Coinbase Stock Rockets on Historic S&P 500 Inclusion

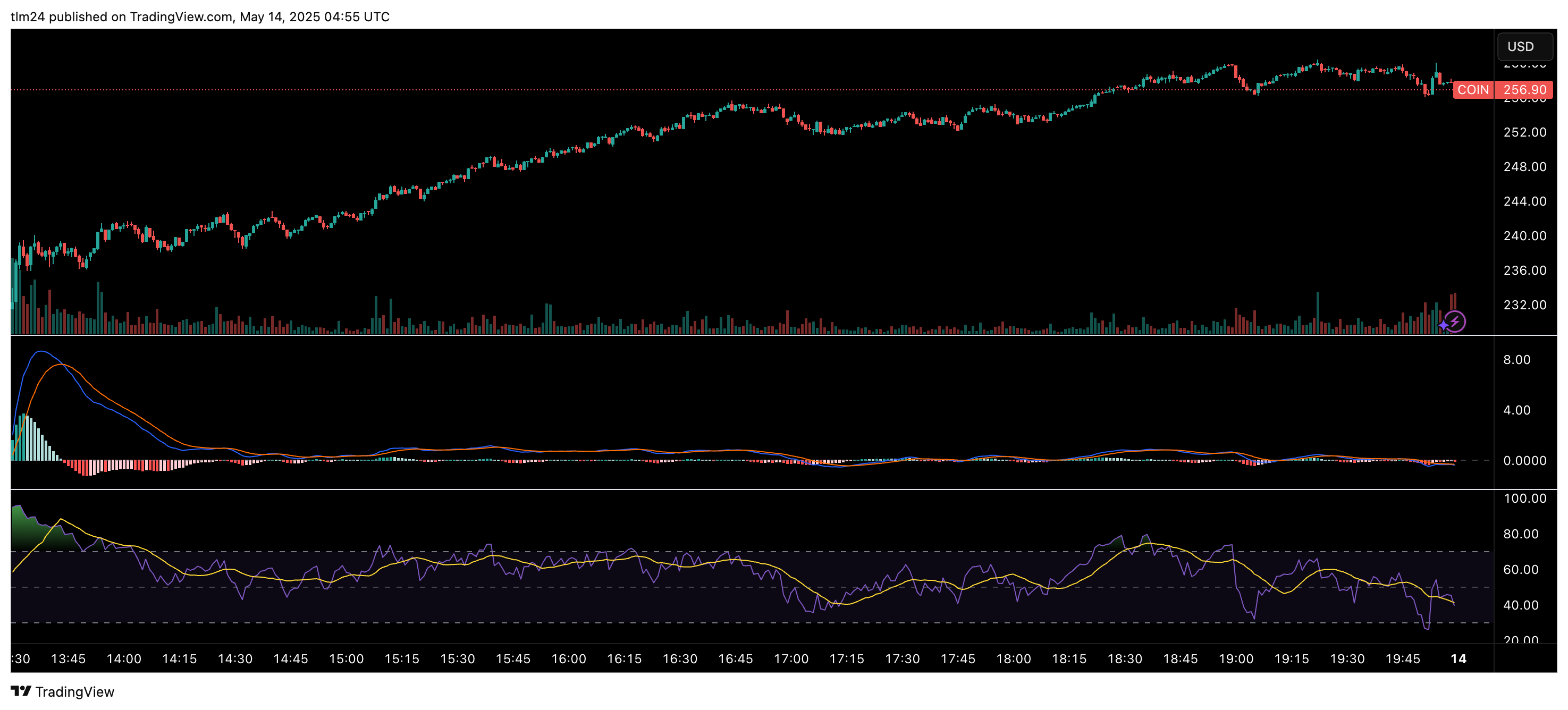

Shares of Coinbase (Nasdaq: COIN) experienced a dramatic surge on Tuesday, climbing by $49.68, or a staggering 23.97%, as investors reacted to the news that the cryptocurrency exchange will become the first pure-play crypto firm to join the S&P 500 index.

The stock closed the trading day at $256.90 and continues to trade higher in after hours at $258.30.

The inclusion, set to take effect before trading commences on Monday, May 19th, will see Coinbase replace Discover Financial Services in the benchmark index. This move is widely being interpreted as a watershed moment for the cryptocurrency industry, signifying its increasing integration into the traditional financial establishment.

Analysts at Oppenheimer described the S&P 500 inclusion as a major credibility boost for Coinbase and the crypto sector as a whole. They raised their price target for the stock to $293, anticipating a significant influx of institutional investment as passive funds that track the S&P 500 are now compelled to add Coinbase to their portfolios. Estimates suggest that this index inclusion could drive billions of dollars in fresh capital into COIN stock.

Cathie Wood, CEO of Ark Investment Management, a notable long-time supporter of Coinbase, also weighed in on the development. While emphasizing Ark Invest's active, research-driven investment strategy, Wood acknowledged the significance of index inclusion, stating on social media that it will compel "index-sensitive managers" to now consider Coinbase.

Well deserved recognition, @brian_armstrong and @coinbase ! While you probably agree that active managers should depend on fundamental research, not index providers, to screen for stocks, @ARKInvest is pleased that index-sensitive managers will be compelled to consider $COIN now. https://t.co/STfHZJ8wAw

— Cathie Wood (@CathieDWood) May 13, 2025

Bernstein analysts projected that Coinbase could see up to $16 billion in capital inflows as a direct result of its S&P 500 entry, with a substantial portion coming from passive index funds.

Coinbase CEO Brian Armstrong himself underscored the importance of the milestone, declaring, "Coinbase just became the first and only crypto company to join the S&P 500. This milestone represents what the true believers... knew all along. Crypto is here to stay."

Coinbase just became the first and only crypto company to join the S&P 500.

— Brian Armstrong (@brian_armstrong) May 12, 2025

This milestone represents what the true believers, from retail investors to institutional investors to our employees and partners, knew all along.

Crypto is here to stay. https://t.co/MnMRCX8pMg

In a separate development on Tuesday, Coinbase announced an investment in Canadian stablecoin issuer Stablecorp to promote its fiat-collateralized stablecoin, QCAD. Coinbase Canada CEO Lucas Matheson said at the Blockchain Futurist Conference there is a need for a stablecoin tailored to the Canadian market to address existing payment infrastructure challenges.

Wealthy Asians Are Shifting to Crypto, Gold Amid Dollar Diversification

The move away from a purely US dollar-centric approach towards a more diversified allocation that in...

Why an Altcoin-Led Rally is Our Favored Scenario

Your daily access to the backroom....

Anchorage Digital Acquires Mountain Protocol to Boost Institutional Stablecoin Adoption

The acquisition aims to significantly accelerate the adoption of stablecoins among institutional pla...