US Economy Opens 2025 With a Contraction; Tariffs Taking Hold?

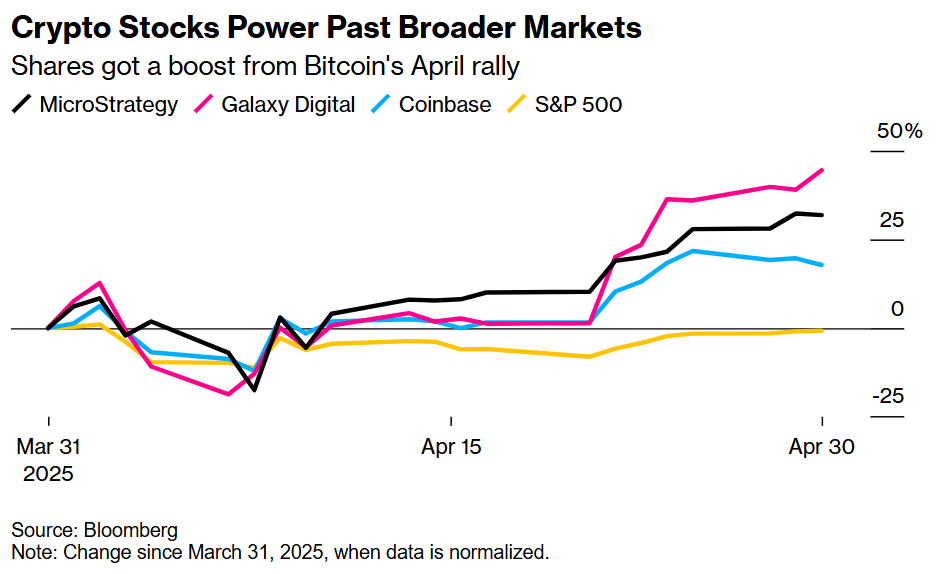

In the month of extreme fluctuations in US equity markets, stocks associated with cryptocurrency experienced a significant rise, propelled by the surge in Bitcoin's value.

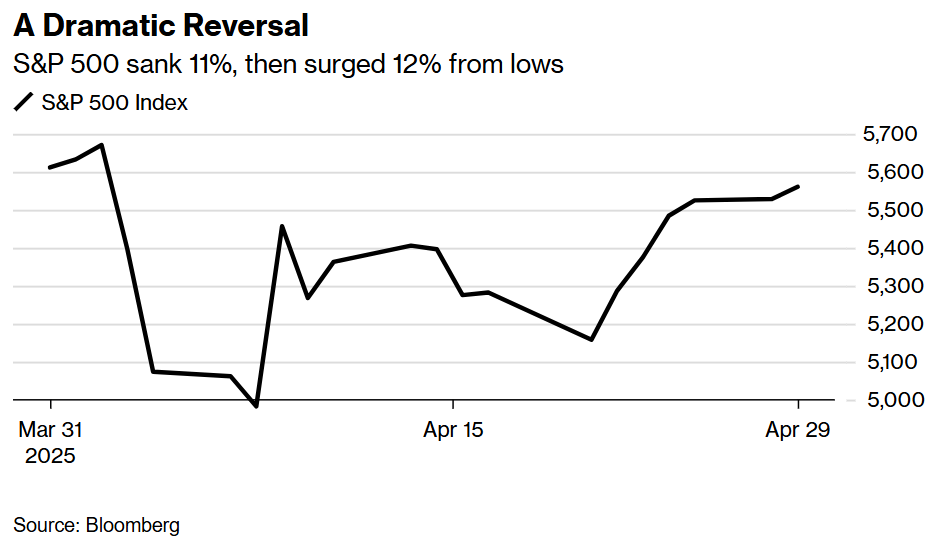

Market sentiment fluctuated significantly as stock prices reacted to President Trump's global trade war. They initially declined, then rebounded when he paused those stringent tariffs, only to dip again amidst increasing economic uncertainty.

Still, Wall Street stocks ended April only slightly lower after historic swings.

The market is seeking more information on Trump's trade policy and corporate America's growth forecasts. The present environment is characterized by ambiguity.

The market's nervousness was on full display during Wednesday's trade.

Reports of a slowdown in hiring at US corporations and an economic contraction in April sent the S&P 500 Index tumbling at the open, plummeting as much as 2.3%.

However, it recovered during the day and finally surged into the green around five minutes before midnight, capping off the month with a winning run of seven sessions.

However, for crypto stocks, a 15% increase in Bitcoin's value reignited discussion about crypto's potential as an investment safe haven. Stocks linked to digital assets tend to be more volatile than the tokens themselves, meaning that value increases are often amplified when prices go up.

However, April showed a different side.

Still, despite a strong second quarter, many crypto equities are down in 2025. This year has seen a significant decline in the stock prices of crypto miners, as token mining loses profitability and tariffs threaten to increase hardware costs.

Companies that intend to replicate Strategy's Bitcoin buying frenzy recorded the most spectacular monthly gains. In April, Upexi's stock price increased by almost 400% after the company announced plans to raise $100 million to acquire the Solana token for its treasury.

A Bitcoin vehicle linked to industry heavyweights was in the works, and as a result, shares of blank-check firm Cantor Equity Partners nearly doubled. Large companies, such as the conglomerate Galaxy Digital Holdings, were at the forefront.

Permission to list on the Nasdaq and increased artificial intelligence computing business from CoreWeave boosted its shares, which climbed over 40% last month.

What Analysts Are Whispering: Sell in May?

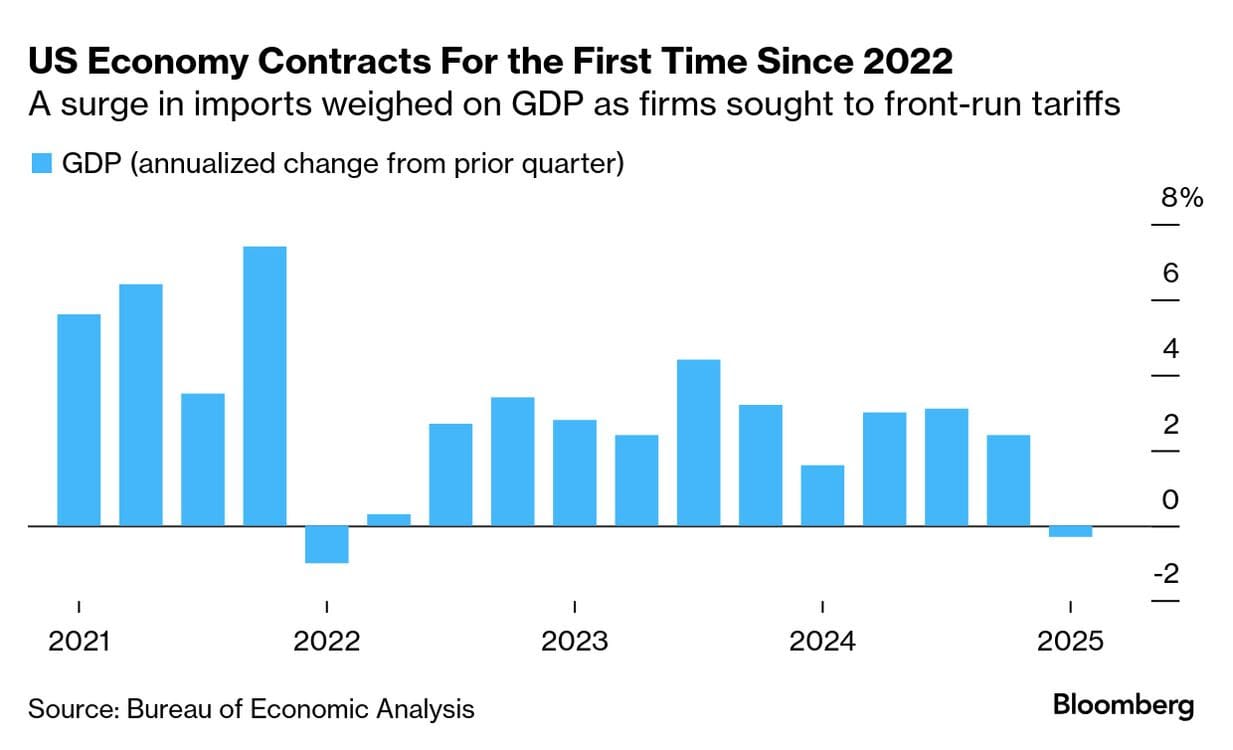

More importantly, bets of a recession are starting to take hold again. While Trump asserts that his presidency has started strongly, the economy speaks a different language.

As importers rushed to bring in goods before tariffs kicked in, the US GDP shrank in the March quarter. Along with worsening economic morale, higher inflation has fueled the stagflation narrative and reduced the Federal Reserve's ability to intervene.

In 2020, a pandemic recession hit the United States hard, but it famously recovered. Rapid economic recovery allowed the country to surpass its competitors quickly, thanks to a large government rescue program that injected enormous sums of money into the economy.

While COVID-19 killed over a million people in the United States, the economy was able to avoid a slump and finally attain a level of employment that was on par with a record set fifty years before under Richard Nixon.

But that was then.

In Donald Trump's thinking this week, it's Gerald Ford rather than Nixon.

At the end of his first 100 days in office, his policies have caused an 8% drop in the S&P 500 Index. Since Gerald Ford replaced his infamous predecessor in 1974, the market has never had a worse first 100 days.

And it gets worse.

Under Trump's watch, the US economy has contracted for the first time since 2022, in contrast to the tumultuous second half of Biden's presidency.

In the March quarter, an annualized 0.3% decline in inflation-adjusted GDP was recorded, far lower than the 3% average growth seen over the previous two years.

Just a few months ago, investors were singing Trump's praises.

Now, they're nervous about his chaotic tariff strategy, his radical push to deport undocumented workers, legal immigrants, and international students, his mass firings of federal employees, and his occasionally overt contempt for the US Constitution.

The S&P 500 has experienced its seventh-fastest correction since 1929 due to a confluence of factors.

Numerous studies of consumer sentiment, including one on Wednesday, have failed to find any signs of optimism. High costs are already a burden for low-income Americans, and the decline in stock prices this year has only made things worse.

An indicator of core inflation frequently followed by policymakers reached a one-year high of 3.5% in the first quarter.

Worse, Trump is at it again against the Fed chair.

The truce between Donald Trump and Jerome Powell was brief — just one week.

Speaking at a rally outside of Detroit, he asserted his superior knowledge of interest rates compared to the head of the Federal Reserve, who is evidently "not really doing a good job."

The president also vigorously defended his tariff regime and economic policies, even as business activity and sentiment suggest otherwise.

May looks to be another rollercoaster month, with cryptos expected to continue their outperformance.

Elsewhere

Consensus 2025, Toronto

We're a media partner for Consensus 2025, held in Toronto, Canada on 14-16 May. Coinbase, BlackRock, Google & The White House Will Be There – Will You? Use the code BLOCKHEAD20 for 20% off tickets!

OSL, Ant Digital Partner on RWA Tokenization, Eye Institutional Adoption

OSL, Ant Digital Partner on RWA Tokenization, Eye Institutional Adoption...

Robinhood's Q1 Earnings Beat Expectations Despite Crypto Trading Dip

he company's strategic focus on diversification suggests a move towards a more balanced revenue mode...

How a Potential Recession Could Create a Major Opportunity for Digital Assets

Your daily access to the backroom....