Analyst Predicts XRP Price Will Decouple From Bitcoin, Here’s What Would Happen

Crypto analyst Arthur has predicted that the XRP price is preparing to decouple from Bitcoin (BTC). For years, XRP’s price movements have mirrored those of BTC , but according to Arthur, the market is evolving in ways that could soon set XRP apart. The emergence of Ripple’s new institutional brokerage platform and recent acquisitions , alongside the growing strength of its associated stablecoin, are key drivers that the analyst believes could drive this separation.

XRP Price Set To Break Away From Bitcoin

Arthur’s recent thread shared on X social media paints a confident picture of XRP’s future. He argues that the cryptocurrency is starting to chart its own course, breaking away from Bitcoin’s influence . Traditionally, XRP’s price has followed BTC’s overall direction and trajectory, rising and falling in tandem with the broader altcoin market .

However, Arthur believes that the latest developments surrounding Ripple, a crypto payments company, could significantly change this dynamic. He points to Ripple Prime as the biggest factor that could drive this shift. Notably, Ripple Prime is a digital asset spot prime brokerage that Ripple recently launched following its acquisition of Hidden Road . The brokerage platform offers OTC spot trading , Foreign Exchange (FX), derivatives, and swaps, all seamlessly integrated with XRP and RLUSD, Ripple’s regulated stablecoin.

By offering Wall Street a means to enter the blockchain finance market, Arthur contends that Ripple Prime could redefine how institutions view digital assets like XRP. Instead of being swayed by broader market sentiment, this institutional demand from Ripple’s new brokerage platform and ongoing developments could drive XRP’s value based on measurable utility . Additionally, it could finally establish the cryptocurrency as a standalone asset rather than one that constantly tracks Bitcoin’s movements.

In his analysis, Arthur frames Bitcoin as a speculative digital asset , while XRP is viewed as a form of financial infrastructure. He explains that this is a crucial distinction considering infrastructure assets are typically driven by real-world adoption and utility, rather than “hype cycles.”

With RLUSD surpassing a $1 billion market cap just a year after its launch, the analyst maintains that Ripple has established a stable and transparent institutional framework that effectively balances liquidity and compliance. Through this setup, RLUSD provides price stability, while XRP offers transaction liquidity , creating a financial ecosystem designed for real-world use, which is ideal for driving price growth.

Regulation And Utility Shifts To Redefine XRP’s Identity

Arthur expands on his analysis by connecting Ripple’s recent developments to a broader picture. He explains that institutions using Ripple Prime to settle payments with XRP and RLUSD are driven by different incentives. They do not care about Bitcoin and are not chasing speculative gains like typical crypto traders, but prioritize efficiency, regulation, and liquidity.

He also highlighted the potential impact of the upcoming CLARITY Act in the US. If passed, the analyst says that the bill could reclassify XRP as a commodity, moving it away from the “crypto basket” and placing it in the same regulatory category as assets like gold. Through this combination of legal clarity, stablecoin integration , asset class change, and subsequent institutional demand, Arthur says that XRP’s price will gradually decouple from Bitcoin.

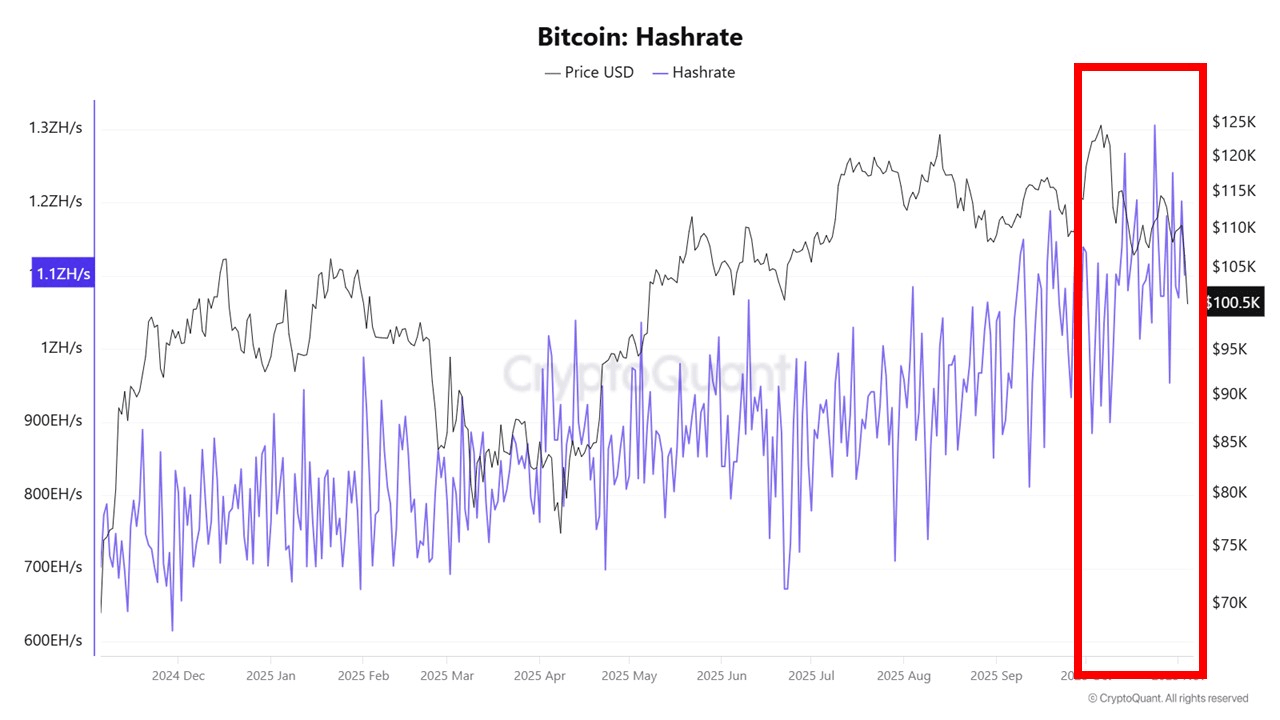

‘Bitcoin $100K Break Was Emotional’ – On-Chain Data Shows No Structural Damage

Bitcoin has officially lost its footing below the critical $100,000 level, rattling markets and fuel...

Web3 Verifiable Settlement Protocol To Bring ‘Internet-Speed’ Payments With New Upgrade

Pi Squared has announced the launch of its Devnet 2.0 to bring “internet-speed payments” to Web3 and...

Trade Crypto with Confidence on BTCC – Proven and Reliable Crypto Exchange Since 2011

What to Know: BTCC is one of the world’s oldest crypto exchanges, offering over a decade of uninterr...