A fierce winter storm that swept much of the US over the weekend forced large parts of the Bitcoin mining fleet to cut power, leaving the network much weaker for a short time.

Reports say power outages and extreme weather pushed some operators to pause or slow their rigs so local grids could breathe. The result was a dramatic, though temporary, fall in the total mining power securing the blockchain.

Miners Adjust Power Use

According to mining operators on the ground, the pause was intentional. Many farms turned down machines to reduce strain on regional utilities when demand spiked and generation dropped.

Abundant Mines, a crypto mining firm headquartered in Oregon, said roughly 40% of global mining capacity went offline in a 24-hour window. That kind of quick scaling back is possible because miners can shut down and restart hardware rapidly, which in some regions acts like a big, flexible electrical load that can be trimmed when needed.

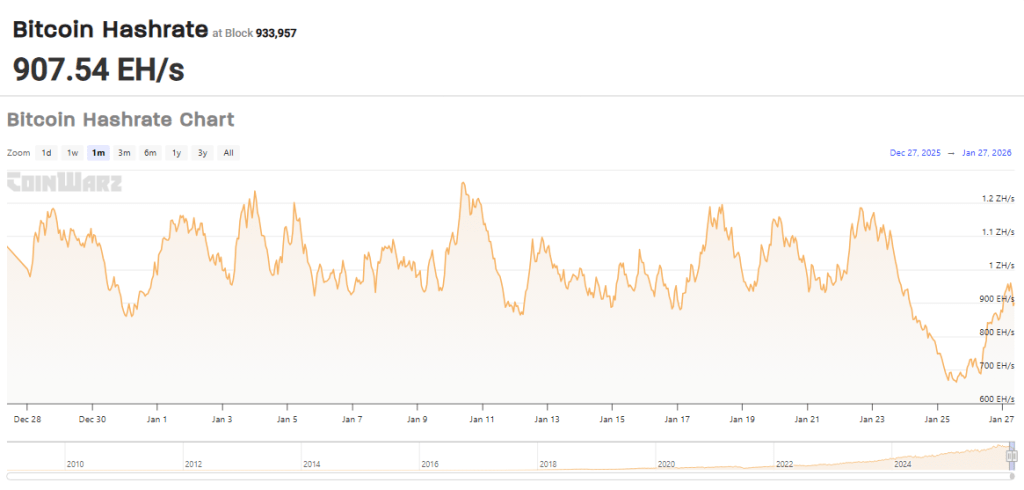

Bitcoin Hashrate Just Dropped Below 700 EH/s

The likely cause: the winter storm impacting Texas & the southeast, where a large share of US mining happens. Power outages and voluntary grid-stabilization measures have taken miners offline.

What this means: – Fewer miners online… pic.twitter.com/j0lv7bU9JN

— Abundant Mines (@AbundantMines) January 25, 2026

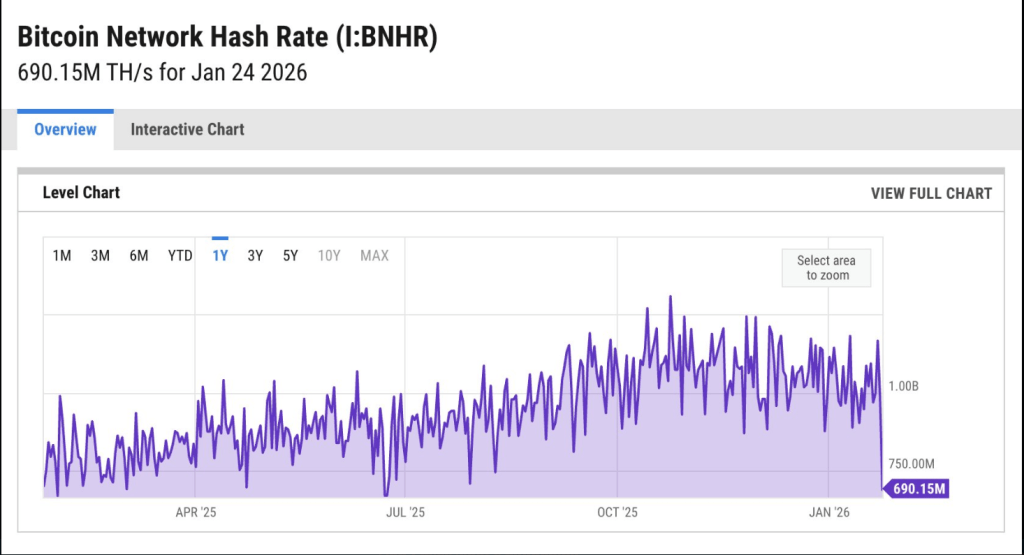

Hashrate Drop And Quick Recovery

Based on reports from mining trackers, network hashrate fell sharply starting Friday and hit a low not seen in seven months by Sunday, dropping to about 663 EH/s. Within a day or so, as crews worked and weather systems moved on, the figure climbed back toward 854 EH/s.

Hashrate Index estimates the US supplies nearly 38% of worldwide mining power, so disruptions in the country show up fast in global totals.

A federal Energy Information Administration report noted there are more than 130 dedicated crypto mining sites across the US, meaning storms that affect broad regions can hit mining supply in a big way.

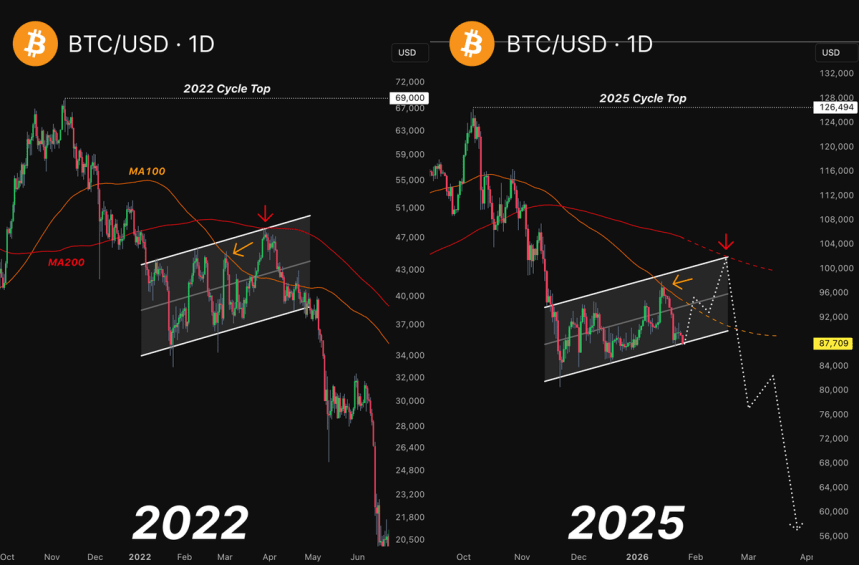

Bitcoin Price ActionPrice moved with the headlines but not in a straight line. Based on reports, Bitcoin traded around $88,300 through the volatility, with swings linked to both weather and wider geopolitical strains.

The market had earlier seen lifts up near $96,000 during episodes of geopolitical tension, while other stretches brought softer prices as macro risks grew.

Traders watched carefully; the temporary hashrate dip raised questions about short-term miner revenue, yet it did not trigger a major crash in market value.

Big Miners Felt The ImpactAs the winter storm hits the US, Bitcoin mining companies curtail operations to support the power grid.

Their daily Bitcoin production was hit significantly in the last few days.

CLSK: 22 bitcoin –> 12 Bitcoin RIOT: 16 –> 3 MARA: 45 –> 7 (more volatile as it mines “solo”)… pic.twitter.com/SzgcbtgQ5V

— Julio Moreno (@jjcmoreno) January 26, 2026

Analytics firms noted output from some big US miners fell sharply. Marathon Digital’s daily production was down from 45 coins to seven in one day, and IREN moved from 18 to six, data compiled by market trackers showed.

CryptoQuant flagged slower daily digs from several major operators as the storm hit. In Texas, reports say miners worked with grid managers to help balance supply and demand, using their machines to soak up extra power when available and to step back when the grid was under strain.

Featured image from Pexels, chart from TradingView