Cardano rallied this month after a clear rebound from a low zone around $0.33–$0.35. Prices jumped more than 10% on January 2, and ADA is up 20% year-to-date.

Reports have disclosed that whale activity spiked on that day across both spot and futures markets, according to recent data.

Governance on January 8 approved a 70 million ADA treasury allocation aimed at supporting USDC/USDT integrations, oracle work with Pyth Network, and cross-chain tools. Market players say that is hard cash being put to work.

Hoskinson Sees Bitcoin As A Trigger

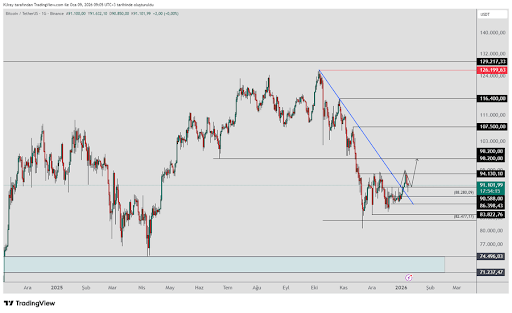

According to Cardano founder Charles Hoskinson, a fresh Bitcoin push to a record high would help lift other tokens, including ADA. He has forecast that Bitcoin could reach $250,000 toward the end of this year, a move that would push its market cap to roughly $5 trillion.

Hoskinson argued that when Bitcoin leads a rally, investors tend to buy BTC first because it offers liquidity and a sense of relative safety, and then capital flows into higher-risk assets later.

UPDATE: #Cardano $ADA Founder Charles Hoskinson says “I believe Bitcoin will reach an all-time high, and I also believe there’s going to be some value leakage from Bitcoin into the altcoin space.” $NIGHT pic.twitter.com/yFAzinx4cs

— Angry Crypto Show (@angrycryptoshow) January 7, 2026

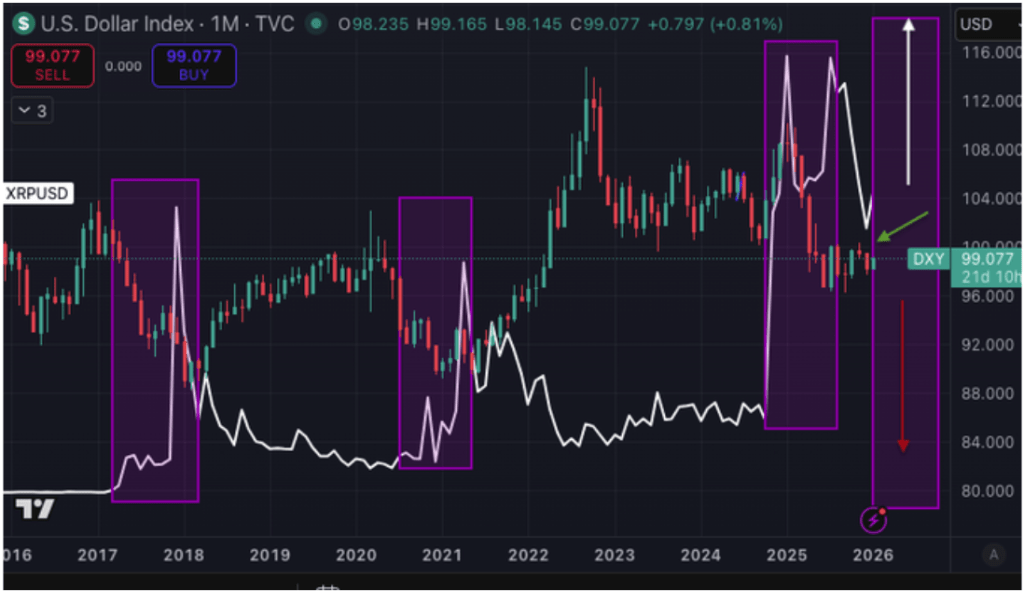

Past Runs Show Rotation Into Altcoins

Based on reports and past market moves, Bitcoin’s big rallies have often preceded strong gains in alternative tokens. In 2021, Bitcoin climbed to about $68,000 and several major altcoins surged afterwards.

Ethereum hit roughly $4,950 in August 2025, while XRP peaked near $3.66 in July of that year. Back then, ADA topped above $3 at its peak. Those episodes are often cited as examples where profit-seeking behavior shifted from the largest coin into smaller projects.

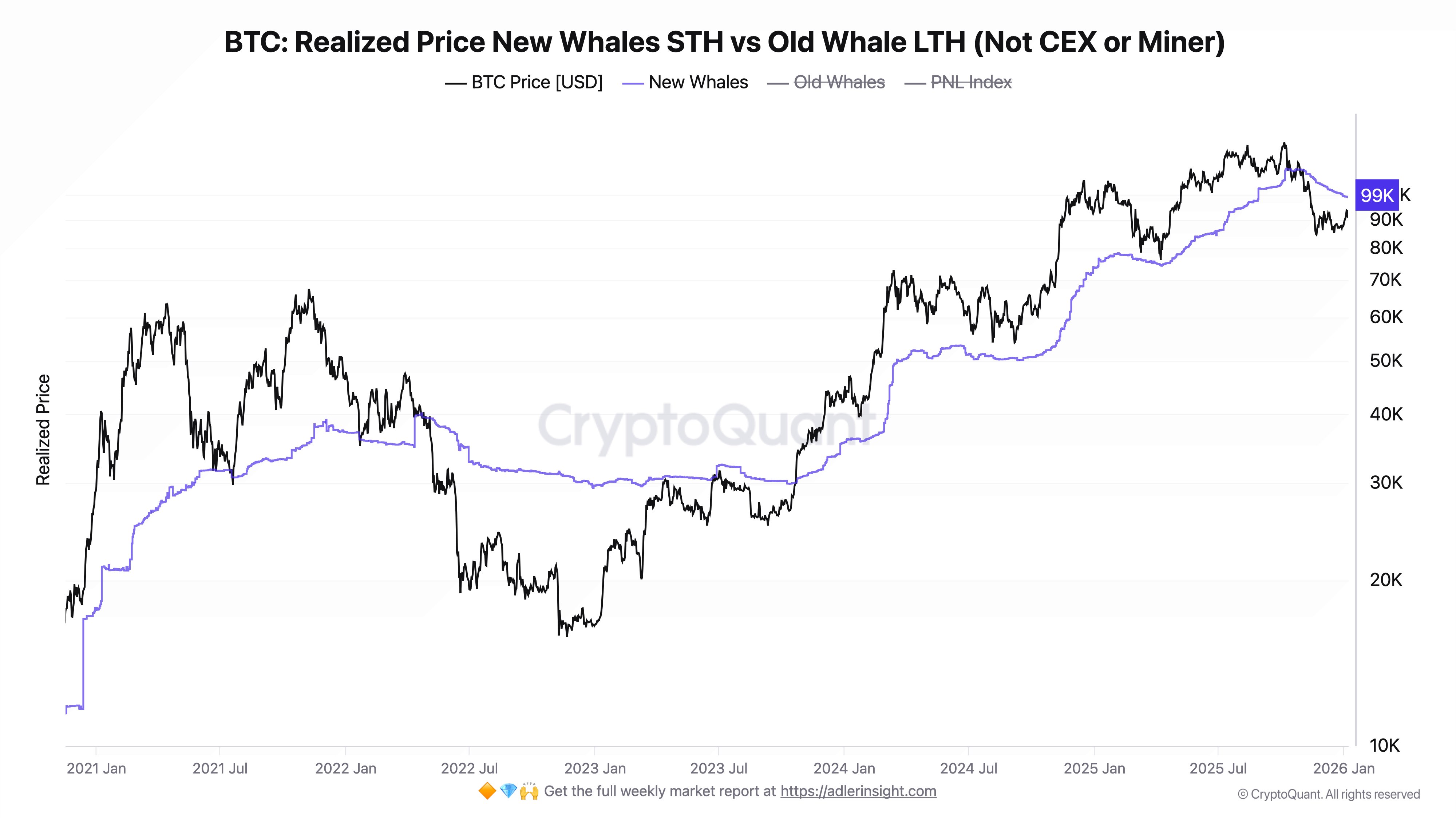

Bitcoin’s Recent Highs Did Not Help All Tokens

Bitcoin’s Recent Highs Did Not Help All Tokens

Market watchers point out that history is not a guarantee. In October 2025, Bitcoin reached a new record of $126,198, but only a few assets rode that wave. Many altcoins stayed flat or posted modest gains.

That pattern is being used by some analysts to temper expectations about how much value will “leak” from BTC into altcoins this cycle. The size of any rotation, Hoskinson himself warned, is still uncertain and could differ from earlier cycles.

Liquidity and macro conditions will matter. ETF flows, trader positioning, and whether developers and users adopt new features are among the things investors will watch.

A Measured OutlookReports note that Cardano’s recent treasury spend targets stablecoins and oracle access, which could help DeFi activity on the network if projects take up the funding. Competition from other layer ones and scaling solutions is real, and capital can move quickly between chains.

The view from Hoskinson is bullish on the linkage between Bitcoin highs and altcoin upside, but the evidence from late 2025 shows that link can be uneven. ADA’s recent moves — a bounce from $0.33–$0.35, a more than 10% single-day gain on January 2, and a 70 million ADA treasury allocation on January 8 — give the token practical catalysts beyond market talk.

Whether those actions translate into sustained price gains will depend on broader market flows and how the allocated funds are used.

Featured image from Gemini, chart from TradingView