Ethereum is back in control, and the market is starting to feel like a fresh risk-on phase. Ethereum is trading around $3,155 today, and that steady climb is doing what it often does: it pulls attention away from the sidelines and into faster-moving plays.

ETH’s strength is not just a number on a screen; it is the signal that confidence is returning. That is why Pepe price is flashing again, and why Remittix is picking up urgency at the exact moment buyers look for the next big move. If Ethereum keeps setting the tone, ETH rotation can turn quick narratives into huge weeks.

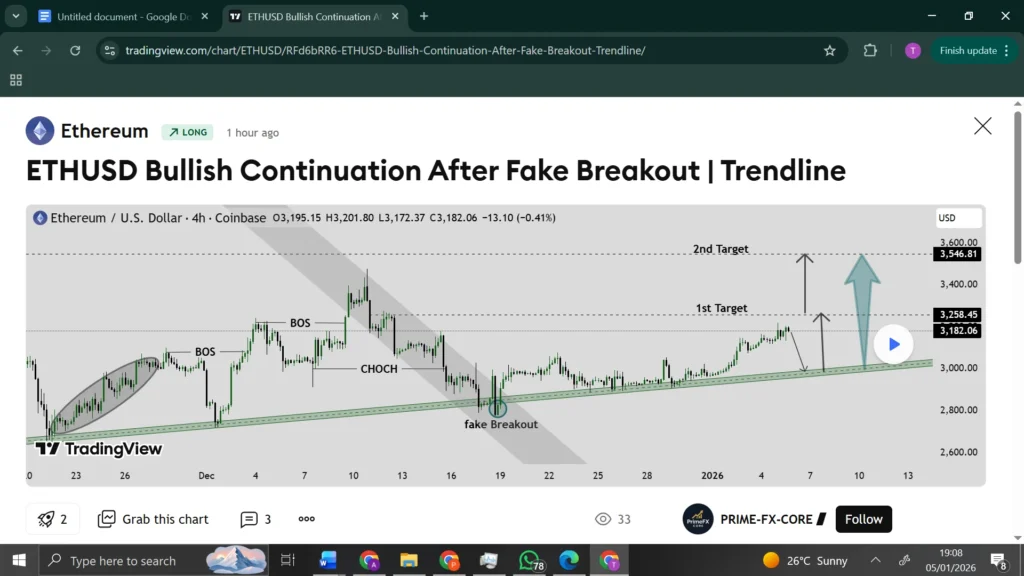

Ethereum and ETH move first, then the rest of the market follows

Ethereum has been pushing higher with ETH holding above key levels, and that matters because ETH often leads the shift in altcoin mood. With Ethereum near $3,155 and ETH staying firm, traders stop waiting for perfect entries and start following momentum. When Ethereum and ETH look stable, buyers usually get braver, and liquidity starts moving into smaller stories.

That flow is already showing up across meme momentum and utility-driven bets. Pepe price tends to react fast when Ethereum is strong, because the market starts rewarding speed again. At the same time, projects with real milestones can outperform even louder memes when ETH sentiment stays positive and deadlines approach.

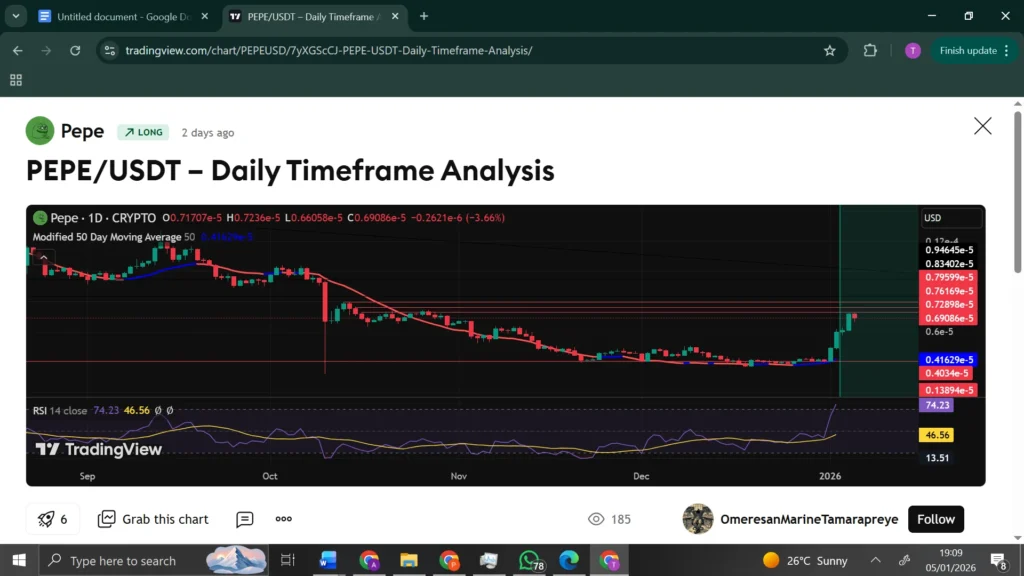

Pepe price is ripping again as meme liquidity returns

The clearest signal is Pepe’s price strength. Pepe’s price is around $0.000006844 today, and the bigger story is how quickly momentum can return when Ethereum is trending higher. When ETH is firm, the market often treats meme moves as permission to take risk, and Pepe price becomes a quick barometer for that mood.

Pepe’s price is not moving in a vacuum. Pepe price is reacting to Ethereum and ETH, giving traders confidence to rotate into higher volatility plays. If Ethereum keeps grinding higher and ETH keeps holding structure, Pepe price can stay hot simply because the market is rewarding narrative and speed again.

Remittix is turning the Ethereum tailwind into a real countdown

This is where the move gets more serious. Ethereum strength can lift everything, but Remittix has its own drivers that create real urgency, not just hype. Remittix is currently priced at $0.119, with 695 million tokens sold and over $28.6 million raised so far.

The security angle is also a significant credibility boost. CertiK thoroughly verifies the Remittix team, and the project is ranked number one on CertiK for tokens still in the pre-launch stage, which is not an easy badge to earn.

Beta testing for the Remittix wallet is live, and community testers are already using it. The wallet is also available on the Apple App Store, which gives the story something most early projects do not have: a product people can actually touch as Ethereum and ETH momentum build.

The PayFi solution is also enjoying strong retail attention. At the moment, Remittix is running a limited 200% bonus event, with only 5 million tokens allocated. If you are watching for the best-of-the-bunch setups, they usually occur when a market trend meets a clear timeline. Remittix has confirmed a crypto-to-fiat PayFi platform launch date of February 9, 2026 , and that kind of deadline changes buyer behaviour.

Here are the key reasons buyers keep circling back to Remittix as Ethereum and ETH fuel risk appetite:

- Remittix is designed to solve a real-world payments problem with a focus on moving value into everyday use.

- Users can send crypto to bank accounts in over 30 countries, targeting adoption rather than pure speculation.

- The project is audited and verified by CertiK, which adds a higher level of trust than most early tokens can claim.

- The wallet beta is live for community testing, and the iOS release on the Apple App Store marks progress.

What to watch next

If Ethereum continues to climb and ETH stays firm, expect Pepe price to remain reactive and volatile, because that is what meme flows do in a risk-on phase. Pepe price can swing hard in both directions, and the primary signal remains Ethereum and ETH. When Ethereum pauses, Pepe price often cools. When ETH pushes again, Pepe prices can light up fast.

For Remittix, the watchlist is simpler. Track whether demand continues to build at $0.119, watch the steady progress of the wallet beta, and keep February 9, 2026, in view. When Ethereum and ETH give the market confidence at the same time, a project has an absolute deadline, and moves can accelerate quickly.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

FAQs

1. Why does Ethereum’s strength matter for Pepe’s price?

Ethereum often sets the tone for risk. When ETH is strong, traders rotate into faster narratives, and the Pepe price can benefit from that flow.

2. What is the current Ethereum and ETH price in this update?

Ethereum is trading around $3,155 today, and ETH’s strength is the key signal driving rotation into higher-beta plays.

3. What is the current Pepe price?

Pepe price is around $0.000006844 today, and Pepe price momentum is tied closely to Ethereum and ETH sentiment.

4. What makes Remittix different from a typical ETH-driven pump?

Remittix has a fixed launch date of February 9, 2026, a wallet beta live with community testers, an iOS wallet on the Apple App Store, and a CertiK-verified team with a top ranking on CertiK for tokens, still before full launch.