Global Crypto Market Reclaims $3T as Bitcoin Crosses $96,000: Here’s Why

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Bullish developments and sustained momentum have pushed Bitcoin above $96,000 and the global cryptocurrency market cap above $3 trillion.

After a turbulent period,

Bitcoin

could be on the verge of breaking the resistance level at $96,000. The pioneering cryptocurrency has surged 3% in the past 24 hours, pushing its price above the crucial price mark.

With the rebound, the global cryptocurrency market has reclaimed the $3 trillion valuation. BTC’s upward momentum has spilled over into the broader market, with Ethereum, XRP, and Solana appreciating by 5%, 3.6%, and 7% over the past day, respectively.

Possible Catalysts for Recent Uptrend

Notably, Bitcoin has been in recovery mode since early April, bouncing back by over 29% from an intraweek low of $74,363 to above $96,000. The momentum follows a bad stint, spurred by macroeconomic headwinds such as the tariff war.

Aside from the positive sentiments emerging from the discussion between China and the United States over the

tariff brawl

, institutional adoption and inflows into the crypto market have spurred this renewed bullishness.

For perspective,

discussions

within crypto circles today suggested that the prominent chipmaker NVIDIA is considering buying Bitcoin. According to speculation, Nvidia, the third-largest company in the world plans to buy the premier asset for “stability.”

Furthermore, the US Bitcoin spot exchange-traded funds (ETFs) appear to have regained momentum. Aside from yesterday’s net outflow of $56.23 million, the investment products were on an eight-day inflow streak, accruing $3.9 billion in the process.

Would Bitcoin Conquer the $96,000 Resistance?

Despite recent momentum, Bitcoin has faced massive selling pressure around the $96,000 area, which is above its yearly opening price. The asset has consolidated around the region for a week, with its recent break above $96,500 being its highest price since March 2.

Meanwhile, data from IntoTheBlock identifies that 1.38 million addresses acquired Bitcoin at an average price of $96,950, making the price mark a strong resistance zone. If the current momentum continues, the token will finally break the supply zone and target higher prices.

Interestingly, a recent

report

highlighted that if Bitcoin finally breaks current resistance, it would be a free ride to $109,000. Per the analysis, there are negligible supply zones after this, meaning BTC’s price could escalate quickly.

In the meantime, Bitcoin trades at $96,920 with a market cap of $1.92 trillion.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/503400.html

Related Reading

Morgan Stanley Plans to Launch Spot Bitcoin Trading for E*Trade Retail Clients

Morgan Stanley, a leading wealth manager and bank with an AUM of $1.7 trillion, is preparing to offe...

Trump-Backed Stablecoin USD1 to Power $2 Billion Binance Deal with Abu Dhabi’s MGX

World Liberty Financial’s USD1 stablecoin has officially been selected by Abu Dhabi-based MGX for th...

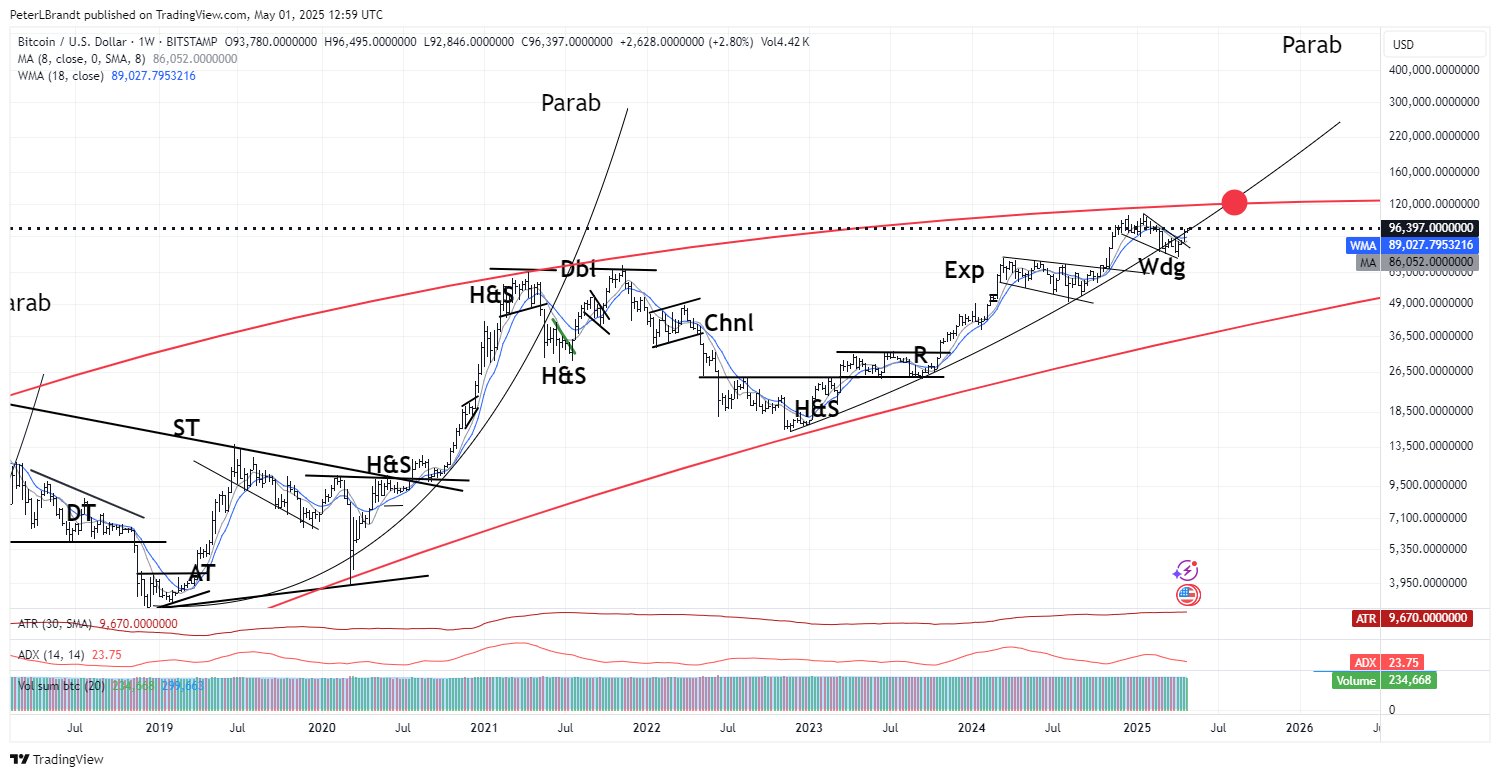

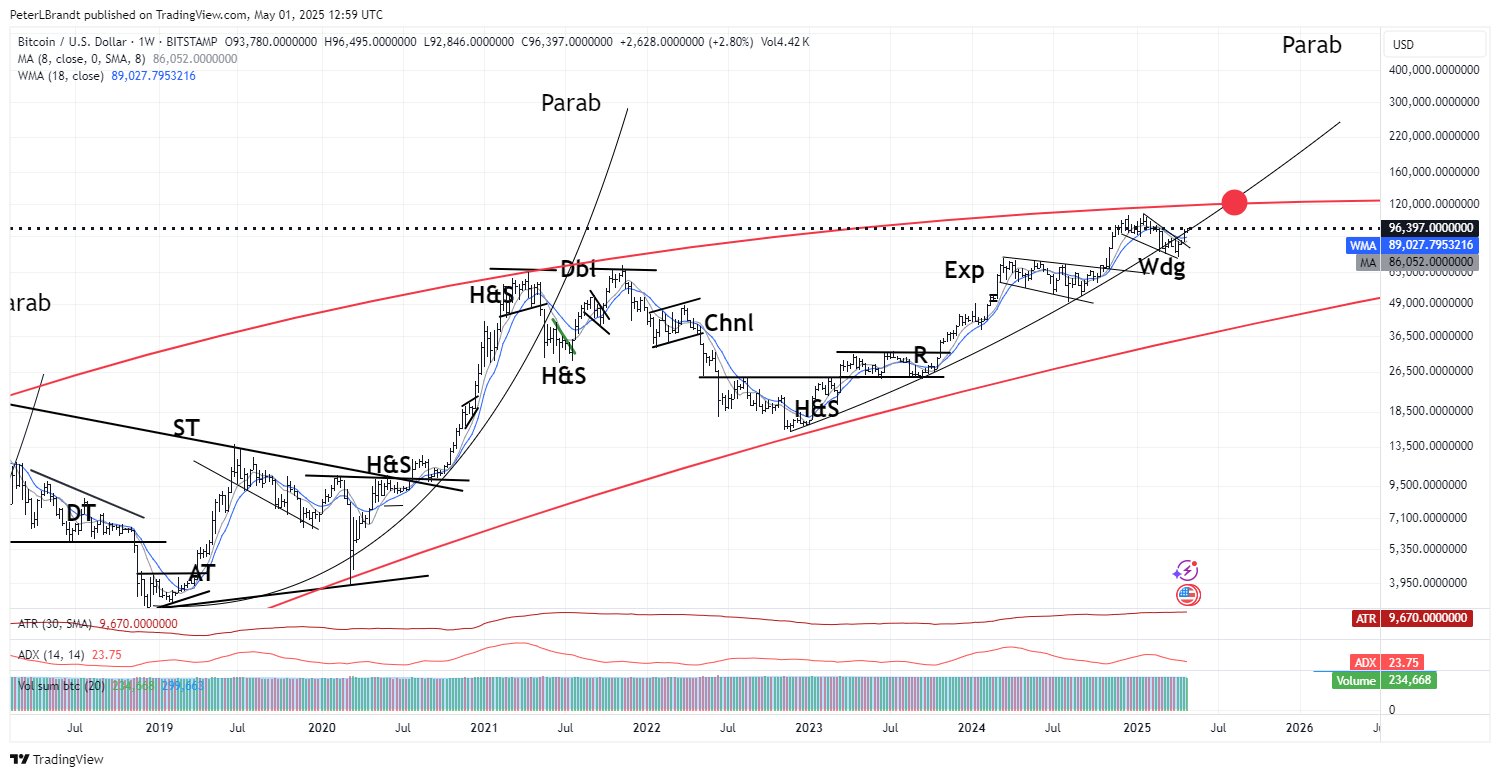

Veteran Analyst Brandt Issues New Bold Prediction for When Bitcoin Will Hit $120K to $150K

Bitcoin has shown a strong start to the new month, breaking into the $96,500 level and inching close...