SBF Report Claims FTX Was Never Insolvent, Blames Lawyers for "Decimating" Value

Convicted former FTX CEO Sam Bankman-Fried (SBF) released a lengthy document today titled, " FTX: Where Did The Money Go? " The report, shared from his X account, asserts that FTX was never technically insolvent and the entire two-year debacle, which led to a $1 billion legal fee bill and the dissipation of billions in assets, was a direct consequence of a rushed, unnecessary bankruptcy proceeding.

[SBF says:]

— SBF (@SBF_FTX) October 31, 2025

This is where the money went. https://t.co/HVRwEw5Z1k https://t.co/5DrA13L5YE pic.twitter.com/O6q77DvmTn

This extraordinary claim arrives even as FTX's estate has delivered an unexpected recovery for customers, a development that itself has drawn significant criticism.

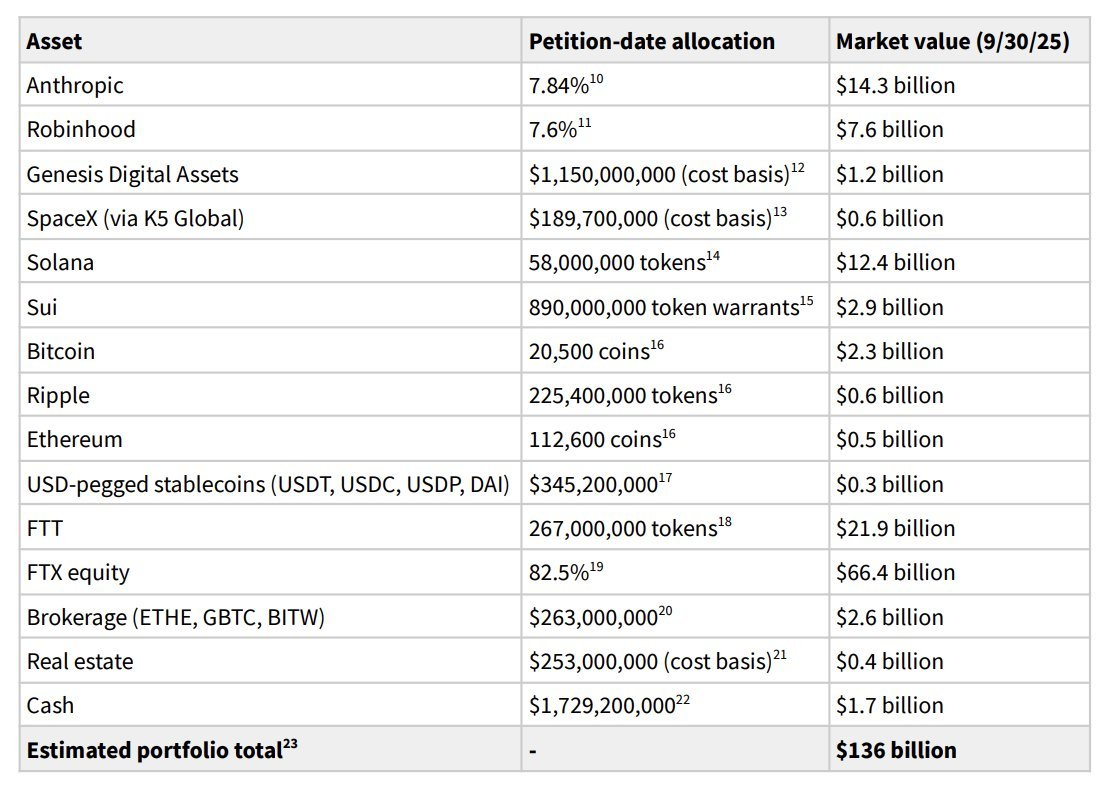

The report argues that the crisis in November 2022 was merely a liquidity crisis, not one of genuine insolvency, and that the company always possessed sufficient assets to fully repay all customers. SBF alleges that the bankruptcy team, led by CEO John J. Ray III and the law firm Sullivan & Cromwell (S&C), was heavily incentivized by the prospect of immense legal fees to seize control, force the company into bankruptcy, and subsequently decimate its true value. The document estimates that FTX's original crypto holdings would be worth an astonishing $136 billion today had they been left intact, compared to the $14.6 billion ultimately secured by the debtors.

This alleged destruction of value is attributed to several decisions, including shutting down the profitable company, discarding FTT tokens now estimated to be worth $22 billion, and selling off valuable venture capital investments (like Anthropic, Sui, and Solana) at fire-sale prices.

A follow-up message by SBF on X attempted to reframe his own role prior to his arrest and conviction, stating, "My highest duty was to do right by FTX's stakeholders: its customers, employees, and investors. In Nov 22, that meant standing strong... against the lawyers who were trying to place it into a bankruptcy that would end up harming all stakeholders except the lawyers."

[SBF says:]

— SBF (@SBF_FTX) October 31, 2025

Yup.

My highest duty was to do right by FTX's stakeholders: its customers, employees, and investors.

In Nov22, that meant standing strong and being the leader FTX needed, against the lawyers who were trying to place it into a bankruptcy that would end up harming…

This report surfaces just as the FTX bankruptcy estate has announced a massive recovery for creditors. Over 98% of claimants have already received a payout, and the estate is on track to pay between 119% and 143% of customers' original claims. Following the repayment of $8 billion in claims and nearly $1 billion in legal fees, the estate remarkably still holds $8 billion in reserve.

However, the high percentage repayment is a bitter pill for many users due to the process of "dollarization." Customers are being repaid the USD value of their crypto assets at the time of the November 2022 bankruptcy filing, not the current, much higher, market price. This means that if a user held assets like Solana (SOL) or Bitcoin (BTC), whose value has dramatically appreciated since 2022, they suffered a massive loss in dollar terms. The 120% recovery of the 2022 dollar value translates to a fraction of the current in-kind crypto value, leading to significant complaints and illustrating the true cost of the two-year delay.

SBF was convicted of fraud and related crimes in November 2023 and sentenced to 25 years in prison. The recovery of funds, while commendable from a bankruptcy management perspective, does not absolve the fact that FTX committed crimes and used customer funds to make investments and cover debts, leading to the $8 billion hole in the first place.

For now, the report’s sensational claims, especially those placing the blame squarely on S&C, will likely spark intense legal and public scrutiny, though the criminal findings against SBF stand.

Elsewhere

Podcast

Licensed to Shill VII: Token Listings, Market Makers & Regulation, ft. Gracie Lin (CEO, OKX Singapore)

This episode of Blockcast's Licensed to Shill features Gracie Lin, OKX Singapore CEO, alongside usual panelists Nikhil Joshi, Lisa JY Tan and host Takatoshi Shibayama, who revisit the contentious topic of token listing practices on exchanges. The conversation covers the evolving roles of centralized (CEX) and decentralized (DEX) exchanges, with Lin highlighting that regulatory clarity will ultimately guide the industry's structure.

We're a media partner for the upcoming Singapore Fintech Festival! Use the promo code SFFSMPBH for 20% off all delegate passes at this link !

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link .

Trump–Xi Accord Lifts Macro Sentiment as Bitcoin Rebounds to $109K Despite ETF Exodus

Your daily access to the backroom...

Coinbase Posts $433 Million Income as Exchange Advances 'Everything Exchange' Vision

The largest U.S. crypto platform beat earnings estimates with $1.9 billion in quarterly revenue, dri...

Bitwise Solana Staking ETF Records $72 Million Second-Day Volume

BSOL achieved the strongest first-day performance among 2025 ETF debuts, as analysts signal growing ...