LCX Price Prediction: Will Liechtenstein Cryptoassets Meet Investors’ Demand?

Decentralized and centralized crypto exchanges work quite differently. Decentralized exchanges, or DEXs, are run by communities rather than companies. They usually allow users to trade a wide range of tokens, although the trade amounts tend to be smaller. Because there’s no central authority, DEXs can offer more freedom, but they’re often harder to use, especially for beginners.

Centralized exchanges, or CEXs, are the more traditional kind. These are operated by companies and tend to support higher volume trades, though with a more limited selection of cryptocurrencies. They usually require users to go through identity checks, known as Know Your Customer (KYC), to help prevent fraud and money laundering. Compared to DEXs, centralized exchanges are generally easier to use, which makes them more appealing to newcomers in the crypto space.

One example of a centralized exchange is the Liechtenstein Cryptoassets Exchange, or LCX. While the company was founded in 2018, the actual trading platform didn’t launch until 2020. It was started by Monty Metzger, a digital entrepreneur and investor from Liechtenstein, who also serves as the company’s CEO. In this article, we’ll explore LCX price prediction along with deep technical analysis of the current market sentiment. This will guide investors with a strategic investment plan.

LCX: A Quick Introduction

Besides being a crypto exchange, LCX built out a whole ecosystem of tools and services designed to support both casual users and serious crypto projects.

For example, LCX created the LCX Terminal, a platform that connects up to 16 different crypto exchanges in one dashboard. This makes it easier for traders to compare prices across platforms and ideally get the best possible deal. Then there’s the LCX Token Sale Manager, which helps users in launching their own cryptocurrencies. It includes tools for building smart contracts, finding investors, and handling regulatory requirements like Know Your Customer (KYC) verification.

The platform also supports more advanced features. The STO Launchpad allows businesses to issue tokenized securities, giving them a way to raise capital while complying with security laws. Meanwhile, the LCX Smart Order platform helps traders find the best prices in real-time. It uses algorithms to scan centralized exchanges for the most favorable bid and ask prices, and it also supports arbitrage trading, which allows users profit from price differences between exchanges.

LCX has also expertise in other areas of the crypto market, offering a decentralized exchange (DEX) aggregator and even a platform for tokenized diamond NFTs. And for users who want access on the go, there’s a mobile app so everything doesn’t have to be done on a computer.

LCX Token and Its Use cases

It’s the platform’s native cryptocurrency and is used to pay for things like trading fees, subscriptions, and custodial services. Holding the token also gives users perks like discounts on exchange fees.

The LCX Token launched in March 2019 through a token generation event. According to the company’s whitepaper , there were a few lock-up and vesting periods in place to manage distribution. Team tokens were released gradually over 36 months, and advisor tokens followed the same schedule. Originally, there were 1 billion tokens created, but LCX burned 50 million of them during 2019 and 2020 to reduce supply. Today, most of the tokens are held by the LCX community.

The LCX Token plays a central role in how the LCX platform works, offering several practical uses that go beyond just being a digital currency.

- Fee Discounts: Holding LCX Tokens gives users up to 50% off trading fees on the LCX Cryptocurrency Exchange.

- Payment for Services: The token can be used to pay for all LCX services, making it a flexible utility token across the platform.

- Asset Tokenization: LCX Tokens enable the tokenization of real-world assets like bonds, artwork, and commodities (e.g. diamonds), allowing them to be represented and traded on the blockchain.

- Platform Functionality: The token serves as a digital voucher that helps sign, encrypt, and secure digital assets, improving the security and efficiency of LCX’s blockchain operations.

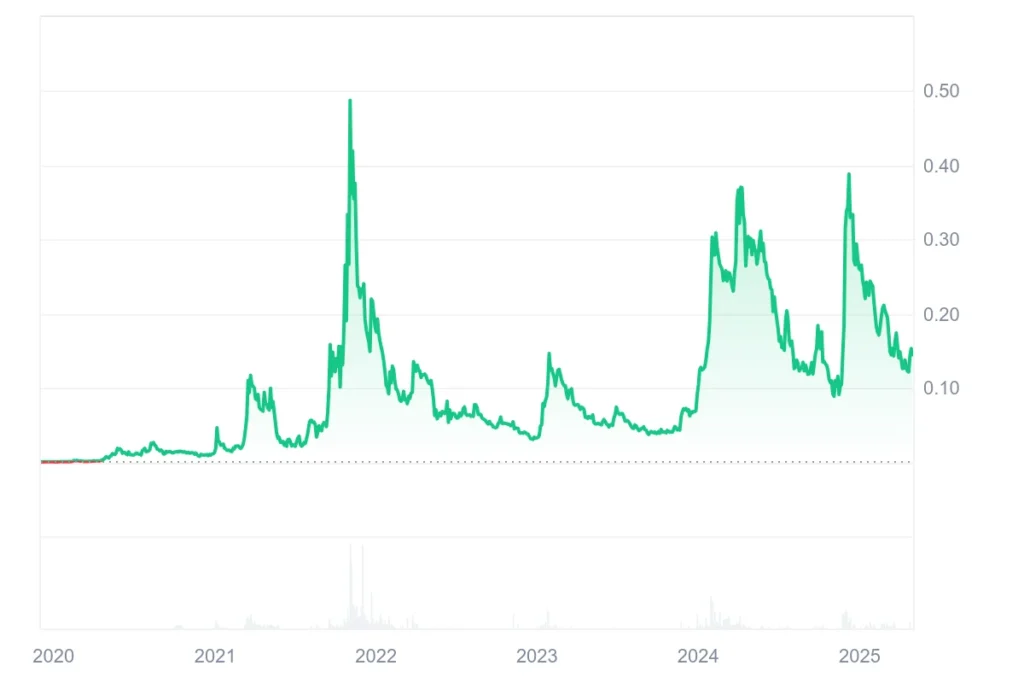

LCX Historical Price Sentiment

Before diving into LCX’s price predictions, it’s important to look back at how the token has performed in the past. While history doesn’t guarantee future results, it can give us some useful context.

LCX hit the market in late 2019, and it got off to a slow start—hitting an all-time low of just $0.00007085 on November 26 of that year. It wasn’t until May 2020 that it managed to climb above one cent.

The real momentum came in early 2021 during a crypto market boom, partly fueled by stimulus money from the U.S. making its way into digital assets. LCX shot past $0.10 in March 2021. However, that run was cut short by the big market crash on May 19, which led to a period of stagnation.

Later that year, in November, excitement around Bitcoin reaching new highs pushed LCX to its own peak—an all-time high of $0.7048 on November 16, 2021. But concerns around the Omicron COVID-19 variant triggered a market pullback, and LCX ended the year at $0.1752.

In 2022, the overall crypto market started sliding, and LCX was no exception. Things got worse in January when hackers stole about $8 million from an LCX wallet, causing the token to dip below $0.10. There was a brief rebound in March, when it reached $0.1679.

But May brought another big blow: the collapse of the LUNA token and the UST stablecoin shook the entire market. LCX dropped as low as $0.04922. Although it briefly bounced back in June to $0.101, the announcement that Celsius had paused withdrawals confirmed a bear market, and LCX dropped again to $0.05157.

After a few ups and downs, LCX reached $0.08093 in August, but the momentum didn’t last. By late September, it had fallen back to around $0.04459. A slight rally in October—thanks to buzz around the relaunch of the LCX exchange, pushed the price up to $0.06172. Still, by early November, it had slipped again to about $0.0492.

LCX began 2023 with a surprisingly strong rally. It opened the year at just over $0.03 and surged to $0.12 by the end of January. That momentum slowed in the following months, with February and March closing at $0.1036 and $0.07929 respectively. From April through September, LCX gradually declined, dropping to a low of around $0.03887. October remained flat, but a modest rebound began in November, with the price climbing to $0.07059, and by December, it closed the year at $0.1041—marking a slow but steady recovery.

2024 kicked off with a major breakout. LCX soared in January to close at $0.303, continuing its rise into February and reaching a March high of $0.4008 before closing that month at $0.3669—its strongest performance since late 2021. After this peak, the token began to cool off. April through August saw a gradual decline, with prices falling from $0.28 in April to $0.1355 by August. September offered a brief lift to $0.1609, but October brought another dip, with LCX closing at just $0.0921. November, however, brought renewed excitement. The token rallied strongly, reaching a high of $0.3859 and closing the month at $0.2952. December saw a pullback to $0.2298, wrapping up a volatile but mostly bullish year.

In 2025, LCX showed early signs of strength, opening January at $0.2298 and climbing to a high of nearly $0.294 before closing at $0.2337. However, this was followed by a downward trend—February ended at $0.2024, and March continued the slide to $0.1509.

LCX Price Prediction: Technical Analysis

LCX price has dropped to its moving averages, indicating that the bearish trading may persist for some time. However, buyers are aiming for a recovery rally from the recent lows. As of writing, LCX price trades at $0.145, surging over 1.5% in the last 24 hours.

A strong bounce from the moving averages could prompt the bulls to push the LCX/USDT pair above the $0.177 resistance. A successful breakout would confirm a double-bottom pattern, with a potential upside target of $0.25.

However, if the price fails to break above $0.17 and reverses, it would signal that the pair remains stuck in the current range. A drop below the key support at $0.14 would give the bears the advantage to push the price toward $0.11.

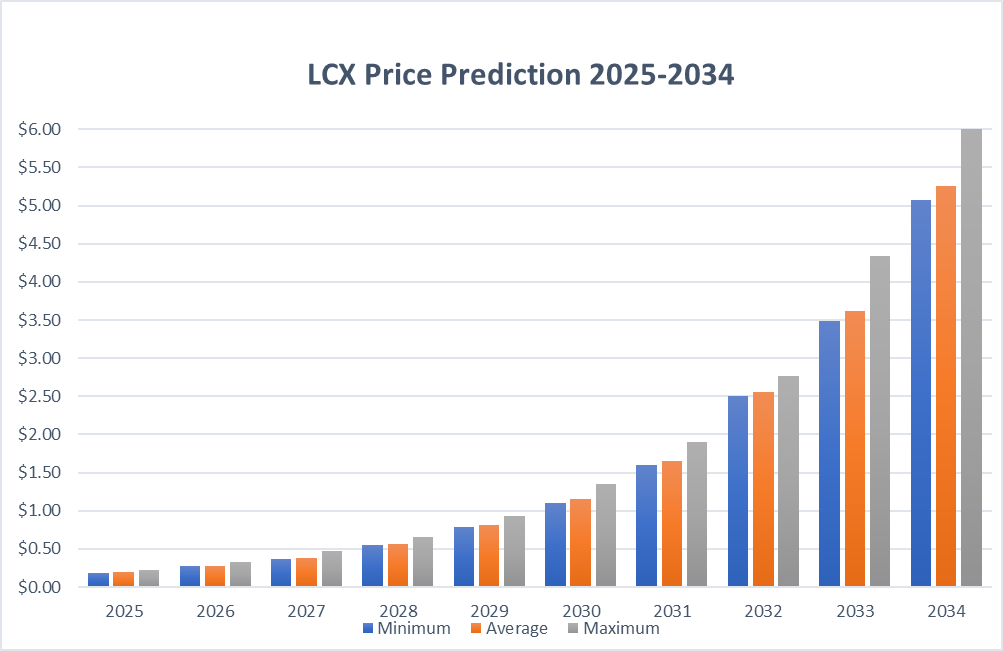

LCX Price Predictions by Blockchain Reporter

| Years | Minimum ($) | Average ($) | Maximum ($) |

| 2025 | 0.1877 | 0.195 | 0.2244 |

| 2026 | 0.2708 | 0.2806 | 0.3258 |

| 2027 | 0.3705 | 0.3846 | 0.4739 |

| 2028 | 0.5505 | 0.5697 | 0.6579 |

| 2029 | 0.789 | 0.8118 | 0.9331 |

| 2030 | 1.1 | 1.15 | 1.35 |

| 2031 | 1.6 | 1.65 | 1.9 |

| 2032 | 2.5 | 2.56 | 2.76 |

| 2033 | 3.49 | 3.62 | 4.34 |

| 2034 | 5.07 | 5.25 | 6.04 |

LCX Price Prediction 2025

In 2025, LCX is expected to reach a minimum price of around $0.1877. Based on forecasts, the token could climb as high as $0.2244, with an average trading price estimated at $0.1950.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.1 | 0.12 | 0.14 |

| February | 0.11 | 0.13 | 0.15 |

| March | 0.12 | 0.14 | 0.16 |

| April | 0.13 | 0.15 | 0.17 |

| May | 0.14 | 0.16 | 0.18 |

| June | 0.15 | 0.17 | 0.19 |

| July | 0.16 | 0.175 | 0.2 |

| August | 0.165 | 0.18 | 0.205 |

| September | 0.17 | 0.185 | 0.21 |

| October | 0.175 | 0.19 | 0.215 |

| November | 0.18 | 0.193 | 0.22 |

| December | 0.1877 | 0.195 | 0.2244 |

LCX Price Prediction 2026

LCX is projected to start 2026 at a minimum of $0.2708 and potentially rise to a maximum of $0.3258. The average price for the year is expected to be about $0.2806.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-26 | $0.1853 | $0.2048 | $0.2106 |

| Feb-26 | $0.2051 | $0.2129 | $0.2208 |

| Mar-26 | $0.2075 | $0.2172 | $0.2315 |

| Apr-26 | $0.2118 | $0.2215 | $0.2402 |

| May-26 | $0.2162 | $0.2260 | $0.2513 |

| Jun-26 | $0.2272 | $0.2350 | $0.2626 |

| Jul-26 | $0.2343 | $0.2421 | $0.2743 |

| Aug-26 | $0.2415 | $0.2493 | $0.2840 |

| Sep-26 | $0.2490 | $0.2568 | $0.2940 |

| Oct-26 | $0.2548 | $0.2645 | $0.3042 |

| Nov-26 | $0.2653 | $0.2751 | $0.3148 |

| Dec-26 | $0.2708 | $0.2806 | $0.3258 |

LCX Price Prediction 2027

Forecasts suggest that in 2027, LCX could trade as low as $0.3705, while reaching a peak of $0.4739. The average predicted price for the year is $0.3846.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-27 | $0.2694 | $0.2946 | $0.3030 |

| Feb-27 | $0.2865 | $0.3005 | $0.3178 |

| Mar-27 | $0.2953 | $0.3065 | $0.3298 |

| Apr-27 | $0.3014 | $0.3127 | $0.3421 |

| May-27 | $0.3077 | $0.3189 | $0.3546 |

| Jun-27 | $0.3176 | $0.3317 | $0.3705 |

| Jul-27 | $0.3337 | $0.3449 | $0.3871 |

| Aug-27 | $0.3413 | $0.3553 | $0.4043 |

| Sep-27 | $0.3512 | $0.3624 | $0.4221 |

| Oct-27 | $0.3584 | $0.3696 | $0.4402 |

| Nov-27 | $0.3630 | $0.3770 | $0.4550 |

| Dec-27 | $0.3705 | $0.3846 | $0.4739 |

LCX Price Prediction 2028

By 2028, LCX is anticipated to increase further, with prices ranging from a minimum of $0.5505 to a maximum of $0.6579. The average trading value is forecasted at $0.5697.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-28 | $0.3653 | $0.4038 | $0.4153 |

| Feb-28 | $0.4007 | $0.4200 | $0.4315 |

| Mar-28 | $0.4130 | $0.4284 | $0.4525 |

| Apr-28 | $0.4301 | $0.4455 | $0.4739 |

| May-28 | $0.4390 | $0.4544 | $0.4962 |

| Jun-28 | $0.4572 | $0.4726 | $0.5144 |

| Jul-28 | $0.4714 | $0.4867 | $0.5333 |

| Aug-28 | $0.4811 | $0.4965 | $0.5527 |

| Sep-28 | $0.5010 | $0.5163 | $0.5776 |

| Oct-28 | $0.5178 | $0.5370 | $0.6034 |

| Nov-28 | $0.5377 | $0.5531 | $0.6302 |

| Dec-28 | $0.5505 | $0.5697 | $0.6579 |

LCX Price Prediction 2029

In 2029, analysts expect LCX to hit a low of $0.7890 and potentially rise to a high of $0.9331. The average price over the year is projected to be $0.8118.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-29 | $0.5412 | $0.5982 | $0.6153 |

| Feb-29 | $0.5874 | $0.6101 | $0.6392 |

| Mar-29 | $0.5996 | $0.6224 | $0.6697 |

| Apr-29 | $0.6120 | $0.6348 | $0.7008 |

| May-29 | $0.6254 | $0.6538 | $0.7262 |

| Jun-29 | $0.6572 | $0.6800 | $0.7589 |

| Jul-29 | $0.6708 | $0.6936 | $0.7861 |

| Aug-29 | $0.6790 | $0.7075 | $0.8139 |

| Sep-29 | $0.7002 | $0.7287 | $0.8422 |

| Oct-29 | $0.7294 | $0.7578 | $0.8713 |

| Nov-29 | $0.7597 | $0.7882 | $0.9016 |

| Dec-29 | $0.7890 | $0.8118 | $0.9331 |

LCX Price Prediction 2030

LCX could continue its upward trend in 2030, with a minimum price of $1.10 and a possible high of $1.35. The average price throughout the year is forecasted at $1.15.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-30 | $0.7712 | $0.8524 | $0.8767 |

| Feb-30 | $0.8459 | $0.8865 | $0.9194 |

| Mar-30 | $0.8806 | $0.9131 | $0.9637 |

| Apr-30 | $0.8989 | $0.9313 | $1.00 |

| May-30 | $0.9175 | $0.9500 | $1.04 |

| Jun-30 | $0.9284 | $0.9690 | $1.08 |

| Jul-30 | $0.9478 | $0.9883 | $1.12 |

| Aug-30 | $0.9756 | $1.01 | $1.16 |

| Sep-30 | $1.02 | $1.05 | $1.20 |

| Oct-30 | $1.05 | $1.08 | $1.26 |

| Nov-30 | $1.06 | $1.10 | $1.30 |

| Dec-30 | $1.10 | $1.15 | $1.35 |

LCX Price Prediction 2031

By 2031, LCX is predicted to trade between $1.60 and $1.90, with an average yearly price of around $1.65.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-31 | $1.09 | $1.20 | $1.24 |

| Feb-31 | $1.18 | $1.24 | $1.29 |

| Mar-31 | $1.21 | $1.26 | $1.35 |

| Apr-31 | $1.24 | $1.30 | $1.41 |

| May-31 | $1.28 | $1.33 | $1.48 |

| Jun-31 | $1.31 | $1.35 | $1.53 |

| Jul-31 | $1.32 | $1.38 | $1.58 |

| Aug-31 | $1.38 | $1.44 | $1.64 |

| Sep-31 | $1.44 | $1.49 | $1.70 |

| Oct-31 | $1.47 | $1.52 | $1.76 |

| Nov-31 | $1.54 | $1.58 | $1.82 |

| Dec-31 | $1.60 | $1.65 | $1.90 |

LCX Price Prediction 2032

Forecasts for 2032 suggest LCX could reach a minimum value of $2.50 and a maximum of $2.76, while the average price is estimated at $2.56.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-32 | $1.57 | $1.73 | $1.78 |

| Feb-32 | $1.72 | $1.80 | $1.87 |

| Mar-32 | $1.77 | $1.84 | $1.94 |

| Apr-32 | $1.83 | $1.91 | $2.01 |

| May-32 | $1.92 | $1.99 | $2.09 |

| Jun-32 | $1.98 | $2.07 | $2.19 |

| Jul-32 | $2.08 | $2.15 | $2.27 |

| Aug-32 | $2.17 | $2.23 | $2.36 |

| Sep-32 | $2.26 | $2.32 | $2.47 |

| Oct-32 | $2.33 | $2.39 | $2.56 |

| Nov-32 | $2.40 | $2.46 | $2.66 |

| Dec-32 | $2.50 | $2.56 | $2.76 |

LCX Price Prediction 2033

In 2033, the LCX token may see prices ranging from $3.49 to $4.34. The average expected trading value is $3.62.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-33 | $2.43 | $2.69 | $2.77 |

| Feb-33 | $2.64 | $2.74 | $2.90 |

| Mar-33 | $2.75 | $2.85 | $3.04 |

| Apr-33 | $2.81 | $2.91 | $3.15 |

| May-33 | $2.87 | $2.97 | $3.30 |

| Jun-33 | $2.93 | $3.03 | $3.42 |

| Jul-33 | $3.02 | $3.15 | $3.57 |

| Aug-33 | $3.12 | $3.25 | $3.70 |

| Sep-33 | $3.18 | $3.31 | $3.86 |

| Oct-33 | $3.31 | $3.44 | $4.02 |

| Nov-33 | $3.42 | $3.55 | $4.20 |

| Dec-33 | $3.49 | $3.62 | $4.34 |

LCX Price Prediction 2034

Looking ahead to 2034, LCX is forecasted to reach a low of $5.07 and a high of $6.04, with an average predicted price of $5.25.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-34 | $3.47 | $3.80 | $3.91 |

| Feb-34 | $3.73 | $3.87 | $4.06 |

| Mar-34 | $3.84 | $3.99 | $4.21 |

| Apr-34 | $3.96 | $4.11 | $4.37 |

| May-34 | $4.09 | $4.27 | $4.54 |

| Jun-34 | $4.18 | $4.36 | $4.71 |

| Jul-34 | $4.35 | $4.53 | $4.93 |

| Aug-34 | $4.57 | $4.71 | $5.15 |

| Sep-34 | $4.66 | $4.81 | $5.34 |

| Oct-34 | $4.86 | $5.00 | $5.58 |

| Nov-34 | $5.01 | $5.15 | $5.83 |

| Dec-34 | $5.07 | $5.25 | $6.04 |

LCX Price Targets: By Experts

According to the latest Liechtenstein Cryptoassets price prediction from Coincodex, the token is expected to decrease by approximately 16.14%, reaching a price of $0.121598 by May 30, 2025. Technical indicators currently reflect a Neutral sentiment, while the Fear & Greed Index stands at 60, indicating Greed. Over the past 30 days, Liechtenstein Cryptoassets has experienced 13 green days out of 30 (43%), with a price volatility of 8.67%. Based on the Coincodex forecast, now appears to be a favorable time to consider buying Liechtenstein Cryptoassets.

According to projections from Digital Coin Price, LCX is expected to begin the year 2027 at approximately $0.43 and trade around $0.52, marking a significant increase compared to the previous year. Analysts consider this a notable and acceptable upward move for LCX. Looking further ahead to 2034, forecasts suggest that LCX could reach a minimum price of $2.75, with a potential peak at $2.86 and an average trading price of $2.83. Digital Coin Price analysts believe LCX may surpass its previous highs and move toward a new price tier if market conditions remain favorable. However, they also caution that a market downturn remains possible.

Is LCX a Good Investment? When to Buy?

Holding the LCX Token grants users a reduction of up to 50% on trading fees at the LCX Cryptocurrency Exchange. The token can be used to pay for all fees associated with the services offered by LCX AG, making it a universal utility token. As LCX token gains attention in the market, the future for LCX looks bright. Thus, it makes LCX a good investment. According to our LCX price prediction, it is suggested to invest in LCX crypto at a price of $0.1 for a profitable return in the long term.

More on LCX and Its License

LCX has filed a pre-application for the Pan-European MiCA license with Liechtenstein’s FMA, making it one of the first regulated crypto exchanges aiming for full MiCA compliance. LCX is creating an ecosystem to become a leading player in the blockchain space. To achieve this, they’re developing several key products:

-

LCX Terminal

: A platform to manage crypto trading across multiple exchanges.

-

LCX Exchange

: Aiming to launch a regulated marketplace for trading cryptocurrencies and security tokens.

-

LCX Assets

: A platform for creating and managing tokenized digital assets.

-

LCX Vault

: A secure storage solution designed for institutions.

-

LCX Protocol

: A decentralized system called the “Liechtenstein Protocol” that sets standards for issuing and trading security tokens.

- LCX Bank : In the long run, LCX plans to become a blockchain-focused bank, offering corporate banking services under a full banking license.

The roadmap of LCX is fascinating. It all began in 2017, when the idea for LCX was formed, focusing on building a regulated and innovative blockchain-based financial ecosystem. In 2018, LCX AG was officially incorporated to secure funding and begin technology development. The following year, in 2019, LCX launched the LCX Terminal—a platform designed to manage crypto asset trading across multiple exchanges—marking a significant step in its product development.

By 2020, LCX focused on tokenization, working to create a new class of digital financial instruments such as security tokens. During this phase, the company also began developing tools for regulatory compliance, including solutions for KYC (Know Your Customer), AML (Anti-Money Laundering), and legal reporting. In 2021, LCX expanded its digital asset services and launched LCX Vault, a secure custody solution for crypto assets aimed at institutional clients.

In 2022, LCX turned its attention to advanced technologies like Artificial Intelligence and Big Data, aiming to set new standards in financial services through scalable tech solutions. The growth continued in 2023, with LCX expanding its digital asset platform to offer more financial services and meet growing market demand. By 2024, the company aimed to refine its operations further through digital excellence, focusing on automation and customer-centric services.

Looking ahead to 2025, LCX’s goal is to manage billions of dollars in assets under management (AuM), with 70% of those assets in crypto and 30% in traditional finance. This milestone reflects LCX’s ambition to lead the blockchain financial space through steady innovation, regulatory compliance, and global growth.

At Paris Blockchain Week 2025, LCX CEO Monty Metzger unveiled a bold roadmap centered on regulation, real-world asset tokenization, and scalable crypto infrastructure. The plan focuses on three pillars: Exchange V3.0 with advanced trading tools, secure tokenization of assets like gold and silver, and global regulatory leadership through MiCA compliance. LCX emphasized its commitment with a strong presence at the event, including private meetings and keynote sessions. With $3B in 2024 trading volume and 250,000+ users, LCX is positioned as a leader in compliant digital finance. As global regulations tighten, LCX’s strategy is built for long-term growth and trust.

Conclusion

LCX is fundamentally a technology company with strong expertise in crypto, blockchain, and the banking sector. The team has been deeply involved in innovation for years and has previously led fast-growing companies.

Its leadership has experience working at tech startups, blockchain initiatives, quantitative funds, venture capital firms, and major financial institutions such as Morgan Stanley, Goldman Sachs, J.P. Morgan, and top banks in Liechtenstein.

As part of its long-term strategy, LCX plans to apply for several financial licenses, including a banking license, to offer transaction banking services for both businesses and individuals, especially in the area of corporate banking. The company also aims to expand into more traditional financial services over time.

LCX is working to provide fast, flexible, and valuable services by combining the speed of cryptocurrency transactions with the global usability of traditional fiat accounts. The platform will support payments in both crypto and fiat, allowing users to easily switch between currencies directly from the main interface.

It is advised to do your own research and conduct expert analysis before investing in the volatile crypto market.

X Empire Rebus of the Day: Daily Puzzles, Rewards & More

Discover how to solve X Empire Rebus of the Day, earn coins, unlock YouTube bonuses, and join a thri...

Neurochain.AI’s 156,000+ Users Set to Benefit from Bitgert’s Gas-Free Blockchain With the New Partnership

Neurochain.AI has recently collaborated with Bitgert to innovate in speed and scalability. Bitgert i...

Cardano’s Bearish Outlook Has Traders Eyeing RCO Finance’s VC-Funded Expansion

Cardano’s momentum has slowed, but a fast-growing DeFi project backed by $7.5M in VC funding is roll...

Full regulatory compliance

Full regulatory compliance