BlackRock Holds Over $5B in Bitcoin Stocks, With $4.23B in Strategy Alone, Latest Filing Shows

Favorite

Share

Scan with WeChat

Share with Friends or Moments

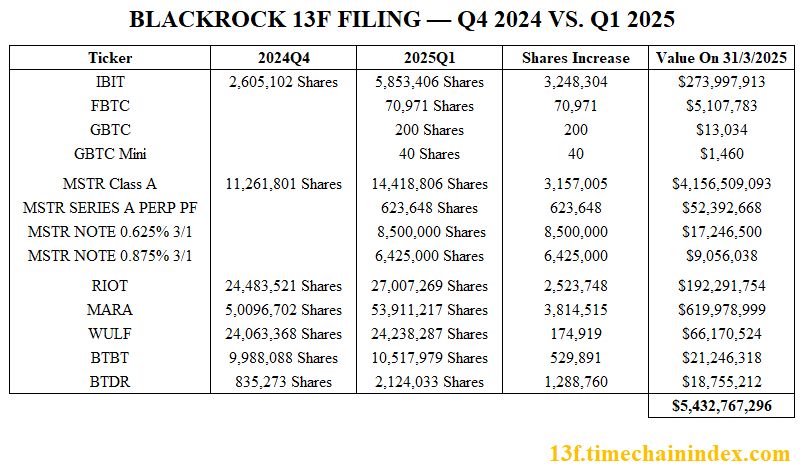

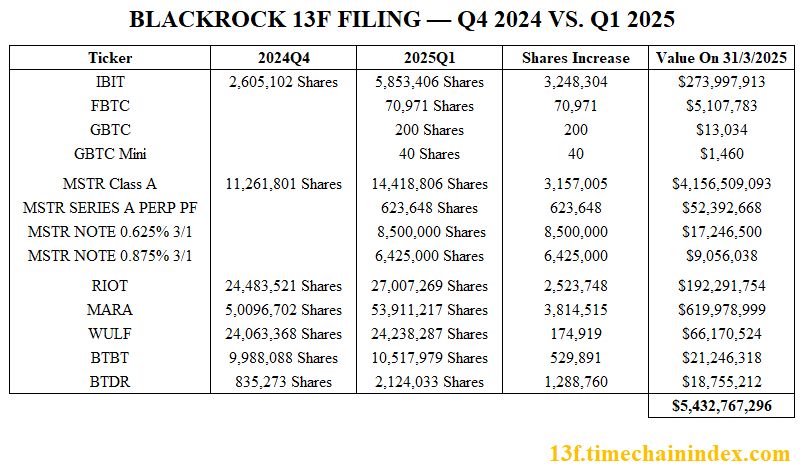

BlackRock's latest 13F filing for Q1 2025 reveals a significant uptick in its Bitcoin exposure.

The

report

shows a total of $5.43 billion invested across Bitcoin spot ETFs and stocks tied to Bitcoin treasuries and mining operations. These latest figures represent a major increase from Q4 2024, amid growing institutional confidence in crypto.

Notably, the firm’s flagship Bitcoin spot ETF, IBIT, saw its holdings grow from 2.6 million shares to 5.85 million shares, now worth $273.9 million. BlackRock also opened a new position in Fidelity’s FBTC. It now holds 70,971 FBTC shares worth $5.1 million. At the same time, it initiated smaller positions in Grayscale's GBTC and GBTC Mini.

Bigger Exposure in Strategy

BlackRock’s largest allocation remains in MicroStrategy (MSTR), the business intelligence firm now known as Strategy,

which holds over 555,000 BTC.

Specifically, BlackRock now owns 14.4 million Class A shares, an increase of 3.15 million shares from Q4 2024. These shares are worth $4.16 billion.

Additionally, the asset manager holds 623,648 Series A Preferred shares—newly added this quarter—worth $52.3 million. Meanwhile, another new addition in Q1 2025 includes 8.5 million convertible notes (0.625%) and 6.4 million notes (0.875%), totaling over $28 million.

Combined, BlackRock’s stake in Strategy-related securities now exceeds $4.23 billion, accounting for nearly 78% of its total Bitcoin-focused exposure.

Bitcoin Mining Stocks See Big Inflows

The asset manager also expanded its footprint in Bitcoin mining firms. Its holdings in Marathon Digital (MARA) surged from 50 million to 53.9 million shares, now valued at $619.9 million.

Similarly, BlackRock’s position in Riot Platforms (RIOT) increased by 2.5 million shares, bringing the total value to $192.3 million.

Bitdeer Technologies (BTDR) grew more than 150%, from 835,000 to 2.1 million shares. Other miners like TeraWulf (WULF) and Bit Digital (BTBT) also saw modest increases, bringing BlackRock’s total mining allocation to over $950 million.

Institutional Conviction Rising

The Q1 2025 13F filing reflects BlackRock’s growing conviction in Bitcoin’s long-term value proposition. With over $5.4 billion in strategic Bitcoin-related positions, the world’s largest asset manager is clearly not fading the ongoing

institutional FOMO

surrounding Bitcoin.

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) now holds 607,685.5 BTC, worth over $57.16 billion. Since its inception, the ETF has attracted $43.68 billion in investment.

Bitcoin Mining Stocks See Big Inflows

The asset manager also expanded its footprint in Bitcoin mining firms. Its holdings in Marathon Digital (MARA) surged from 50 million to 53.9 million shares, now valued at $619.9 million.

Similarly, BlackRock’s position in Riot Platforms (RIOT) increased by 2.5 million shares, bringing the total value to $192.3 million.

Bitdeer Technologies (BTDR) grew more than 150%, from 835,000 to 2.1 million shares. Other miners like TeraWulf (WULF) and Bit Digital (BTBT) also saw modest increases, bringing BlackRock’s total mining allocation to over $950 million.

Institutional Conviction Rising

The Q1 2025 13F filing reflects BlackRock’s growing conviction in Bitcoin’s long-term value proposition. With over $5.4 billion in strategic Bitcoin-related positions, the world’s largest asset manager is clearly not fading the ongoing

institutional FOMO

surrounding Bitcoin.

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) now holds 607,685.5 BTC, worth over $57.16 billion. Since its inception, the ETF has attracted $43.68 billion in investment.

Bitcoin Mining Stocks See Big Inflows

The asset manager also expanded its footprint in Bitcoin mining firms. Its holdings in Marathon Digital (MARA) surged from 50 million to 53.9 million shares, now valued at $619.9 million.

Similarly, BlackRock’s position in Riot Platforms (RIOT) increased by 2.5 million shares, bringing the total value to $192.3 million.

Bitdeer Technologies (BTDR) grew more than 150%, from 835,000 to 2.1 million shares. Other miners like TeraWulf (WULF) and Bit Digital (BTBT) also saw modest increases, bringing BlackRock’s total mining allocation to over $950 million.

Institutional Conviction Rising

The Q1 2025 13F filing reflects BlackRock’s growing conviction in Bitcoin’s long-term value proposition. With over $5.4 billion in strategic Bitcoin-related positions, the world’s largest asset manager is clearly not fading the ongoing

institutional FOMO

surrounding Bitcoin.

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) now holds 607,685.5 BTC, worth over $57.16 billion. Since its inception, the ETF has attracted $43.68 billion in investment.

Bitcoin Mining Stocks See Big Inflows

The asset manager also expanded its footprint in Bitcoin mining firms. Its holdings in Marathon Digital (MARA) surged from 50 million to 53.9 million shares, now valued at $619.9 million.

Similarly, BlackRock’s position in Riot Platforms (RIOT) increased by 2.5 million shares, bringing the total value to $192.3 million.

Bitdeer Technologies (BTDR) grew more than 150%, from 835,000 to 2.1 million shares. Other miners like TeraWulf (WULF) and Bit Digital (BTBT) also saw modest increases, bringing BlackRock’s total mining allocation to over $950 million.

Institutional Conviction Rising

The Q1 2025 13F filing reflects BlackRock’s growing conviction in Bitcoin’s long-term value proposition. With over $5.4 billion in strategic Bitcoin-related positions, the world’s largest asset manager is clearly not fading the ongoing

institutional FOMO

surrounding Bitcoin.

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) now holds 607,685.5 BTC, worth over $57.16 billion. Since its inception, the ETF has attracted $43.68 billion in investment.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/503954.html

Related Reading

Bitcoin Leads as Crypto Investment Products Record $2B in Net Inflows

Investment products tied to cryptocurrencies registered their third consecutive week of inflows, wit...

Bernstein: Public Firms Projected to Allocate $330 Billion into Bitcoin by 2029

Public companies could channel over $300 billion more into Bitcoin over the next five years, accordi...

Strategy Acquires 1,895 BTC in Latest Purchase, Expands Bitcoin Holdings to Over 555,000

Strategy, formerly known as MicroStrategy, has confirmed another addition to its growing Bitcoin res...