XRP’s Price Doesn’t Match Its Growing Real-World Use, Study Finds

According to Bayberry Capital, XRP’s market price does not match its real-world role. The hedge fund firm argues the token is often judged like a speculative coin when it actually serves as plumbing for moving value between financial systems.

The research compares the current stage of XRP to early internet infrastructure — quiet work laying the base while prices drift — and says many investors miss that deeper build-out. Ripple CEO Brad Garlinghouse has also stressed the token’s role across multiple settlement uses, reports show.

Bayberry Capital Warns Mispricing

Reports have disclosed that the investment house sees XRP as a liquidity tool, not just a tradable asset. It notes that institutional integrations, compliance work, and deep technical links take time to appear in prices.

The firm believes the token’s recent price steadiness reflects growing backbone work, rather than lack of demand. Market observers are urged to look past headlines and volatility and weigh actual settlement activity.

According To Onchain Data, Traders Are Shifting

Based on CryptoQuant data, open interest in BTC and ETH positions fell within the last 72 hours while XRP accumulation rose. That pattern is being read as traders rotating toward assets with clearer utility. The shift does not prove a long-term trend, but it does show changing flows in the short term.

Exchange Activity ShiftsBinance Traders Pile into XRP as BTC & ETH Positions Unwind

“Traders are using these slight dips to add positions, showing conviction that contrasts sharply with the fear gripping BTC and ETH markets.” – By @Crazzyblockk pic.twitter.com/QdXlsJCV2L

— CryptoQuant.com (@cryptoquant_com) November 6, 2025

Lookonchain flagged a large move on Hyperliquid where a whale opened a short position worth over $20 million. The same actor moved $7 million in USDC into that DEX before placing the trade.

At the same time, XRP’s price swung: after falling more than 13% to a low of $2.06 on Nov. 4, it climbed 6.27% the next day and reached $2.41. These opposing forces — fresh demand and a major short — are creating pressure around the current recovery attempt.

Ripple Partnerships Add Practical Use CasesSomeone created a new wallet and deposited 7M $USDC to Hyperliquid, opening 20x short on both $BTC and $XRP .

Positions: • 1,129 $BTC ($116M) • 8,888,888 $XRP ($20.35M)

This guy seems to be a high-stakes gambler — he’s a Roobet and https://t.co/ZZPnpTmYqj user.… pic.twitter.com/GqWZaca4BC

— Lookonchain (@lookonchain) November 6, 2025

Reports show Ripple has expanded use of RLUSD after deals with Mastercard, WebBank, and Gemini. The company also raised $500 million at a $40 billion valuation, with backing that included Citadel Securities and affiliates of Fortress.

Those moves are aimed at making it easier to settle credit-card transactions on the XRP Ledger using stablecoins, and they provide more pathways for real-world usage.

Outlook And Market TensionBayberry Capital believes that slow-moving institutional adoption means the market underestimates what’s being built. Adoption, compliance checks, and systems integration do not happen overnight; they creep forward as partners sign deals and test flows.

Featured image from Unsplash, chart from TradingView

OG Bitcoin Whales Dumping Assets: Chart Reveals Significant Sell-Off Activity

Charles Edwards, founder of Capriole Investments, has identified a concerning trend in the Bitcoin (...

XRP Price To Reach $1,000 By End Of 2025? Rumor Mills Are On Fire With BlackRock Speculations

Speculations across the crypto space have ignited a wave of excitement for the XRP price as rumors l...

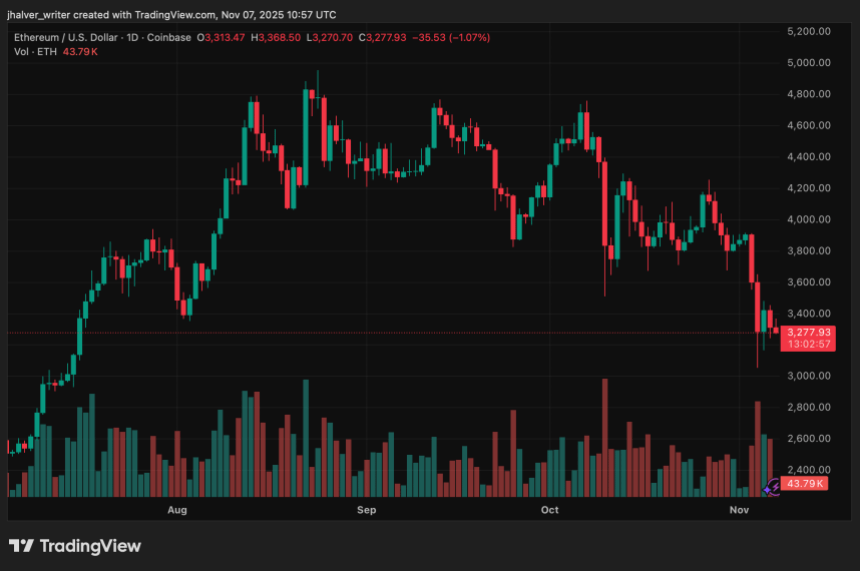

Ethereum Price Falls 25% But On-Chain Data and Institutional Staking Signal Q4 Recovery Potential

The Ethereum price dropped nearly 25% this quarter, slipping to lows around $3,099 before stabilizin...