Bitcoin’s Grip Loosens: Market Expert Says Dominance Has Hit Its Ceiling

Raoul Pal, Real Vision founder and prominent trading name, stated on Wednesday that the dominance of Bitcoin may have topped this cycle.

In an X post, Pal said that DeMark Indicators’ signals point toward the potential that a change is imminent after several months of Bitcoin at the top of the market. Pal noted that daily, weekly, and monthly charts all are flashing top signals on Bitcoin dominance.

Bitcoin dominance is now at nearly 65%, a figure that has increased steadily since December 2024. Despite this growth, it is still yet to reach the 2021 high of 74%, or the 2017 high previously. This, according to Pal, indicates a weakening trend in the percentage of the crypto market dominated by Bitcoin over time.

DeMark Tops Flash Warning Signs

Pal relied on technical analysis tools called DeMark Indicators, developed by market veteran Tom DeMark. They are used to identify when a trend could be losing momentum. Although Pal didn’t specifically state what the exact signals were that he watched for, one of the TD Sequential’s functions is to find turning points like this.

I think BTC dominance topped today. There are daily, weekly and monthly DeMark tops in place and the top is well below 2021 top and that was below the 2017 top.

If that plays out, it is the hallmark of the next phase of the Banana Zone. Let’s see…

— Raoul Pal (@RaoulGMI) May 8, 2025

Currently, Bitcoin is over 6% higher since the beginning of 2025 and has just reclaimed the $103k level. The coin is slowly making its way toward the $105,000 threshold. But while Bitcoin is going higher, most other cryptocurrencies have not been able to keep pace.

Altcoins Have Fallen Behind

Statistics indicate that the TOTAL2 index, which captures the value of the crypto market excluding Bitcoin, has fallen by almost 20% this year. It declined from $1.34 trillion to $1.07 trillion. This difference between Bitcoin and the rest of the market has contributed to increasing Bitcoin’s dominance. If Pal’s analysis is correct, this difference will soon begin to narrow.

He thinks that as soon as Bitcoin dominance reaches a peak, money may begin entering altcoins . Traders usually move their focus from Bitcoin to smaller coins as soon as they feel the top coin has gotten its run out. That’s what happened before, and Pal believes the same may occur.

The Banana Zone TheoryPal also mentioned what he refers to as the “Banana Zone.” It’s his terminology for a period where prices accelerate in a sharp, curved trajectory — sort of like a banana. He divides this into three stages. Phase one, he says, began in November 2024, when the prices of crypto started to break out.

Now he believes we’re entering phase two, which he calls the “Banana Singularity.” That’s the part where altcoins start rising faster than Bitcoin, as more investors start hunting for bigger gains in riskier coins. This is usually when people start seeing major moves across smaller tokens.

Altcoin Season May Be On The WayPal’s message is crystal clear: Bitcoin’s time at the top may be slowing down. If the technical indicators are correct, altcoins may soon be taking center stage. It wouldn’t be the first time. In previous bull runs, capital rotated out of Bitcoin and into altcoins as the top coin’s dominance tailed off.

Featured image from Unsplash, chart from TradingView

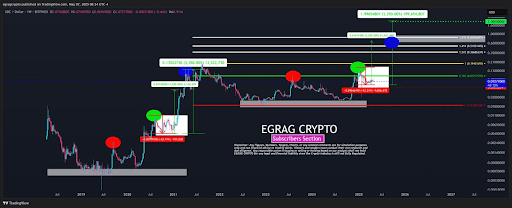

XRP Analyst Marks XDC For 3,350% Take-Off As Bullish Metrics Emerge

XRP analyst Egrag Crypto, who is well-known for offering bullish predictions about the altcoin, has ...

Chainlink Holds Strong At $15.29 Support – Is A New Breakout Imminent?

Chainlink (LINK) continues to showcase resilience, holding firm within a well-established uptrend as...

Ethereum Breaks Key Resistance In One Massive Move – Higher High Confirms Momentum

Ethereum has finally broken above the long-watched $2,000 resistance level—and it didn’t just edge p...