Roswell Launches Bitcoin Emergency Fund for Public Aid

- Roswell became the first city in New Mexico to accept Bitcoin donations to fund the city’s emergency and utility services.

- The fund will be used to help pay for senior citizens’ water bills and for future disaster aid, BTC, once it hits $1 million.

- While it seems that Roswell actively promotes the use of Bitcoin, central banks such as the Swiss and European Union block it due to the high volatility.

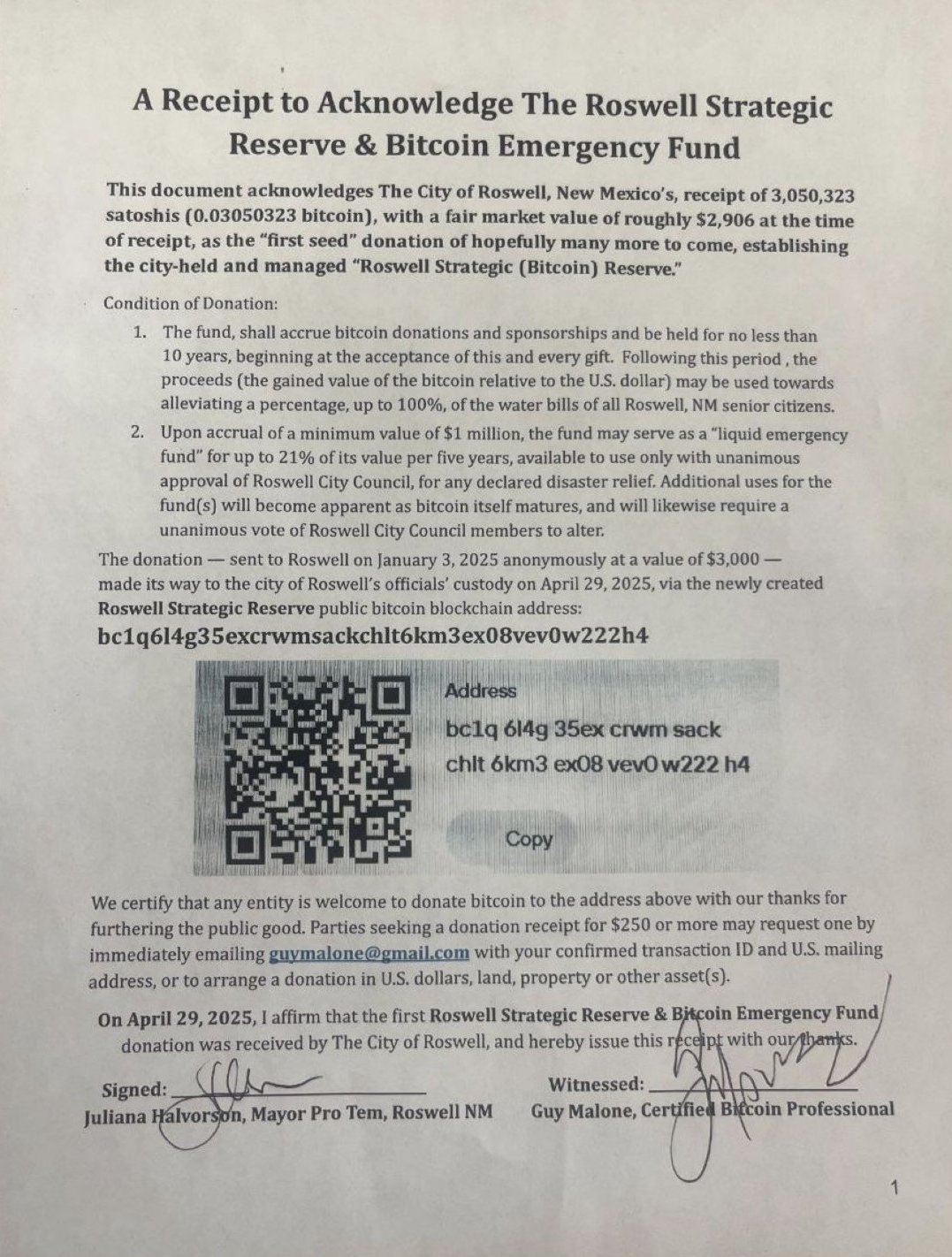

Roswell, New Mexico, formally accepted its first Bitcoin donation to create the city’s Strategic Bitcoin Reserve and Emergency Fund. The contribution was made on April 29, 2025, and amounts to 3,050,323 satoshis or $2,906.

Acting mayor Juliana Halvorson, alongside Certified Bitcoin Professional Guy Malone, accepted and signed a receipt to acknowledge the seed donation. The city plans to expand this reserve over 10 years through contribution and sponsorship. The fund is to be used to enhance the lives of Roswell’s senior citizens by paying for part of their water expenses and assisting in emergencies such as disasters.

The policy stipulates that up to 21% of its value could be withdrawn every five years as long as the reserve hit $1 million, with city council approval. Further, any amendment to the fund’s mission or the provisions on withdrawal also has to be made on a consensus basis. The donation address is also open for contenders to which any further audiences can contribute.

Bitcoin in City Reserves Gains Ground Amid Global Rejection

Rosswell’s move occurred when global financial institutions were refuting expectations of embracing Bitcoin as a reserve currency. The Swiss National Bank (SNB) has reiterated its ban on the accumulation of crypto assets due to volatility and liquidity problems in the recent past.

Speaking at the bank’s general assembly, SNB President Martin Schlegel pointed out that cryptocurrencies have no long-term stability for sovereign wealth funds. He further maintained that though it seems that the crypto markets are liquid during stable periods, the opposite is the case during periods of crisis.

The SNB’s resistance comes even as the local Bitcoin Initiative has provided research that proves that even a 1% addition to the bank’s reserves would have near-doubling the result since 2015. The group also claimed that Bitcoin has to be considered through the lens of a portfolio as a whole rather than on its own.

EU Central Banks Close Doors, But U.S. Shows Strategic Interest

Other European financial leaders followed Switzerland’s example. European Central Bank Christine Lagarde frequently addressed Bitcoin, calling its application and its likelihood to be integrated by CBDC unbeneficial due to known links to unlawful activities and instability.

Similarly, in Poland and Romania, the central authorities have ruled out the possibility of using BTC as a reserve. On the other hand, the U.S Federal Reserve currently does not legally own Bitcoin directly due to the Federal Reserve Act.

However, Federal Reserve Chair Jerome Powell has stated that there is no existing plan to change the law despite the increasing interest in digital assets in the country. On the other hand, reports from the European Bitcoin Initiative show that the United States has begun amassing a strategic Bitcoin stockpile. Although it is not official, it is a sign of increasing recognition of Bitcoin’s capabilities in terms of a store of value.

Reown and Nansen Unveil Key Findings in Onchain UX Report 2025

Nansen and Reown’s 2025 report on onchain UX reveals the rising wallet use, stablecoin growth, and k...

GraphLinq and Ice Open Network Unite to Advance No-Code Blockchain Innovation

The partnership between GraphLinq and Ice Open Network aims to strengthen developers and creators ac...

OpenLedger and SpaceLabs Join Forces to Decentralize the Future of Intelligence & AI Economy

OpenLedger formed an essential strategic partnership with SpaceLabs. They will build infrastructure ...