Two Stablecoins, MiCA-Compliant EURØP and Braza Group’s USDB, Debut on XRP Ledger

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Two new fiat-backed stablecoins, EURØP and USDB, have launched on the XRP Ledger (XRPL).

Their arrival follows the U.S. Senate’s advancement of the

GENIUS Act

, a bill focused on stablecoin regulation. Both digital assets aim to provide compliant, cross-border transaction solutions at a time of increasing scrutiny and regulatory clarity.

MiCA-Compliant EURØP Introduced by Schuman Financial

Notably, European stablecoin finance firm Schuman Financial has launched EURØP on the XRPL as the first MiCA-compliant euro stablecoin to operate on this blockchain.

https://twitter.com/thecryptobasic/status/1925493461702017414

The company, regulated by the ACPR under the French Central Bank, confirmed that EURØP is fully backed by euros and redeemable. Additionally, KPMG audits its reserves, which are held at financial institutions such as Societe Generale.

The integration positions EURØP as a euro-native settlement asset, supporting enterprise-grade blockchain activity. Over the past decade, the XRP Ledger has processed over 3.3 billion transactions and maintains more than 200 validators.

With these capabilities, EURØP can support a wide range of use cases, including decentralized finance applications, tokenized real-world assets, and both B2B and B2C payments. According to Ripple’s Managing Director for UK & Europe, Cassie Craddock, this move aligns with Europe’s evolving regulatory environment and increasing institutional adoption.

USDB Launches with Support from Braza Group

Meanwhile, Braza Group, a Brazilian financial services company, has

introduced

USDB, a USD-backed stablecoin that is now live on the XRPL. Pegged 1:1 to the U.S. dollar, USDB is backed by U.S. and Brazilian government bonds.

Braza reports that these assets undergo regular audits to ensure transparency and compliance. The company is already known for its operations in the Brazilian interbank market, moving over $1 billion in 24 hours this past April.

USDB joins Braza’s earlier stablecoin, BBRL, offering a unified infrastructure on XRPL. With both assets live, the company seeks to expand its blockchain-enabled financial services. Braza’s CEO, Marcelo Sacomori, stated that the new

stablecoin

will help mitigate currency volatility and enhance transaction speed for local and international users.

According to the firm, USDB facilitates swift, affordable global transfers, making it especially useful for individuals sending funds across borders or looking to safeguard their savings in a stable currency. Beyond remittances, it plays a key role in broadening access to digital finance, helping create a more inclusive and equitable financial ecosystem.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/507543.html

Related Reading

Pundit Says XRP Today’s Prices Are a Generational Entry, Compares XRP to Bitcoin at $0.05

Crypto commentator Dustin Layton is urging XRP holders not to underestimate the potential of their h...

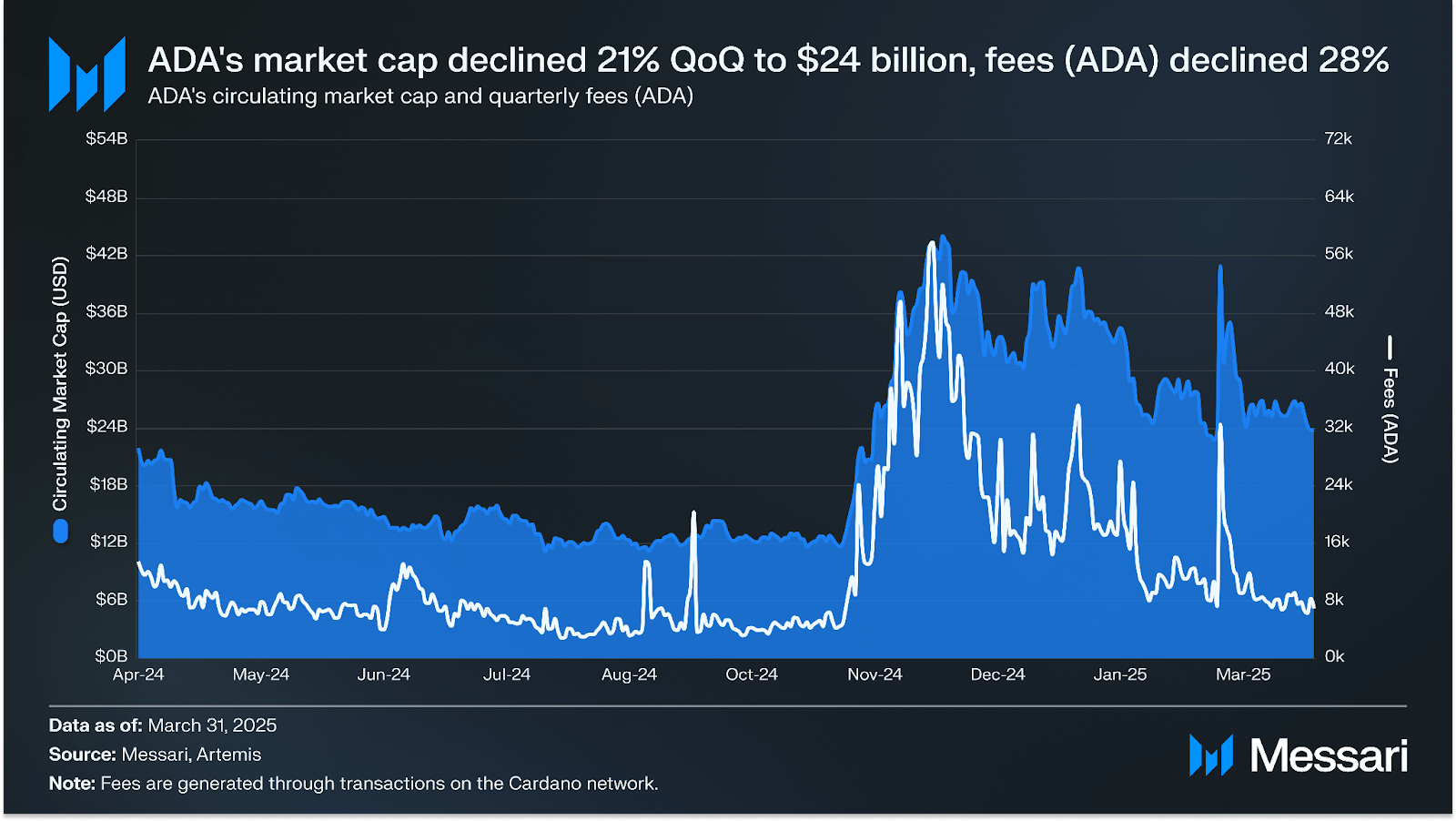

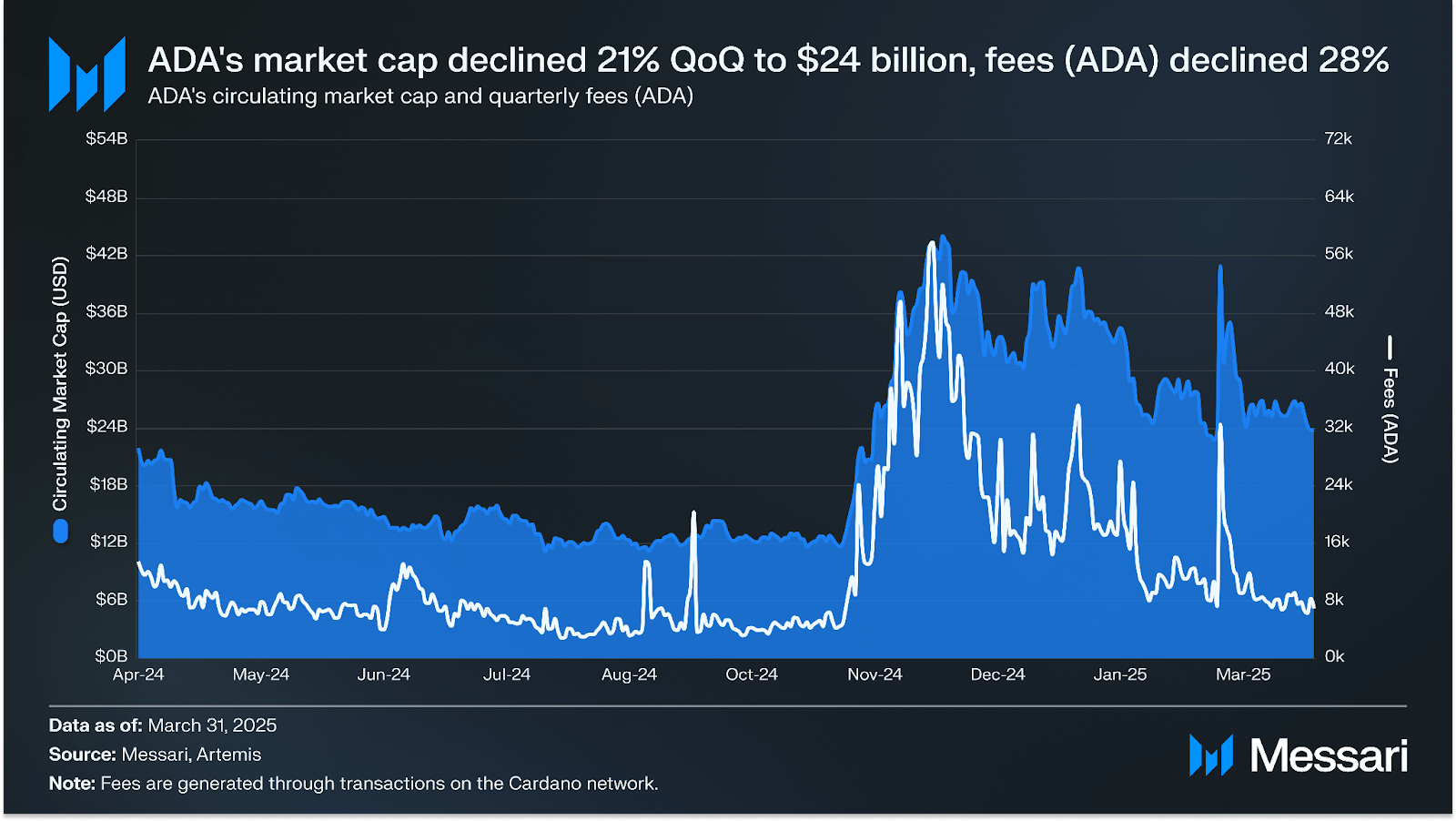

Cardano Ends Q1 2025 with $1.1B Treasury, Rising Governance Participation, and Mixed On-Chain Metrics

Leading analytics platform Messari has released a new report on Cardano, highlighting key developmen...

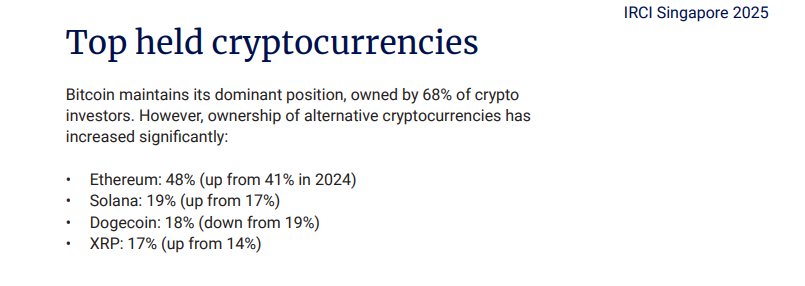

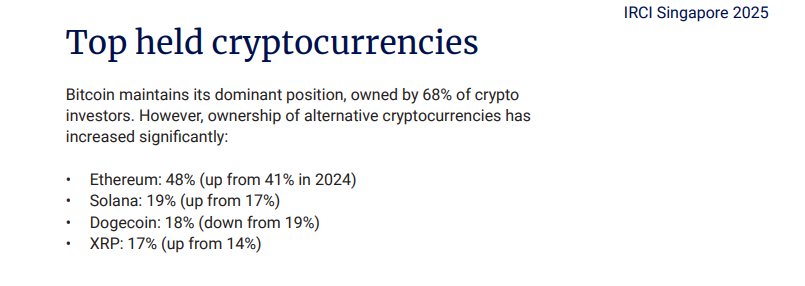

XRP Now One of the Top Holdings Among Singaporeans: Independent Reserve Report

Singaporeans are increasingly buying altcoins like XRP as the asset’s adoption spreads across the na...