The Bitcoin price has gone through an intense bout of volatility over the past few days, with a violent sell-off that has dragged its price into the $70,000 range. The move wiped out short-term bullish positioning and forced the price below several intraday support levels. Although there are risks of further downside , Bitcoin is now looking to stabilize and push to reclaim important reference levels. A technical outlook suggests that a path back to the $81,000 region could open up faster than expected if certain conditions are met.

Sweep Of The Yearly Low

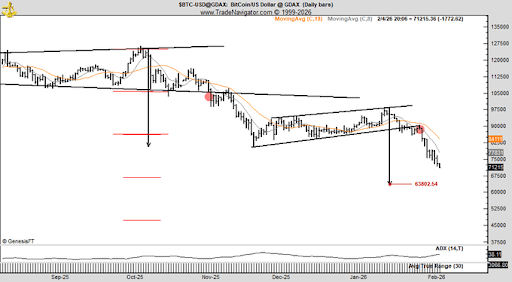

One of the most important developments on the chart is the sweep of the last yearly candle low around $74,456. That move flushed liquidity resting below prior lows and was a clear downside grab that had been waiting for months.

In terms of a market-structure perspective, this type of sweep is a reset point that clears weak hands and allows price to build a more stable base. The bounce that followed pushed Bitcoin back to $77,000, a move that shows buyers were willing to defend the area after the liquidation event. This is now transitioning into a decision zone , which is where the next directional move becomes more important.

As noted by crypto analyst Minga on the social media platform X, Bitcoin went back to testing the weekly open just below $77,000. Holding above it would mean that the recovery has real follow-through, which in turn would allow the price to revisit the monthly open at $78,700. The chart shared by the analyst also shows multiple equal highs stacked above that region, right within the previous range low.

Together, these elements form a pocket of unfinished business. If Bitcoin reclaims and sustains acceptance above the weekly open, the probability of a push through the monthly open increases, with that momentum then potentially carrying price into the $80,000s, where prior range liquidity is around $81,000.

Bitcoin Price Chart. Source: @Mingarithm on X

Downside Scenario And The Relief Bounce Zone Below

There is a valid alternate path if Bitcoin’s advances continue to reject at the weekly open, which is looking like the case in the current price action. In that case, there is a deeper downside target between $70,800 and $69,100. This area stands out as a high-confluence zone that aligns with a higher-timeframe order block, the 0.5 Fibonacci retracement, and the last cycle’s all-time high in 2021.

At the time of writing, Bitcoin is trading at $70,930, down by 7.2% in the past 24 hours and is now at risk of losing $70,000. If price holds above this zone after the current test, then Bitcoin is likely to transition into a range before attempting continuation and breaking above $81,000.