According to an exchange on X, a user asked when Bitcoin would “boom.” A crypto expert answered bluntly that relying on a single price explosion to get rich is the wrong plan and summed up his approach as “time plus stacking.” The remark cut through the guessing and put the focus back on steady habits, not wild hopes.

Bitcoin As A Store Of Value

Bitcoin’s supply is fixed, with a hard cap of 21 million coins. That matters because, as Jeremie and other long-term holders point out, Bitcoin is best used to hold value you earned elsewhere.

Stacking, in practice, means buying small amounts regularly. Time means keeping those holdings for years. Both together reduce the pressure to guess tops and bottoms and make the plan mechanical rather than emotional.

Many buyers still chase quick gains. They ask when the next big run will hit. The answer from long-term traders is simple: hope is not a plan. Fiat money often loses buying power over time, while Bitcoin’s limited supply is designed to preserve value for those who hold through cycles.

If you’re relying on #Bitcoin to “boom” to make you rich, you’re doing it wrong.

Bitcoin is for storing what you earn. The win is time plus stacking. https://t.co/PDdrf3G6nv

— Davinci Jeremie (@Davincij15) January 5, 2026

Price Movements And Political Ties

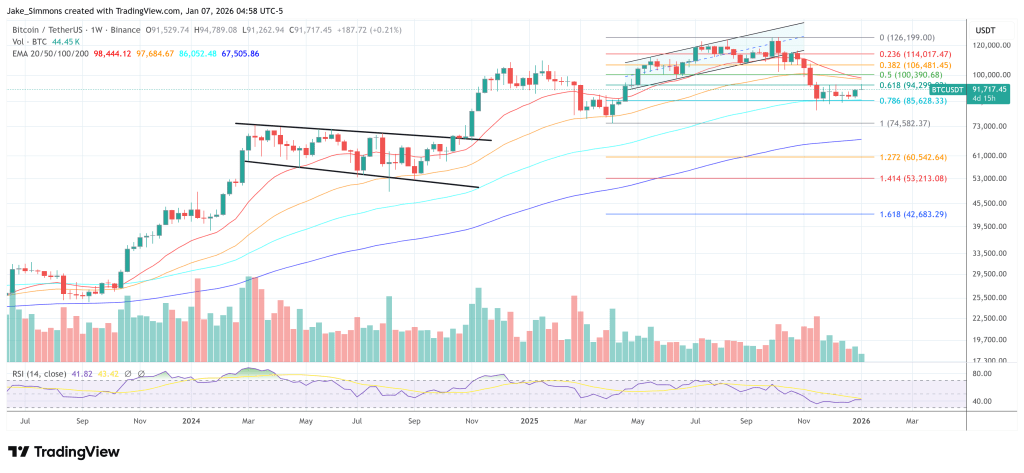

Based on reports, Bitcoin hit a three-week high and traded above $93,000 , rising as much as 2.54% on Monday morning. The token cleared its 50-day moving average for the first time since the market tumble that began in early October.

Bitcoin is up about 6% so far this year after plunging roughly 22% in the fourth quarter. Ether also moved higher alongside Bitcoin as broader markets rallied.

Political events, including the ouster of Venezuela’s President Nicolas Maduro by US special forces and related developments, pushed some investors toward safe-haven assets like gold and silver while not putting a clear dent in appetite for riskier bets like tech stocks. Trading activity and headline news have been linked to short-term moves in crypto prices more than once this year.

How Ordinary Investors Should Act

How Ordinary Investors Should Act

According to veteran holders, the mix of steady buying and patience beats timing the market. That is the core of Jeremie’s message. Buy small. Keep adding. Don’t watch the screen every hour. Over time, that habit smooths out the big swings and removes emotional buying at highs and panic selling at lows.

Reports indicate many newcomers still treat Bitcoin like a lotto ticket. That mindset fuels big swings. When prices climb, people rush in. When they fall, sellers rush out. The strategy Jeremie described aims to flip that behavior: make accumulation routine, make holding routine.

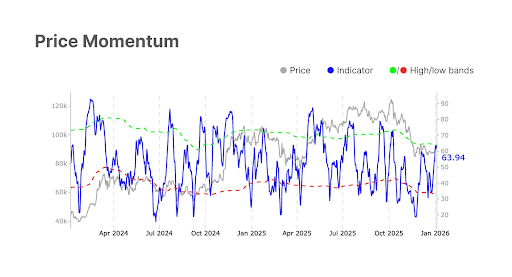

Market Signals And A Clear ChoiceTraders can use signals such as moving averages to judge momentum, but technical signs are not a plan by themselves. For people who want to use Bitcoin to protect savings, the clear choice is steady accumulation plus a long holding period. For those chasing a sudden “boom,” the risk is high and the outcome uncertain — at least according to the analyst.

Featured image from Unsplash, chart from TradingView