Bitcoin ETF Inflows Reach $5.13B: Could This Be the Start of a Crypto Bull Run?

The post Bitcoin ETF Inflows Reach $5.13B: Could This Be the Start of a Crypto Bull Run? appeared first on Coinpedia Fintech News

While everyone’s eyes are on the upcoming Fed decision on May 7, something much bigger might be happening quietly in the background. Since mid-April, billions of dollars have been flowing into Bitcoin ETFs — but that’s not all. Bitcoin whales have also been buying huge amounts of BTC, even though the market hasn’t made a big move just yet.

Could this be a setup for the next big rally?

Let’s break it down.

Billion-Dollar Bitcoin ETF Inflows Ahead of FOMC Meet

Starting April 16, Bitcoin ETFs have attracted over $5.13 billion in total inflows. One of the main drivers of this is BlackRock, whose iShares Bitcoin Trust alone pulled in $4.7 billion since early April.

However, despite the strong inflows in recent weeks, Bitcoin ETFs saw an outflow of $85.7 million on May 6.

This ongoing accumulation comes just ahead of the FOMC’s rate decision, where there’s a 98% chance , according to Polymarket, that the Fed will keep interest rates unchanged at 4.50%. If that happens, it would mark the third straight meeting without a hike, possibly giving Bitcoin more room to breathe.

Big BTC Whale Buying Huge, Retail Sells

At the same time, on-chain data tells an interesting story. Big Bitcoin whales with a wallet of 10 to 10,000 BTC have quietly added more than 81,000 BTC in the last six weeks.

On the other hand, smaller wallets (holding less than 0.1 BTC) have sold around 290 BTC in the same period. This shows that while retail investors are unsure or losing patience, large holders are quietly building positions.

Bitcoin Price Outlook

Looking at the price momentum, Bitcoin price has briefly hit $97,500 before pulling back to $96,694, gaining about 2.35%. Meanwhile, prominent crypto analyst Crypto Rover recently shared some important price points for Bitcoin. He says that if Bitcoin starts to go up again, it will need to break these levels:

- $98,000: Bitcoin is close to this price but hasn’t gone past it yet.

- $102,000: This is an important level many traders are watching.

- $106,000: This could be the last hurdle before Bitcoin reaches a new high.

Rover’s chart also shows that Bitcoin might drop to around $92,000 before it starts rising again, possibly reaching $106,000.

Bitcoin Dominance Nears 71% – Is It a Warning or the Calm Before Altcoin Season?

The post Bitcoin Dominance Nears 71% – Is It a Warning or the Calm Before Altcoin Season? appeared ...

Altseason Watch: Will Altcoins Rally in 2025 After Fed Chair Announced Further Quantitative Tightening (QT)

The post Altseason Watch: Will Altcoins Rally in 2025 After Fed Chair Announced Further Quantitative...

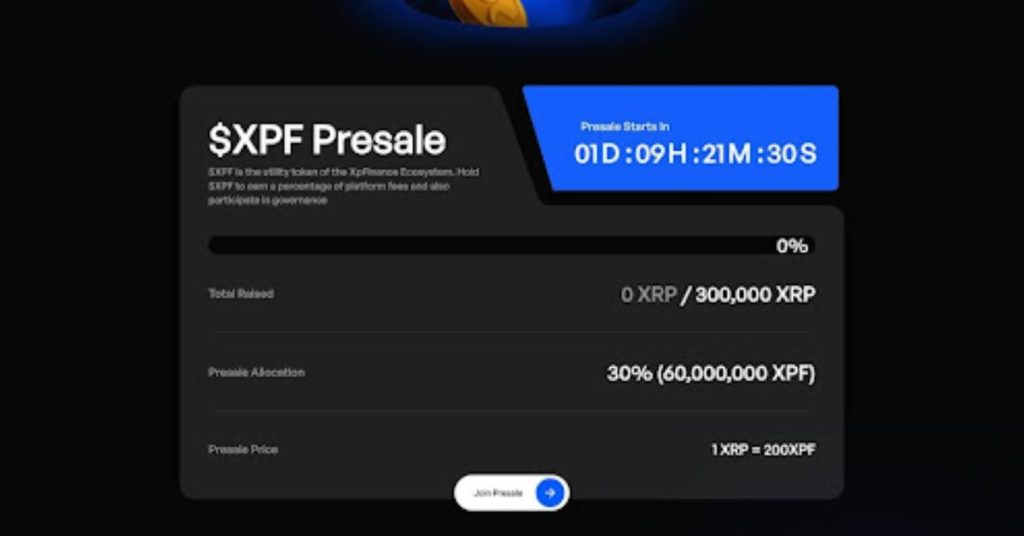

XRP Investors Rush To Xpfinance, Ripple’s First Non-Custodial Lending Platform Set To Launch XPF Token

The post XRP Investors Rush To Xpfinance, Ripple’s First Non-Custodial Lending Platform Set To Launc...

As traders brace for the upcoming FOMC decision, a major positive that crypto won't see a serious drop is the fact that Bitcoin ETF inflow money has been sky-high since mid-April. Since April 16th, there has been $5.13B moved into collective BTC ETF's, pumping markets.

As traders brace for the upcoming FOMC decision, a major positive that crypto won't see a serious drop is the fact that Bitcoin ETF inflow money has been sky-high since mid-April. Since April 16th, there has been $5.13B moved into collective BTC ETF's, pumping markets.