Bitcoin Obsession Costs Saylor — S&P Tags Strategy As ‘Junk’

Strategy Inc., the company led by Michael Saylor that rebranded from MicroStrategy, was hit with a junk credit grade on Monday as S&P Global Ratings flagged its heavy concentration in Bitcoin and weak dollar liquidity.

According to S&P, the firm’s balance sheet is tied closely to the price of Bitcoin and carries risks that traditional ratings models find hard to treat as stable collateral.

Bitcoin Holdings Drive The Score

Based on reports, Strategy’s Bitcoin stack is enormous — about 640,808 BTC on its books — worth roughly $73 billion to $74 billion at recent prices.

S&P said that while the company owns a large digital-asset hoard, the volatility of that asset and the company’s limited cash flow make it risky under S&P’s credit rules.

S&P assigned a B- issuer credit rating and kept the outlook stable. That B- places the company squarely in non-investment-grade territory, signaling a higher chance of stress if markets turn against it.

S&P Global Ratings has assigned Strategy Inc a ‘B-‘ Issuer Credit Rating (Outlook Stable) — the first-ever rating of a Bitcoin Treasury Company by a major credit rating agency. https://t.co/WLMkFqkkCb

— Michael Saylor (@saylor) October 27, 2025

Currency Mismatch And Debt Pressure

Reports have disclosed that S&P was particularly concerned about a mismatch: most obligations are owed in US dollars, but most of the company’s value sits in Bitcoin. This gap can force the sale of Bitcoin to meet dollar payments if prices slide.

Analysts and commentators pointed to sizable convertible securities and preferred-stock commitments that add cash demands on the company. According to filings and market write-ups, the firm faces billions of dollars in convertible and preferred obligations spread over coming years.

Saylor and Strategy have made repeat purchases of Bitcoin as part of their stated plan. Those buys have created big unrealized gains on paper, but S&P’s methodology largely treats the token differently from traditional equity when measuring risk-adjusted capital.

Liquidity, Access To Markets

Liquidity, Access To Markets

S&P noted that, for now, Strategy still has access to capital markets, which is why its outlook is stable rather than immediately negative.

But the rating agency warned that a sharp drop in Bitcoin’s price or any sudden tightening of funding channels could trigger a further downgrade.

Market participants will watch funding costs, preferred dividend payments and convertible notes for signs of stress.

Investors reacted with mixed signals in early trading. Some buyers treated the downgrade as a formal recognition of a known risk, while others judged the move as a calibration that won’t stop Saylor’s accumulation strategy if markets stay calm.

Trading volume and price swings in both Strategy shares and Bitcoin may rise as traders reassess odds.

Featured image from Gemini, chart from TradingView

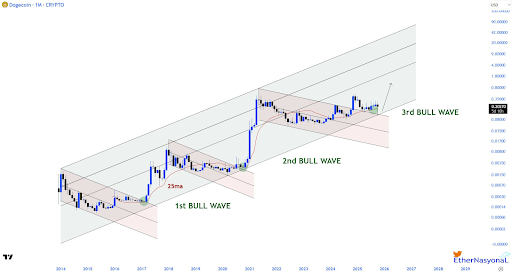

Dogecoin Price Hasn’t Begun Its 3rd Wave Yet, ATH Above $0.8 Still In The Cards

The recent Dogecoin market action has seen its price now hovering below $0.20 after surging to $0.20...

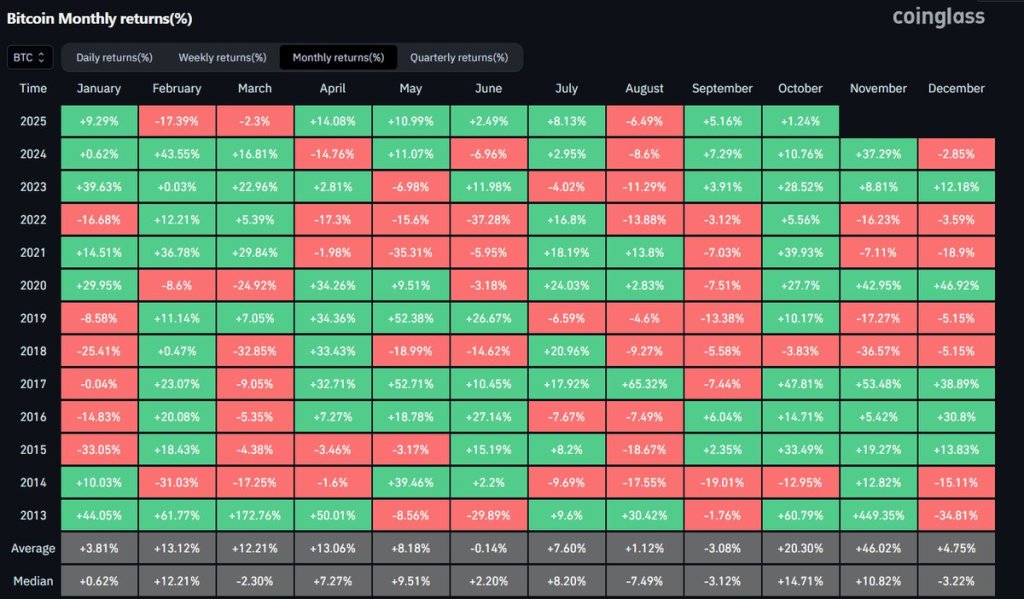

November Preview: Will Bitcoin Break The Cycle Or Repeat It?

A widely shared seasonality snapshot is making the rounds ahead of month-end: a Coinglass heat map o...

Analyst Predicts XRP Price Crash To $1.4 In Final Wave

Crypto analyst CasiTrades has predicted that the XRP price could still crash to $1.4 in the final wa...