin Takes a Breather — Is ETH Leading the Charge?

Ethereum price found support at $2,460 and started a fresh increase. ETH is now up over 5% and might...