What to Know:

- Solana’s rejection at the $84 mid-band signals potential exhaustion and a risk of leverage unwinds in the short term.

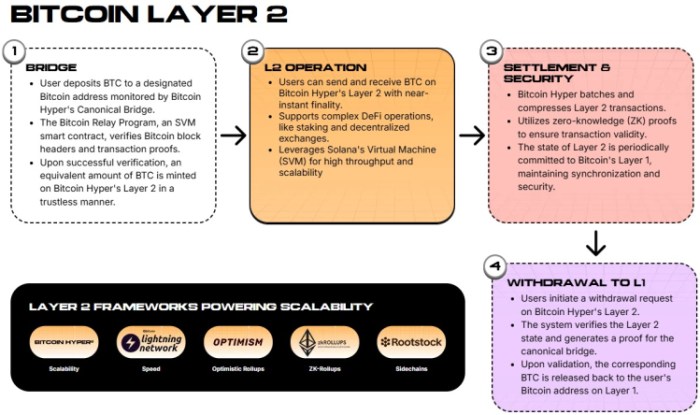

- Capital is rotating from stagnant major cap altcoins into the high-growth Bitcoin Layer 2 narrative.

- Bitcoin Hyper combines Solana’s speed with Bitcoin’s security, raising over $31.3M as whales accumulate early positions.

- The integration of the Solana Virtual Machine (SVM) on Bitcoin creates a new paradigm for high-speed DeFi and gaming.

Solana (SOL) is facing a critical test.

After a rally that captivated retail attention, the asset hit a wall at $84 , a clean rejection from the technical mid-band.

For chart watchers, this isn’t just a psychological barrier; it marks a heavy supply zone where profit-taking finally drowned out fresh demand. That midline rejection suggests momentum is waning (fast), forcing price into a precarious consolidation range. Bulls are hesitant. Bears are sharpening their claws.

Right now, $SOL looks trapped between institutional distribution and retail hope. The ‘mid-band rejection’ is a classic technical signal. Often, it precedes a deeper correction or that painful sideways chop traders call ‘time capitulation.’ While the broader ecosystem remains active, the price action screams exhaustion. But capital hates a vacuum. As liquidity cycles out of stagnant large-caps, it’s rotating aggressively into the emerging Bitcoin Layer 2 narrative.

You can see this rotation in the explosive interest surrounding Bitcoin Hyper ($HYPER) .

While Solana struggles to reclaim the $90 handle, this new infrastructure protocol, marketing itself as the fastest Bitcoin Layer 2 with Solana Virtual Machine (SVM) integration, is absorbing significant liquidity.

Frankly, the timing is impeccable. The contrast is sharp: legacy L1s are battling resistance, while next-gen L2s are entering price discovery mode. The market is effectively signaling that while Solana’s architecture is desirable, its current valuation offers limited upside compared to bringing that same speed to the $1T Bitcoin network.

Read more about $HYPER here.

Risk-Off Sentiment and Leverage Unwinds Add Pressure

The stall at $84 matters less for the number itself than for what it unlocks: a potential cascade of leverage unwinds. When an asset like Solana fails to break a key resistance level after multiple attempts, open interest on derivatives platforms starts to look heavy.

Traders who went long expecting a breakout are now paying funding fees to hold underwater positions. Ouch. History suggests that if the $84 rejection holds, the market often seeks liquidity lower to flush out these over-leveraged longs before any genuine reversal can occur.

Zooming out, the risk-reward ratio for SOL has deteriorated. The Daily Relative Strength Index (RSI) has reset but shows zero bullish divergence, implying the ‘buy the dip’ crowd is becoming more selective. The real danger? Complacency.

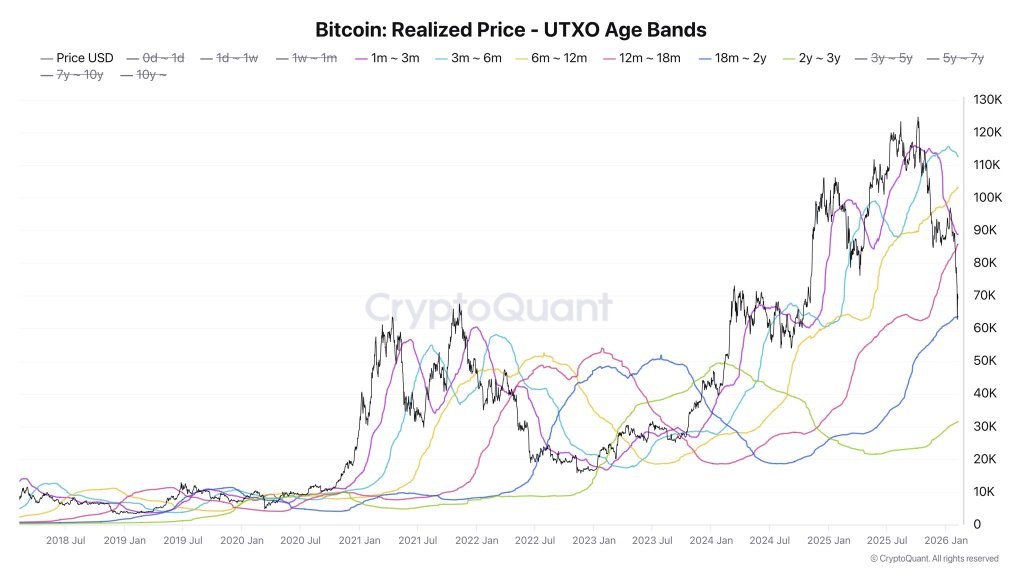

Many investors assume the bull run will lift all boats simultaneously, but smart money flows are currently favoring specific narratives, primarily the unlocking of Bitcoin’s programmable liquidity, over generalized Layer 1 plays.

While $SOL consolidates, the opportunity cost of holding stagnant assets rises. This creates a migration pattern where traders exit stalled positions to capitalize on early-stage entries elsewhere. The current beneficiary of this capital flight appears to be protocols that promise to fix Bitcoin’s core limitations, speed and cost, without sacrificing its security.

$HYPER is available here.

Bitcoin Hyper Absorbs Liquidity With $31M Raise

While the headline majors chop sideways, Bitcoin Hyper has been quietly executing one of the cycle’s most significant capital raises. According to the official presale page, the project has already raised a staggering $31.3M, signaling immense demand.

The premise is simple yet disruptive: Bitcoin Hyper integrates the Solana Virtual Machine (SVM) as a Layer 2 on Bitcoin. This effectively brings Solana’s sub-second finality and low fees to the Bitcoin network, solving ‘digital gold’s’ inability to host high-performance DeFi and gaming applications.

The smart money trail is visible on-chain (if you know where to look). Etherscan records show 3 whale wallets recently accumulated over $1M ( $500K , $379.9K , $274K ) positioning themselves ahead of the public listing. These investors aren’t buying a promise; they’re buying into a technical leap that allows developers to write smart contracts in Rust (via SVM) while settling on Bitcoin.

Currently priced at $0.0136753, the token offers an entry point that stands in stark contrast to SOL’s saturated market cap. With a decentralized canonical bridge for BTC transfers and a modular architecture that separates execution from settlement, Bitcoin Hyper is positioning itself as the ‘Solana killer’ that lives on Bitcoin.

For investors tired of watching SOL reject $84, the logic is compelling: why bet on a stalled L1 when you can own the infrastructure that brings L1 speed to the world’s largest asset class?

Buy $HYPER here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrencies are high-risk assets. Always conduct your own due diligence before investing. The author may hold positions in the assets mentioned.