CryptoJack, a prominent crypto market analyst, today observed that a head-and-shoulders pattern has formed on the Ethereum (ETH) weekly chart. The analyst shared his analysis on the X social media platform and illustrated the possible outcomes of this pattern and its impacts on Ether’s price movements.

The head-and-shoulders pattern is a well-known technical chart formation that points out a possible trend reversal. As shown in the analyst’s chart, this pattern consists of a left shoulder, a head, and a right shoulder. The formation of the pattern and the price move below the neckline (as indicated) often suggests upcoming bearish momentum.

What The Head and Shoulders Pattern Says About Ether

Ethereum is displaying an interesting technical action currently, as the analyst’s data identified a head-and-shoulder pattern on the weekly chart; a development that could determine the altcoin’s next move. After a recent strong rally that saw Ether’s price reclaim the above the $3,000 psychological level during the greater part of this month (January), the asset has cooled off its momentum.

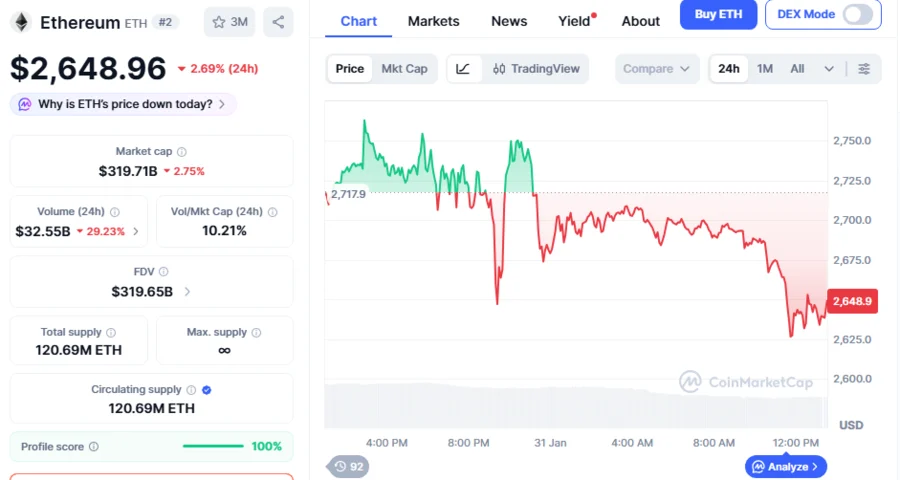

Two days ago, on Thursday, January 29, 2026, was the last time when ETH dropped below the $3,000 mark. Today, the price of Ethereum currently trades at $2,648, after seeing 3.7% declines over the past 24 hours and a further decrease of 11.1% over the past week.

The analyst associates this shift with the wider volatility currently being noticed in the larger crypto market and technical factors. The head and shoulder structure further confirms that the Ethereum price is set to experience greater downturns. The formation of the head-and-shoulders chart signals that a bullish momentum is shifting into a bearish trend, pointing out that the recent upward trend is coming to an end.

The pattern predicts that ETH has entered into a consolidation period where key price levels are beginning to matter most. According to the pattern, with the beginning of the downward trend, Ether is likely to drop to around the $2,300 level soon, indicating a potential 12.42% drop.

ETH Amid Bearish Catalysts

In short, ETH is facing looming decreases as the head-and-shoulder pattern suggests the end of the uptrend. This negative shift reflects the broader cryptocurrency market weakness, with factors such as macro surprises and geopolitical tensions fueling market declines. Based on its latest FOMC meeting on Wednesday, January 28, the Federal Reserve voted to maintain key interest rates steady, a move that caused the cryptocurrency markets to respond with increased volatility. The bearish sentiment is further compounded by rising geopolitical tensions involving Iran’s conflict with Israel and the US, which have also caused cool-offs in risk appetite in crypto markets.