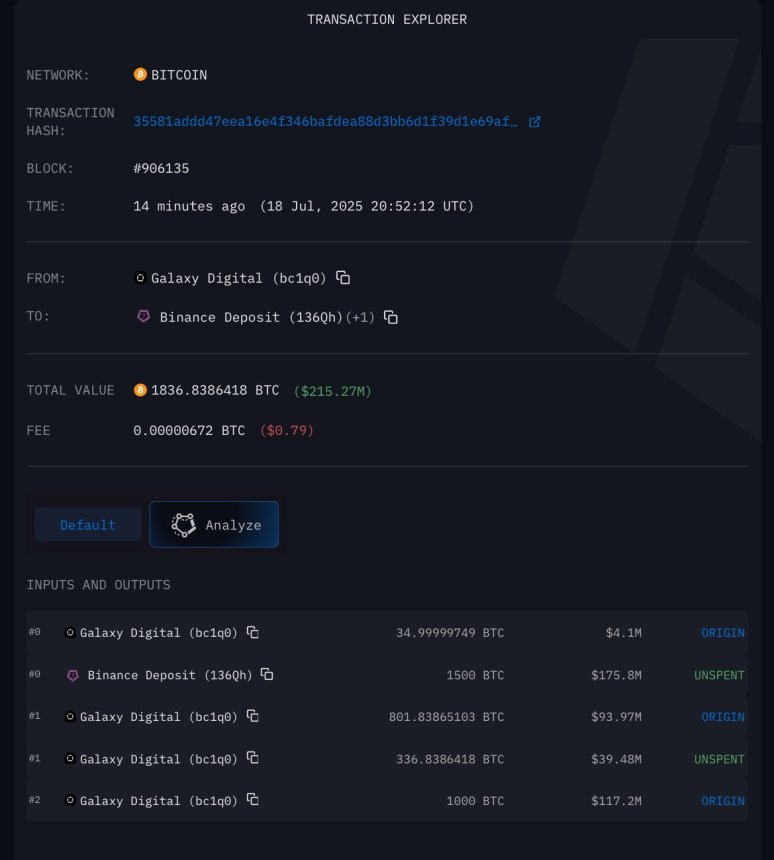

Satoshi-Era Bitcoin Now For Sale: Galaxy Digital Sends 1,500 BTC To Binance

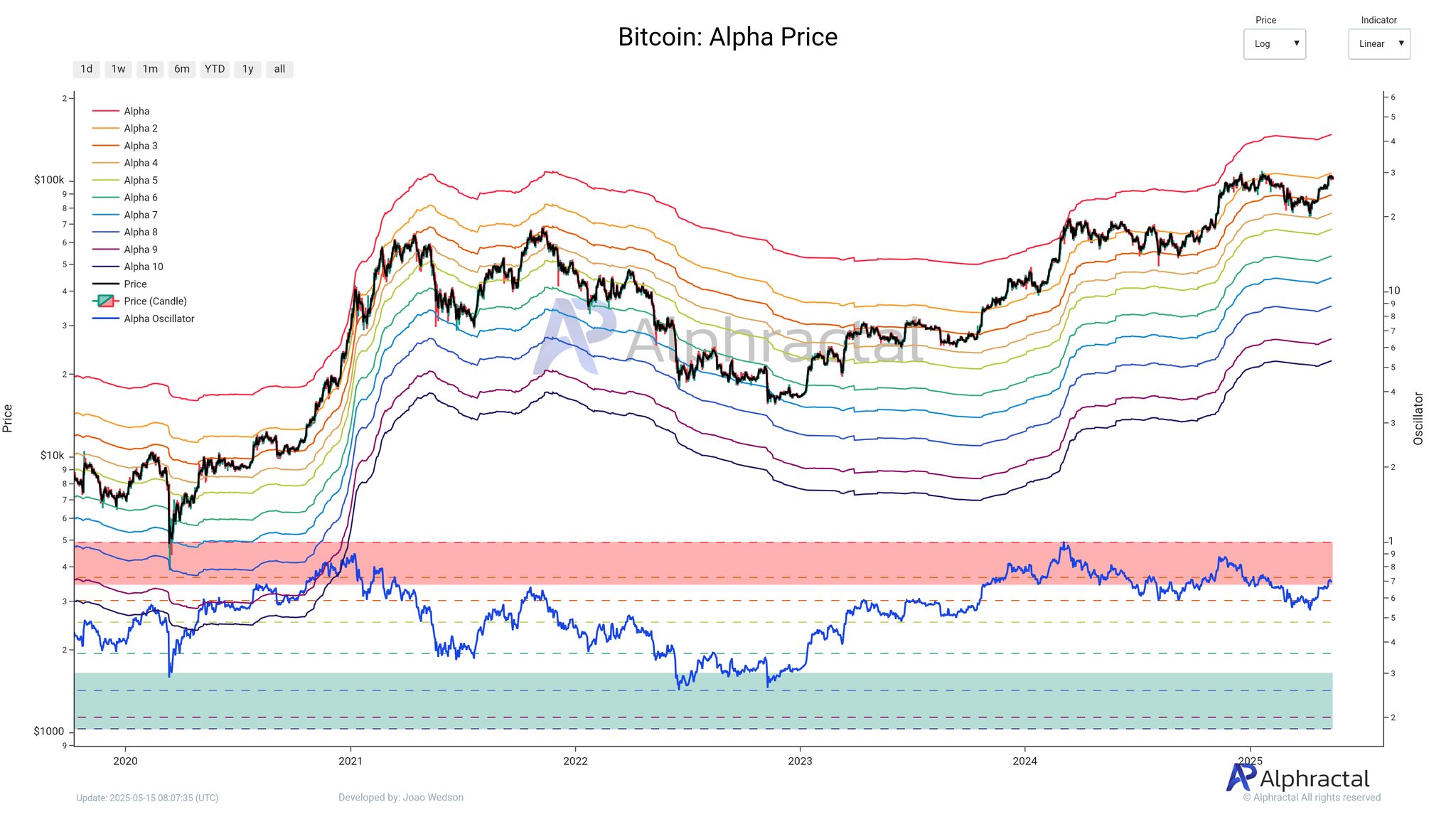

Bitcoin is currently consolidating between $115,000 and its all-time high of $123,000, forming a tight range that has kept both bulls and bears on edge. Despite the recent surge, price action has slowed, and while bulls are holding strong above key levels, market participants are growing cautious about the potential for a correction.

Adding to the uncertainty is the resurfacing of a Satoshi-era whale. Top analyst Darkfost has been tracking this long-dormant wallet, which recently transferred 80,000 BTC to Galaxy Digital, a major player in digital assets and AI infrastructure. The move immediately triggered speculation across the crypto space, as such large transfers are often associated with upcoming sales.

The timing of this transfer is crucial. It coincides with increased exchange inflows and rising discussions of institutional profit-taking. With the market already in a delicate position, the possibility that a portion of this massive BTC stack could be sold has analysts and investors bracing for elevated volatility.

Whale Starts Selling: 1,500 BTC Sent To Binance

Darkfost has confirmed that Galaxy Digital has just moved 1,500 BTC to a Binance deposit address. These coins were previously part of the massive 80,000 BTC linked to a Satoshi-era whale who recently reactivated their wallet. The latest transfer suggests that a portion of this historic stash is officially up for sale.

At current prices, the 1,500 BTC represents around $180 million in market value. More importantly, it marks one of the fastest and most significant offloads ever recorded from a single wallet, with the total 80K BTC valued at roughly $9.54 billion. While they have only moved a small fraction to exchanges so far, the sale could signal larger intentions.

Some view this transfer as a potential warning sign, especially given the current consolidation above $115K. In their view, such high-volume activity from a long-term holder might precede further profit-taking or even a broader correction. Others, however, see it as a smart and well-timed move from an investor who has held since Bitcoin’s earliest days and is finally realizing some gains.

BTC Price Holds Tight Range After ATH

Bitcoin is currently trading at $118,000, consolidating within a tight range between $115,730 and $123,230, as shown in the 12-hour chart. This comes after a strong breakout earlier this month that pushed BTC to a new all-time high of $123,230. Since then, price action has shown signs of cooling without a major pullback, suggesting bulls remain in control, but short-term momentum is slowing.

The chart displays a healthy structure, with BTC trading well above its 50-day, 100-day, and 200-day simple moving averages, which are currently at $111,819, $108,563, and $102,963. This confirms strong trend support from long-term holders and momentum investors.

Volume has increased during the move higher, indicating conviction behind the breakout, but the last few candles show lower follow-through volume, consistent with a consolidation phase. If BTC holds above $115,730, the structure remains bullish and could lead to another breakout toward $130,000 and beyond. A break below this level, however, could open the door for a deeper retracement, with the $112K–$111K zone acting as key moving average support.

Featured image from Dall-E, chart from TradingView

Why Bitcoin Price Failed To Break $123,000 In The Past Week — Analyst Explains

The crypto market was a story of two distinct halves, one of which saw the Bitcoin price soar to mul...

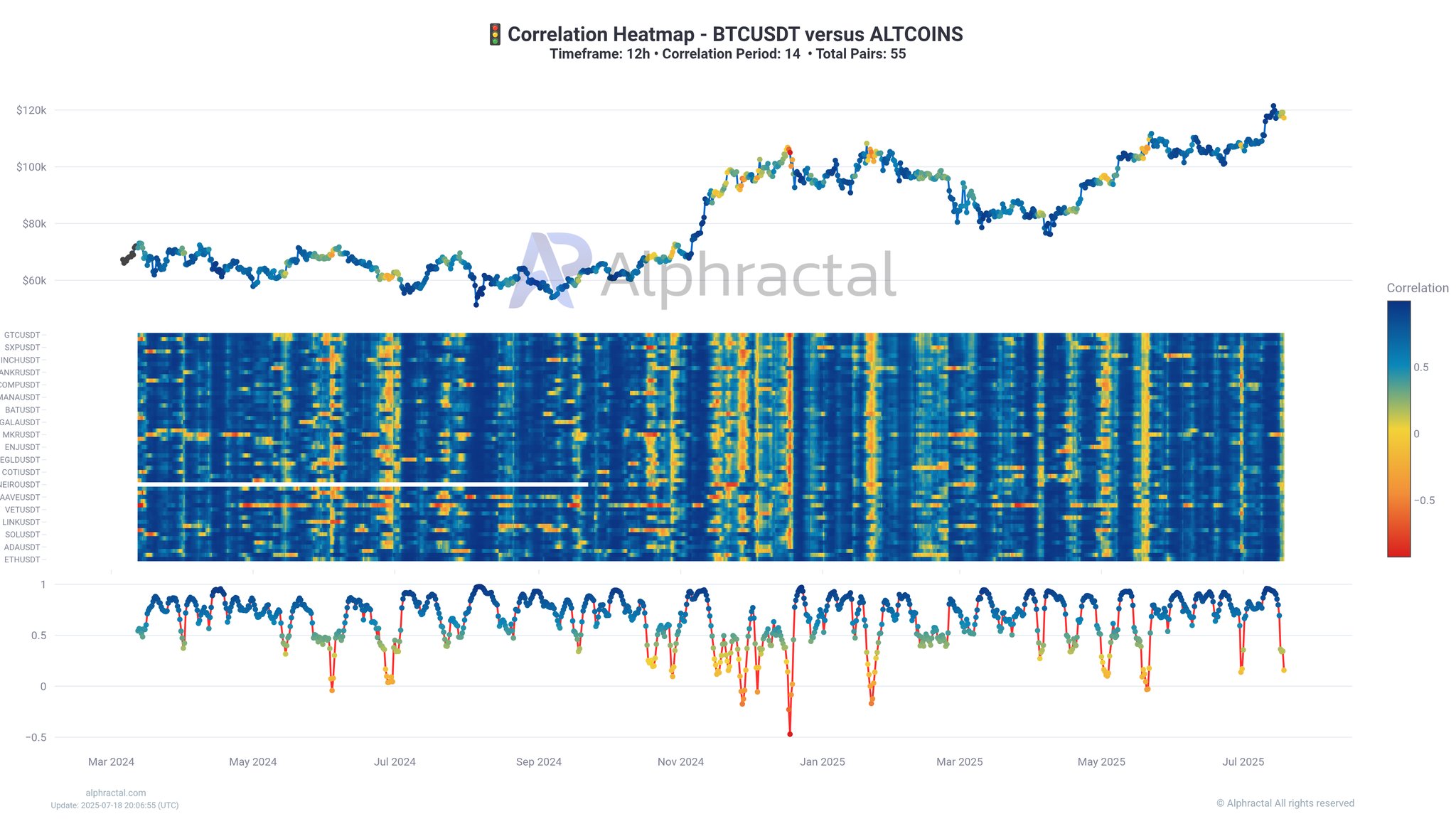

Will Bitcoin Impede Or Support Altcoin Rally? On-Chain Data Signals Market Uncertainty

According to an on-chain analyst on X, Bitcoin has decoupled from other cryptocurrencies or altcoins...

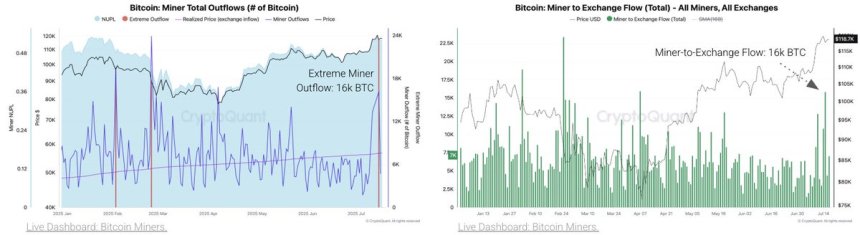

Bitcoin Miner Sales Surge To Highest Level Since April – Details

Bitcoin is currently holding above the $115,000 level after setting a new all-time high of approxima...