Ethereum Price Prediction 2025: Institutional Rotation Signals 40% Gains Ahead

The post Ethereum Price Prediction 2025: Institutional Rotation Signals 40% Gains Ahead appeared first on Coinpedia Fintech News

The Ethereum price prediction 2025 narrative is becoming increasingly bullish as 2026 is only a few months away. This optimism is largely due to a significant shift in institutional demand from Bitcoin to Ethereum. With Ethereum ETFs now surpassing Bitcoin ETFs in quarterly inflows and whale accumulation returning, ETH is showing renewed momentum heading into the final months of the year.

Institutional Rotation Redefines ETF Landscape

In the $3.76 trillion global cryptocurrency sector, Bitcoin and Ethereum together account for over 70% of the market. However, recent ETF data indicates a shift in institutional sentiment.

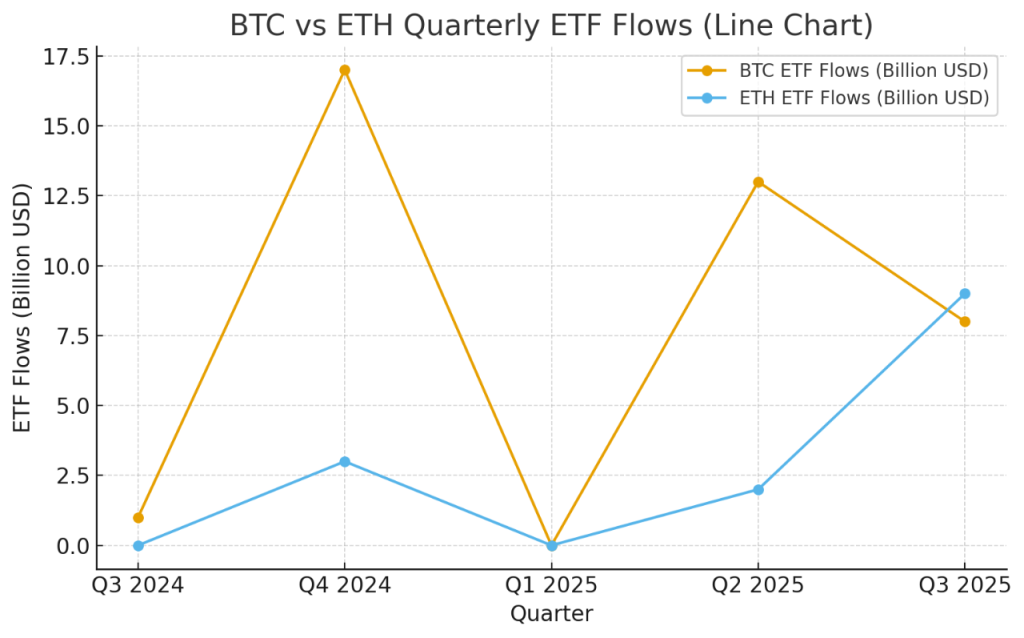

Bitcoin ETFs, which previously attracted over $30 billion from late 2024 to mid-2025, saw inflows decline to just $8 billion in the third quarter of 2025.

In contrast, Ethereum ETFs experienced a surge in popularity, reaching $9 billion in inflows during the same quarter. This marks their strongest quarter yet and the first time that ETH has outpaced BTC in ETF demand.

While it’s too early to say whether this shift could indicate a change in dominance, it’s clear that Ethereum is evolving, but BTC still holds the biggest share.

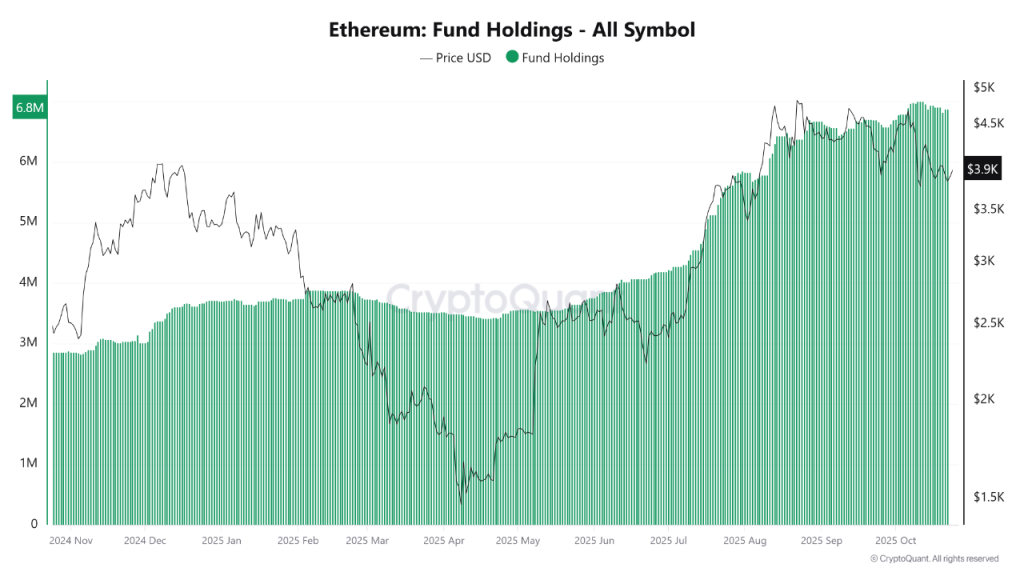

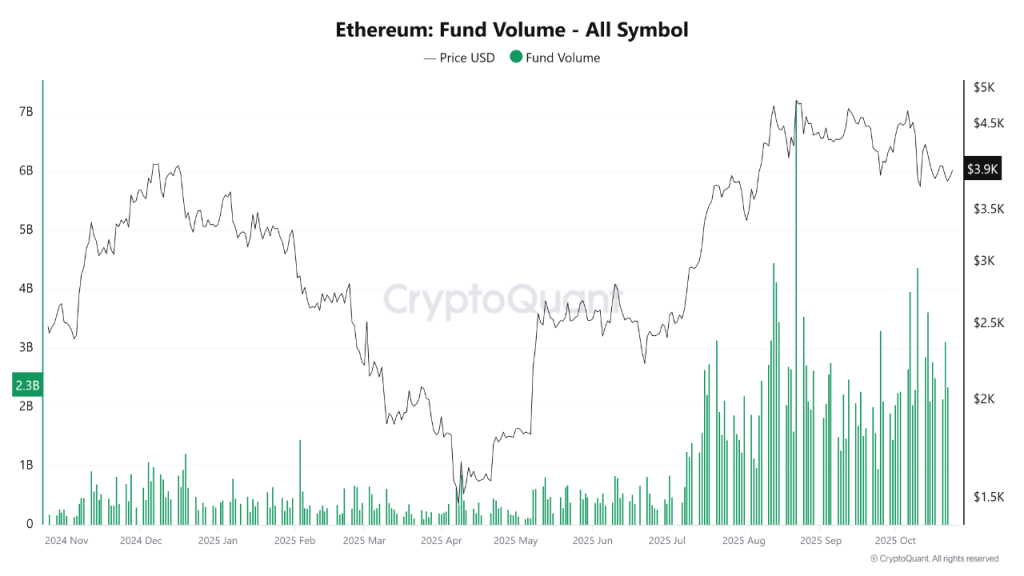

Moreover, XWIN Research Japan highlighted this trend in ETFs as a significant shift in investment strategy among institutional investors. They also mentioned that the Ethereum fund holdings have doubled in 2025, reaching 6.8 million ETH by October, which confirms sustained accumulation.

Even during market pullbacks, fund volumes have continued to grow, reflecting long-term confidence rather than short-term speculation.

Ethereum Gains Ground Amid Bitcoin’s ETF Slowdown

While Bitcoin ETFs dominated early 2025, their inflows have turned more volatile as institutions rebalance. The Ethereum ETF momentum, however, underscores a structural shift as investors are now prioritising assets offering yield through staking and exposure to on-chain innovation.

This shift suggests that professional investors are moving from simple store-of-value strategies toward protocols with real-world utility and income potential. If this pattern persists into Q4 2025, Ethereum could soon redefine portfolio allocations across the digital asset market, setting a new benchmark for institutional exposure.

Whales Return as On-Chain Confidence Builds

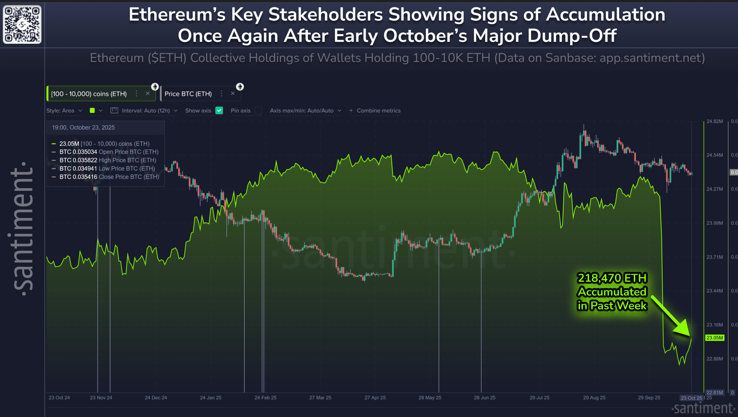

Beyond ETF inflows, Ethereum on-chain data indicate renewed accumulation by whales and sharks. After dumping roughly 1.36 million ETH between October 5 and 16, wallets holding between 100 and 10,000 ETH have begun rebuying, accumulating about 218,470 ETH in the past week.

This rebound in accumulation signals recovering confidence among large holders. Historically, similar patterns have preceded multi-month rallies, as these participants tend to buy during periods of structural lows.

Ethereum Price Prediction 2025 Technical Setup: ETH Eyes $5,600 if Support Holds

Technically, the Ethereum price chart supports the bullish case. Ethereum price today trades near $3,950, holding strong above the $3,670 to $3,870 support range, a zone that has flipped from resistance to key support in the final quarter of this year.

This level also aligns with the midline of a long-term ascending channel that has defined ETH’s broader uptrend since 2023. If this support continues to hold, the Ethereum price forecast 2025 anticipates a move toward $5,600, which coincides with the upper channel resistance, implying nearly 40% upside before the year’s end.

XRP News: Why Wall Street May Soon Turn Into XRP’s Biggest Cheerleader

The post XRP News: Why Wall Street May Soon Turn Into XRP’s Biggest Cheerleader appeared first on Co...

3 Reasons Why Solana & Cardano Whales Are Loading Up on $TAP – The First Would Shock You!

The post 3 Reasons Why Solana & Cardano Whales Are Loading Up on $TAP – The First Would Shock You! a...

Fundstrat’s Tom Lee Predicts Year-End Crypto Rally, S&P 500 Could Rise Up to 10%

The post Fundstrat’s Tom Lee Predicts Year-End Crypto Rally, S&P 500 Could Rise Up to 10% appeared f...