Coinbase Rejects Bitcoin Hoarding, Rides Caution to S&P 500

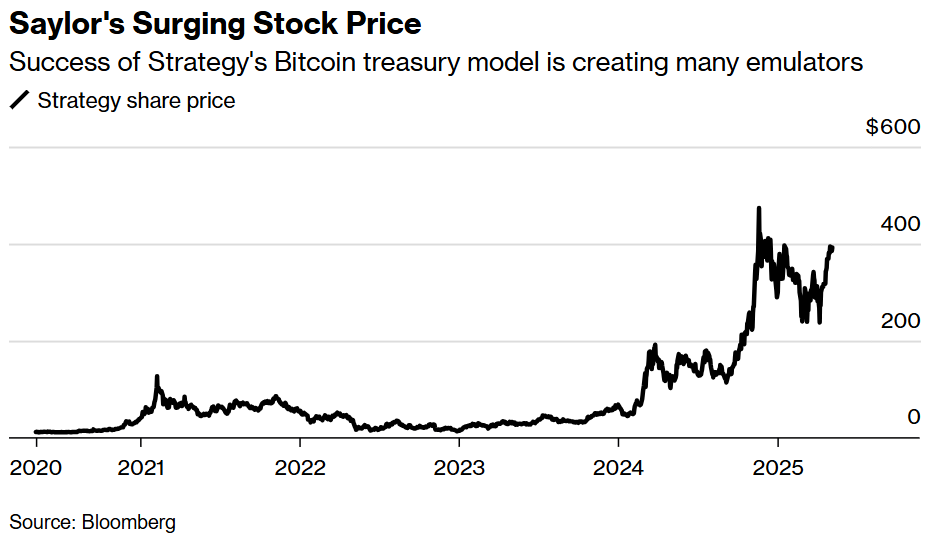

Michael Saylor's securities associated with his firm, Strategy (Nasdaq: MSTR), emerged as the most sought-after trade on Wall Street due to a substantial investment in Bitcoin, which had a remarkable bull run last year.

Several firms are trying to copy Saylor's strategy and achieve that same success.

While this may have contributed to Bitcoin's resurgence past the $100,000 mark, it has simultaneously resulted in a crowded trade of US stock market proxies replicating hedge fund strategies.

Bitcoin miners , a range of modest small-cap companies, and publicly traded firms created by major players in the crypto space are offering investors diverse avenues for Bitcoin exposure, such as convertible bonds and preferred stocks. The approach has leveraged crypto-linked securities to secure billions for Bitcoin purchases, yet it has recently needed to enhance offerings to entice investors with extra funding.

Convertible bonds have been one of the main ways for Strategy to raise capital. However, the company juiced potential returns for buyers with a lower conversion premium in February, while its preferred stock offering in the prior month saw a hefty discount.

The issuance of convertible debt to buy Bitcoin as a whole has also slowed down in recent weeks.

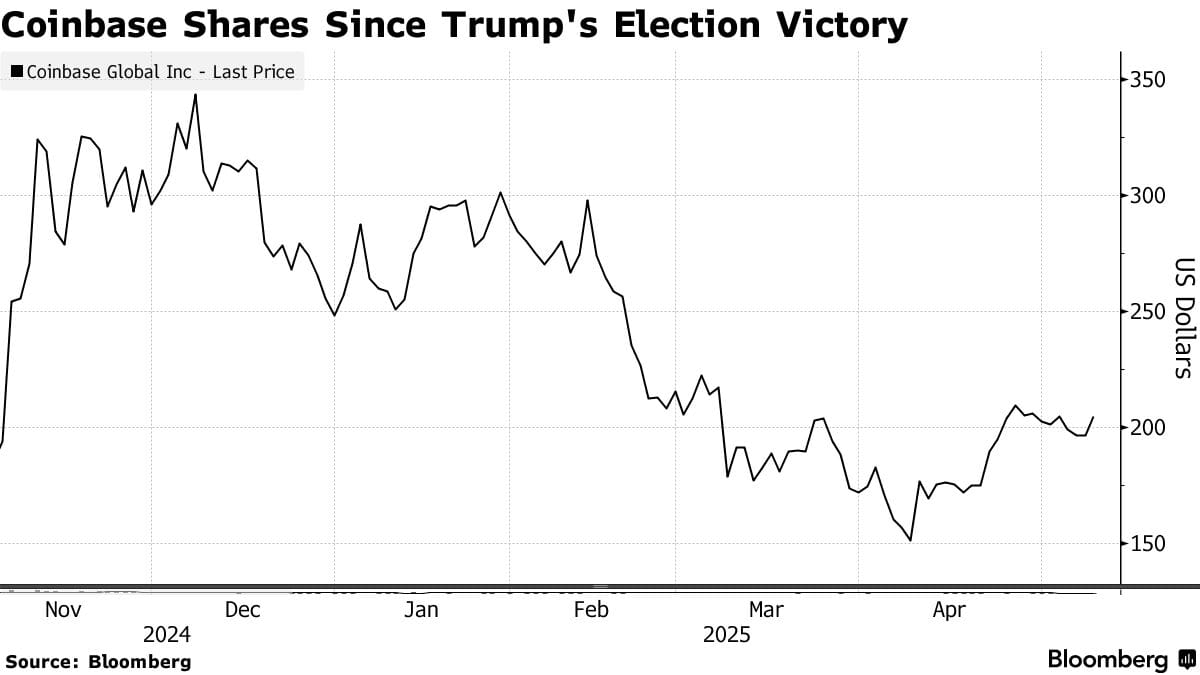

Coinbase Global (Nasdaq: COIN) previously considered Michael Saylor's popular Bitcoin buying approach but ultimately decided against it due to the high risk involved.

During a Bloomberg video call, Brian Armstrong, co-founder and chief executive officer of Coinbase, said, "There were definitely moments over the last 12 years where we thought, man, should we put 80% of our balance sheet into crypto—into Bitcoin specifically?"

According to Armstrong, the San Francisco-based company could have been "killed" if Coinbase had gone through with the gamble, which would have hurt the liquidity of the largest US crypto exchange. Armstrong said, "We made a conscious choice about risk."

The latest shareholder letter from Coinbase reveals the investing platform bought $153 million worth of cryptocurrency, primarily Bitcoin, during the March quarter. The letter, which was posted on Thursday, states that it has cryptocurrency holdings valued at $1.3 billion, with Bitcoin being the most valuable of them.

Coinbase CFO Alesia Haas said in a Bloomberg video interview with Armstrong that the company sought to avoid being perceived as competing with its crypto-investing consumers.

Twenty One Capital, a firm that mimics Strategy's business model, will soon be launched by an affiliate of Cantor Fitzgerald in collaboration with stablecoin issuer Tether Holdings and SoftBank Group.

A Bitcoin treasury firm is being formed through the merger of Strive Enterprises, a subsidiary co-founded by Vivek Ramaswamy, and Asset Entities, a company listed on the Nasdaq.

Additionally, following the Beijing-based software company's disclosure that it had expanded its Bitcoin holdings to 5,833 from 833, Next Technology Holding's shares surged 600% in US trading on Friday, causing volatility halts.

The sheer volume of securities issued linked to Bitcoin as an underlying asset is astonishing.

The quantity of securities linked to Bitcoin may be too overwhelming for investors if stock markets start to falter again due to uncertainties related to President Trump's trade war.

Coinbase Global has agreed to pay $2.9 billion to expand into the derivatives market to purchase Deribit, the largest exchange for Bitcoin and Ether options. Coinbase announced the acquisition as a major step in its global expansion strategy. The deal will include $700 million in cash and 11 million shares of the company's stock, with the purchase price subject to the usual adjustments. Luuk Strijers, CEO of Deribit, confirmed the transaction.

The acquisition is one of the most consequential purchases in the crypto industry's history, coming at a time when crypto companies are seeing a surge in deal-making following Trump's reelection as president.

Trump has created a Bitcoin reserve and assigned proponents of digital assets to high-ranking government positions; at the same time, he is actively involved in his own cryptocurrency ventures, which Democratic senators claim constitutes a serious conflict of interest.

With this purchase, Coinbase is making its most audacious move into the potentially lucrative crypto derivatives market.

With options, traders in this extremely risky asset class can gain the right to purchase or sell an asset at a fixed price at a given time without actually making the move.

Investors might use this advantage when hedging their bets on different investments.

And in a significant development that underscores the wisdom of Coinbase's measured approach to cryptocurrency investment, the company is now set to join the S&P 500 index. This landmark inclusion, announced after Monday's trading session and effective before trading on May 19th, marks a pivotal moment for both Coinbase and the broader acceptance of the crypto industry within mainstream finance.

The news sent Coinbase's stock price soaring in after-hours trading, reflecting strong investor confidence in the company's stability and future prospects. Coinbase will replace Discover Financial Services in the benchmark index, becoming the first pure-play crypto firm to achieve this milestone. This inclusion reflects Coinbase's robust financial performance, including a recent adjusted net income of $527 million for the first quarter of 2025, demonstrating the viability of their diversified business model. CFO Alesia Haas hailed this event as "monumental," emphasizing its significance for the company and the entire crypto ecosystem.

While Coinbase may not be directly joining the line of copycats imitating Saylor's strategy, the broad trend of betting big on cryptos is still at play.

Elsewhere

Blockcast

Unveiling Crypto’s Hidden Rates Market With Rho Protocol's Alex Rvykin

Rho Protocol addresses a critical gap in the crypto ecosystem. While traditional finance boasts the largest asset class in rates, the crypto market has largely overlooked its own unique and volatile interest rate dynamics, particularly perpetual funding rates. Listen to founder Alex Rvykin on our latest episode .

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Consensus 2025, Toronto

We're a media partner for Consensus 2025, held in Toronto, Canada on 14-16 May. Coinbase, BlackRock, Google & The White House Will Be There – Will You? Use the code BLOCKHEAD20 for 20% off tickets!

Trade Deals Details, Stagflation & New Crypto Milestones

Your weekly macro cheat sheet....

David Bailey's Nakamoto, KindlyMD Merge to Launch $710M Bitcoin Treasury

This marks the largest capital raise dedicated to launching a Bitcoin treasury and the largest PIPE ...

China-U.S. Truce Fuels Crypto Surge – Why We Expect Altcoins to Outperform

Your daily access to the backroom....