Bitcoin’s Fear Index Slumps to Annual Low — Time to Accumulate, Says Bitwise

Amid the volatility that defines digital assets, today’s crypto market is sending a compelling signal: the Bitcoin Fear & Greed Index has plunged to an annual low of 24, a level historically aligned with major market troughs.

Rather than sounding an alarm, Bitwise interprets the sentiment slump as the start of a prime accumulation window. According to their research, a rapid unwind of leveraged longs, including a record $11 billion drop in perpetual futures open interest, suggests that much of the selling pressure has already been absorbed.

Taken together, the sentiment exhaustion, leveraged flush and accumulating base set a backdrop for a potential Q4 Bitcoin rebound , not a panic-driven collapse. Bitwise’s thesis summarizes, “when fear hits these extremes, history shows it may mark the inflection point toward re-accumulation.”

In short, Bitcoin’s recent turbulence may be less a red flag and more a contrarian entry opportunity, especially for investors willing to look past short-term whipsaws toward the next leg of the cycle. Couple that with recent news of Binance co-founder Changpeng Zhao (CZ) being pardoned by President Trump, showing that the US is committed to removing regulatory uncertainty from the market, and you have the type of catalyst that can drive market sentiment in the positive direction.

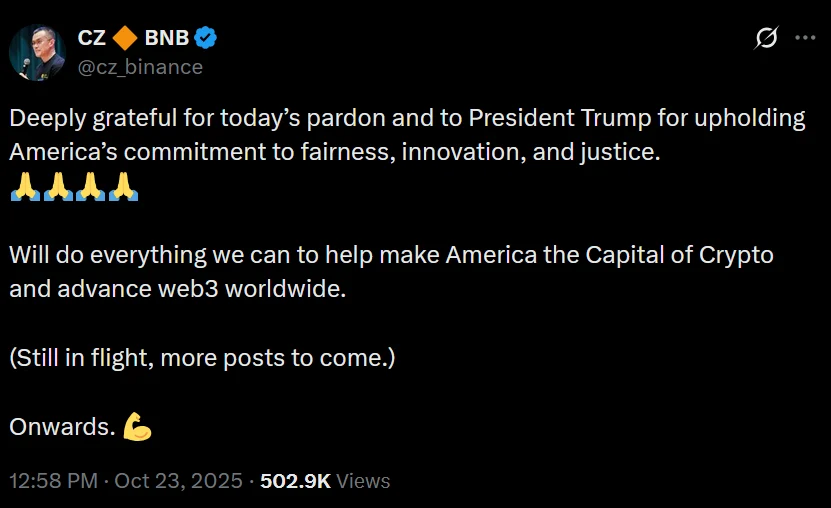

BNB price jumped 6% as the news came out. In a statement on X,

CZ posted

, “Deeply grateful for today’s pardon and to President Trump for upholding America’s commitment to fairness, innovation, and justice. Will do everything we can to help make America the Capital of Crypto and advance web3 worldwide.”

Bitcoin Fear Index Hits Annual Low

Anticipation of new Bitcoin all-time highs is fading as market sentiment turns bearish. The Fear and Greed Index dropped from a monthly high of 71 in early October to a yearly low of 22. The drop marks a shift in investor perception, as Bitcoin’s 22 Fear & Greed score mirrors levels seen during the 2018 and 2022 bear markets.

The sharp decline is the result of a tumultuous period in the markets as Bitcoin dropped over 12% in the past 7 days and over 14% from its all-time high. On-chain data emphasizes geopolitical events triggered cascading liquidations, removing over $19 billion from the market.

Investor confidence waned amid Bitcoin’s largest-ever liquidation. Over 1.6 million traders were affected, as Bitcoin’s price reversal erased its YTD gains of 19%. As analysts reported, BTC’s correction was driven by renewed tariffs between the US and China and by market-maker responses to increased volatility.

Data indicates that between 10 and 11 October 2025, Bitcoin’s perpetual markets dropped by $11 billion. According to Bitwise, the drop is “the strongest decline on record”, exceeding the liquidations triggered by FTX’s black swan event in 2022.

Potential Accumulation Zones

Analysts maintain a neutral outlook on the market despite the perceived negative direction. According to Bitwise report, analysts emphasize a more optimistic perspective for investors, noting that the recent leverage flush-out may create renewed market opportunities.

André Dragosch, the head of research at Bitwise, notes that the forced liquidations have “meaningfully exhausted selling pressure”. That said, the open interest reset opens a new investment window. Derek Lim, the head of research at Caladan , emphasized Bitcoin’s upside potential, noting that the “bullish market structure” has remained intact.

Market volatility remains pronounced in 2025, with Bitcoin prices fluctuating by up to 18% in Q2. Similarly, Bitwise attributes the continued instability to ongoing political tensions. As volatility could push Bitcoin prices lower, Bitwise highlights a potential buying signal, as the “Cryptoasset Sentiment Index” has reached levels similar to the “Yen Carry Trade Unwind” in early August 2024.

Mixed on-chain signals as retail accumulates

On-chain metrics show market movements despite higher volatility. Glassnode data highlights increased activity for Bitcoin users, with holdings between 1 and 1,000 BTC. The move opposes activity from larger wallet holders. Addresses holding between 10 and 10,000 BTC collectively offloaded more than 17,500 BTC between 12 and 14 October. This suggests growing confidence from retail and mid-tier investors compared to institutional investors.

However, other market participants show contrasting trends that shape markets. Data from CryptoQuant notes that miners have increased their deposits on exchanges. Since October 9th, miners have deposited 51,000 BTC or over $5.7 billion, making the largest inflow since July. Historically, miners’ deposit patterns indicate additional selling pressure as they seek to liquidate their positions amid growing uncertainty.

Long-term holders have also been distributing, with 265,715 BTC sold over the past 30 days, representing the largest monthly outflow since January 2025. Nearly all long-term holders currently sit in profit, suggesting significant profit-taking has been underway since early October.

In short, the combination of lower open interest, increased demand from retail and distribution among long-term holders points to a potential reset rather than a continuation of decline. As Bitwise emphasizes, the current market conditions reflect normalization and a potential for accumulation.

This article is not intended as financial advice. Educational purposes only.

Top Crypto Assets to Buy: RIVER, AR, SOSO, BGSC, HBAR, BNB, YB, And Others Lead Social Engagement, Investor Interest

The data listed the top tokens that are experiencing significant social engagement, a development sh...

Gold’s Decline to $3900 Could Signal the Next Big Altcoin Rally, Says Michaël van de Poppe

Michaël van de Poppe reported gold’s consolidation as a bullish signal for crypto, predicting a cont...

BullZilla’s 2,548% ROI Puts It Ahead of Ethereum and Polygon in Top Cryptos to Buy with $500

Discover why BullZilla, Ethereum, and Polygon rank among the top cryptos to buy with $500 for high R...