Ethereum Will Flip Bitcoin, Predicts Tom Lee: Here’s Why And When

Tom Lee says Ethereum can overtake Bitcoin—“flip” it—by playing for dollar-dominance in a world of tokenized assets, even as he remains emphatically bullish on Bitcoin’s monetary role and long-term price.

In a podcast exchange with Cathie Wood, Lee framed the coming competition through a 1971-style lens, arguing that the end of the gold standard catalyzed a wave of financial engineering that ultimately made dollar-based equities far larger than gold; in his telling, the broad tokenization of money and assets will rhyme with that history, positioning Ethereum’s smart-contract rails to capture the lion’s share of activity.

Will Ethereum Flip Bitcoin?

Wood set the premise with ARK’s top-down view of crypto’s addressable market by decade’s end. “You know, the ecosystem we expect to hit $25 trillion in 2030, the vast majority of that in Bitcoin,” she said, citing Bitcoin’s role as “a global monetary system, you know, rules based that we’ve been missing since the US went off the gold exchange standard in 1971.” She asked Lee directly: “I’d love to hear your thoughts on why ETH or the ecosystem will surpass Bitcoin.”

Lee’s answer was to rewind to that same inflection point. “1971 was when Nixon formally withdrew the US from the gold standard . The immediate beneficiary was there was demand and a market to own gold,” he said.

But in his telling, the more consequential development was how finance rebuilt itself around an unpegged dollar. “In 1971, the dollar became fully synthetic because it was no longer backed by anything. And so there was a risk that the world would go off the dollar standard. So Wall Street stepped in create products to propagate the future of Wall Street, including…money market funds…credit…mortgage backed securities…futures, et cetera.” He continued, “Dollar dominance by the end of that period…went from 27 percent of GDP terms…to 57 percent of central bank reserves and 80 percent of financial transaction quotes.”

For Lee, the market-structure consequence was stark: “The market cap of equities today is 40 trillion compared to two trillion for gold. So in other words, gold is 5 percent of all available assets.” He then drew the crypto corollary. “In 2025, we think everything is now becoming synthetic as we tokenize…as we move not just dollars onto the blockchain, just stablecoins, but we’ll move stocks and real estate. Dollar dominance is going to be the opportunity of Ethereum. So digital gold is Bitcoin. And so in that world, we believe Ethereum could flip Bitcoin, similar to how Wall Street and equities flipped gold post ’71.”

Crucially, Lee couched the flippening as a sectoral dynamic rather than a zero-sum bet. “That is just our working theory because I am still a Bitcoin bull,” he said. “I’m very bullish on Bitcoin and I believe [Ark Invest’s] targets for Bitcoin are actually reachable. So we think Bitcoin’s fair value should at least be $1.5 to $2.1 million, but we can see higher values.”

TOM LEE EXPLAINED TO CATHIE WOOD WHY ETHEREUM $ETH WILL EVENTUALLY FLIP BITCOIN $BTC !

pic.twitter.com/uFpoWWyHYY

— Tom Lee Updates (Not Tom) (@TomLeeUpdates) October 16, 2025

In his framework, Bitcoin anchors the “digital gold” monetary premium, while Ethereum’s neutral smart-contract platform becomes the venue “where a lot of Wall Street will innovate ” through real-world-asset issuance and collateral flows. “That would, of course, provide upside to a neutral smart contract platform where a lot of Wall Street will innovate real world assets,” he concluded.

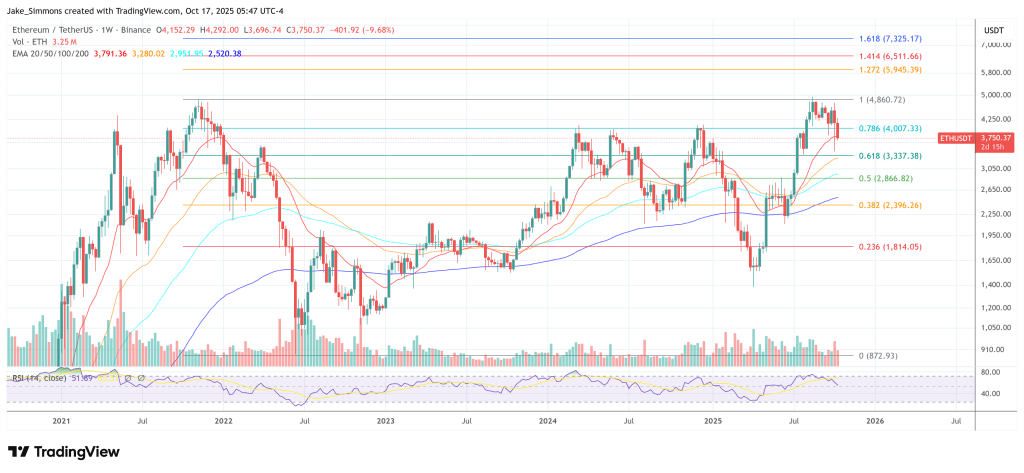

At press time, ETH traded at $3,750.

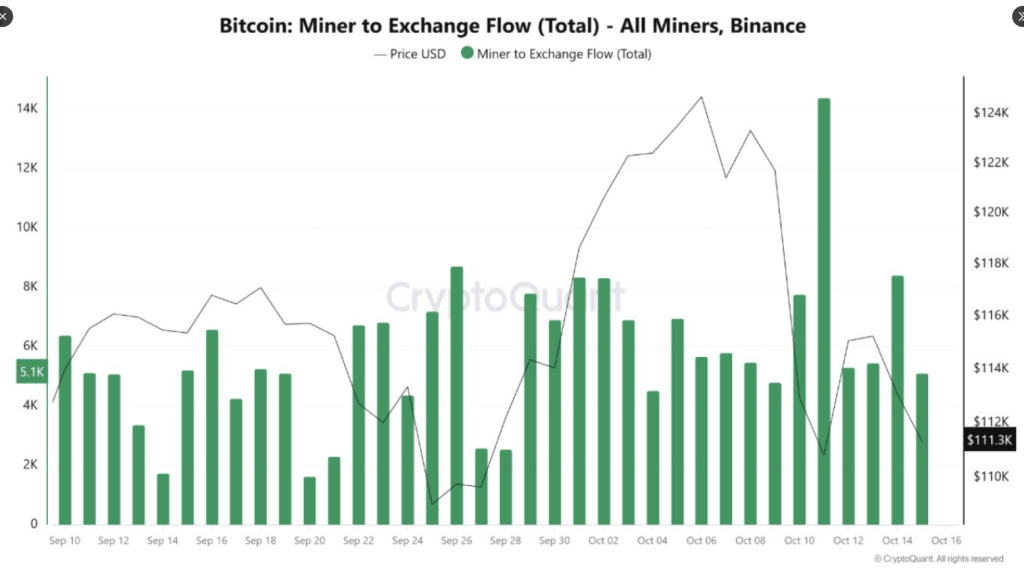

Bitcoin Miners Flood Binance With 51K BTC — Is A Sell-Off Imminent?

According to on-chain trackers, bitcoin miners have moved a huge amount of coins to a major exchange...

Bitcoin Hyper Almost at $24M After Massive Whale Accumulation

What to Know: Bitcoin is back down dangerously close to the $100K barrier A long-term recovery for B...

Is BlackRock About To Go Public With Ripple And XRP? Here’s What We Know

Rumors are circulating that BlackRock has partnered with Ripple to tokenize real-world assets on the...