ORDER Spikes 47% After Orderly Network Launches Buyback Token Program

ORDER , a native token of Orderly Network – a decentralized orderbook protocol providing low-latency and high-performance trading infrastructure – is gaining significant attention from market participants. According to data shared today by market analyst Satoshi Club, ORDER skyrocketed its value massively after the protocol announced a use of 60% of its network fees to buy back ORDER tokens. Yesterday, on Tuesday, November 5, 2025, Orderly Network announced the beginning of a buyback initiative for its ORDER token. As per the announcement, the platform will allocate 60% of the protocol fees to buy ORDER tokens every two weeks from the open market.

The Buyback Program to Reduce Token Circulating Supply

On August 26, 2026, the Orderly community passed a governance proposal to allocate 60% of net transaction fees for regular buybacks of ORDER tokens from the public market. The launch of the buyback program marks the beginning of the governance proposal’s implementation. Using this initiative, the Orderly Network aims to revolutionize its tokenomics model to enhance token value, improve long-term sustainability, and align rewards with token investors.

As illustrated in the announcement, the platform will deposit repurchased tokens into a community-controlled vault, a move that is set to efficiently decrease the circulating supply and create deflationary pressure.

The implementation highlights the Orderly Network’s strategic move away from distributing VALOR tokens as incentives to introducing a buyback program for ORDER tokens. The decision to transition from inflationary VALOR token emissions aims to streamline the reward structure for token holders. With the introduction of the deflationary buyback model, the network seeks to decrease the circulating supply of ORDER over time and align rewards between the network and its token holders.

ORDER Nears Major Breakout

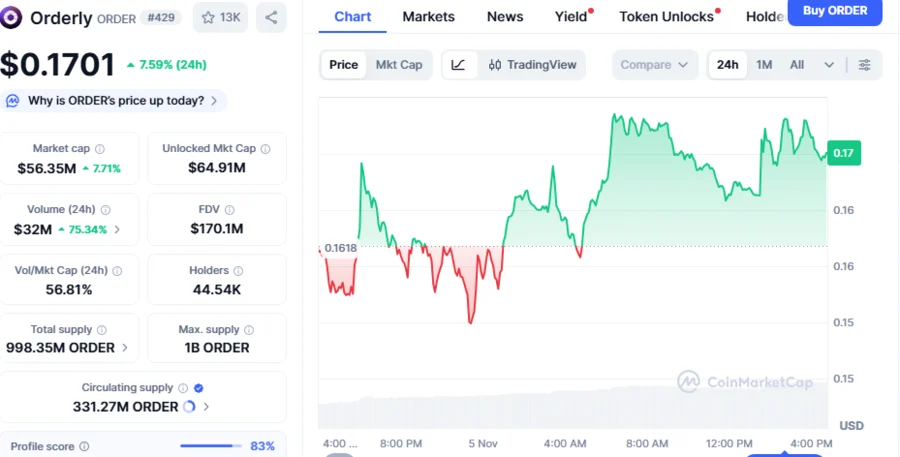

ORDER witnessed a remarkable 47% price surge over the past 24 hours, climbing to a peak value of $0.1732, its highest level since late August. This massive rise placed ORDER as the fourth best crypto performer today, following KITE, CUDIS, and XNO, which gained 48.7%, 72.7%, and 79.4% respectively, according to today’s data from Phoenix Group.

The sudden price spike, which has attracted the attention of analysts, signifies that the asset is preparing for a potential major breakout from its ongoing downturn. ORDER, which currently stands at $0.1701, has been down 28.2% and 63.0% over the past week and month, respectively, indicating its market slump.

The key driver behind today’s rally is the introduction of the buyback program, which bolstered positive market sentiment from strategic investors.

Crypto Dispensers Redefines How America Buys Bitcoin With Cash

Chicago, United States, 5th November 2025, Chainwire...

Venom Integrates x402 Protocol, Paving the Way for AI-to-AI Microtransactions

Venom Foundation announces plans to integrate the x402 protocol, enabling instant, low-cost autonomo...

MetaMars x XDGAI Alliance Ignites a New Era of AI-Driven Blockchain Worlds

MetaMars teams up with XDGAI, the move to create a decentralized AI ecosystem, which combines intell...