Buy Bitcoin, Ditch The Banks Before It’s Too Late—Kiyosaki

Financial writer Robert Kiyosaki urges investors to consider assets like Bitcoin, gold and silver to protect their savings. He argues that these traditional forms of money are better shields against what he calls “mounting financial risks.”

Kiyosaki has issued a fresh warning that an economic turmoil could be on the horizon. He points to the US departure from the gold standard in 1971 as the seed of ongoing instability.

Bitcoin: Signs From Past Crises

According to Kiyosaki, the Long‑Term Capital Management event in 1998 and the Wall Street crash in 2008 were early warnings. He says neither of those shocks caused the real problem—they merely hinted at deeper trouble. In his view, central banks patched holes by injecting cash, but they never fixed the underlying cracks. Those quick fixes run the risk of unravelling when debt levels get too high.

In 1998 Wall Street got together and bailed out a hedge fund LTCM: Long Term Capital Management.

In 2008 the Cental Banks got together to bail out Wall Street.

In 2025, long time friend, Jim Rickards is asking who is going to bail out the Central Banks?

In other words each…

— Robert Kiyosaki (@theRealKiyosaki) May 18, 2025

Central Bank Limits Exposed

Based on reports, Kiyosaki believes that printing money can’t solve every financial headache. He warns that central banks may soon hit their limits. He points out that unlimited cash printing erodes trust in currency, making it hard for banks and governments to rely on the same old playbook. In his words, “You can’t borrow or print your way out of an endless pile of debt.” That debt, he says, is growing every day.

According to the warning, US student loan debt ranks high on his list of danger signs. He sees it as a ticking time bomb that could trigger serious credit shocks. He’s not alone: Treasury Secretary Janet Yellen has said that widespread defaults could unsettle credit markets. Economist James Rickards shares the view, arguing that mass non‑payments may shake the financial system more than commercial real estate or corporate bankruptcies.

Growing Interest In Bitcoin And Precious Metals

Growing Interest In Bitcoin And Precious Metals

Based on his comments, more people are eyeing Bitcoin, gold and silver as lifeboats. He notes that Bitcoin’s capped supply gives it an edge over fiat money, which can be printed in endless batches. He contrasts a fixed 21 million‑coin limit with the unchecked growth of government debt. Gold and silver, with centuries of use as money, also win points because they can’t be created by a keyboard.

What Investors Should WatchKiyosaki suggests keeping an eye on three key signs: rising debt levels, growing numbers of loan defaults, and continued currency printing. He adds that a shift toward alternative assets is a crowd signal—when more people start buying Bitcoin, trust in paper money falls. He reminds readers that no one can guarantee safety in cash; history has shown that hard assets often hold value when paper money weakens.

Featured image from Pexels, chart from TradingView

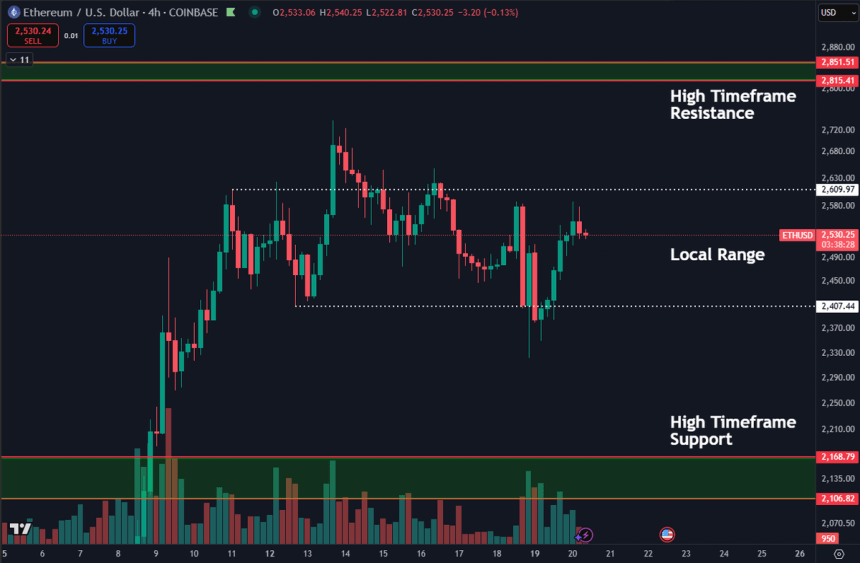

Range-Bound Ethereum Sees Volatility – High Timeframe Levels Hold The Key

Ethereum is holding strong above the $2,500 mark after a volatile two-week stretch marked by heavy r...

XRP Price Will Still Rally From Here, Crypto Veteran Raoul Pal Forecasts

Crypto veteran Raoul Pal has shared his thoughts on the XRP price, predicting it still has more room...

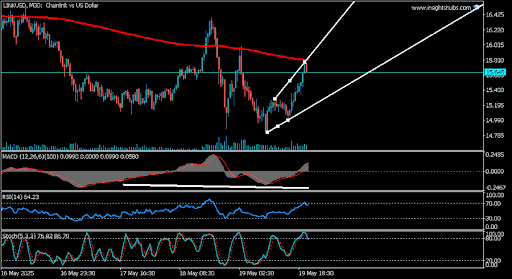

Chainlink In Rally Mode: Rising Channel Formation Signals Continued Climb

Chainlink (LINK) is showing renewed strength as its price moves higher within a well-defined rising ...